FTSE 100 companies and the race to net zero

22nd April 2022 09:12

by Nina Kelly from interactive investor

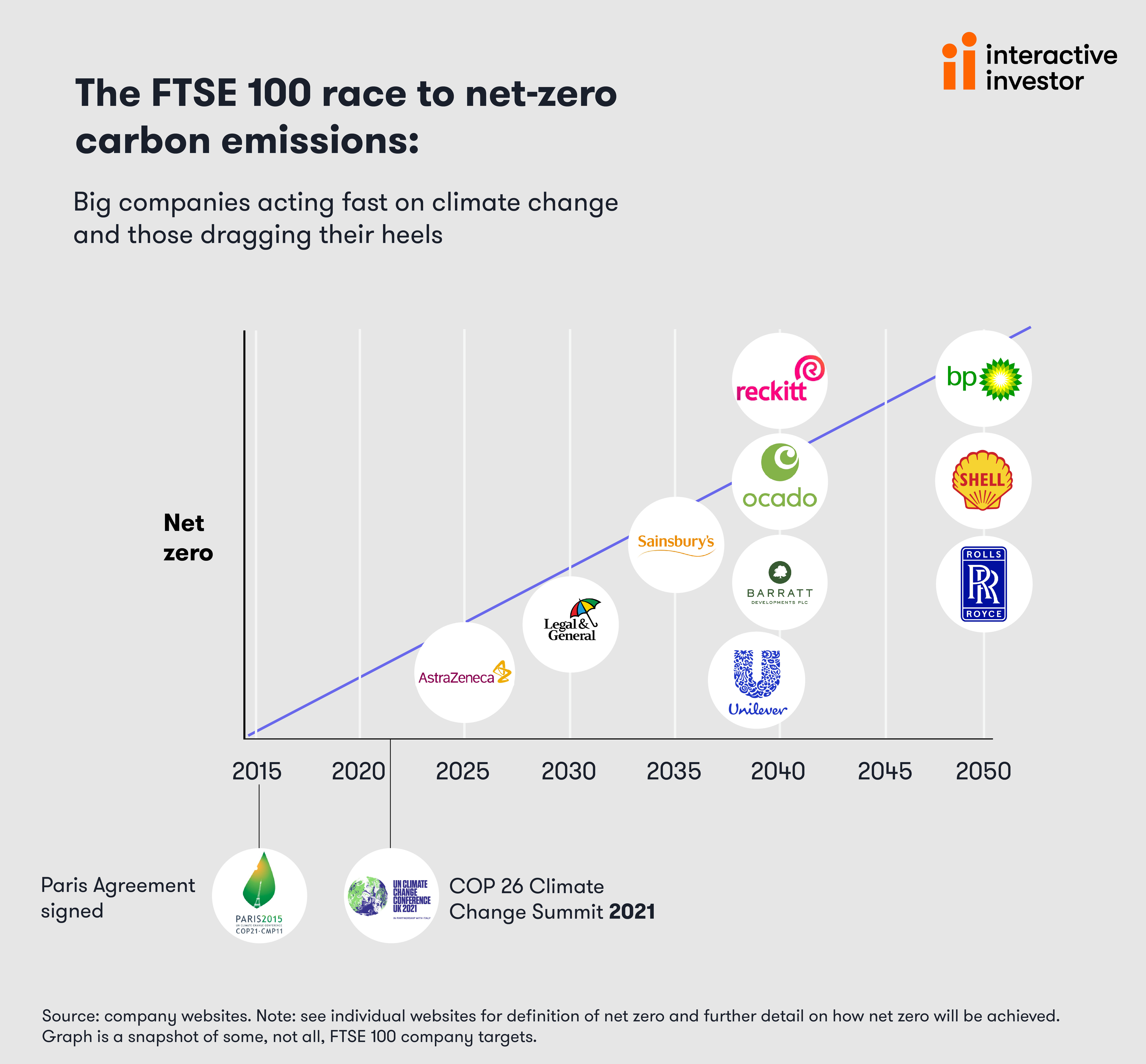

Timely or tardy action on climate change? We examine the approach of a selection of blue-chip firms to eliminating their carbon footprint.

Today is Earth Day, an annual global event designed to concentrate minds and initiate action to protect the world we live in.

This year also marks the sixth anniversary of the Paris Agreement on climate change. Two key targets of this legally binding landmark international treaty include limiting global warming to well below 2C, preferably to 1.5C, compared to pre-industrial levels, and limiting greenhouse gas emissions from human activity.

Net zero means achieving a balance between the greenhouse gases put into the atmosphere and the amount removed.

- Invest with ii: Top UK Shares | ACE 40 Sustainable Investments | Sustainable Investing Ideas

Both before and after the United Nations COP26 Climate Change Conference in Glasgow in 2021, a swathe of FTSE 100 firms laid out their net-zero ambitions. Some have signed up to the UN’s Race to Zero campaign, a global alliance committed to achieving net-zero carbon emissions by 2050 at the latest.

Given today’s date, it seems fitting to look at a snapshot of firms from the FTSE 100 index who’ve entered the race to net zero.

As can be seen from the infographic above, Covid vaccine developer AstraZeneca (LSE:AZN) is “winning” the race with its target to achieve “zero carbon across our global operations by the end of 2025 and [being] carbon negative across our value chain by 2030”. Being carbon negative “requires a company, sector or country to remove more CO2 from the atmosphere than it emits”, according to the International Energy Agency (IEA).

However, it’s important to stress that the devil really is in the detail on the ESG (environmental, social and governance) front, and many different terms are used when talking about environmental targets.

Individual companies’ websites are the best source of information for their targets, and whether emissions discussed also include indirect ones, from suppliers and customers, for example. It’s important to be on guard for greenwashing, which refers to the presentation of an environmentally responsible public image.

- Ethical investing jargon buster: all you need to know

- Energy independence: shares to benefit from green energy boom

- Ian Cowie: battery trust play for shift away from Russian energy

Of course, our infographic of 10 familiar names doesn’t have room to feature every FTSE 100 firm, so we decided to look at where a few other blue-chips stand on net zero.

Big pharma firm GlaxoSmithKline (LSE:GSK) has an ambition to achieve net-zero carbon by 2030 and says: “our climate strategy covers the full value chain of emissions reductions across our own operations, our supplier base and emissions from patient use of our products.”

Drinks giant Diageo (LSE:DGE) is also targeting the next decade, saying: “We will reach net-zero carbon across our operations by 2030. We have reduced half the carbon in our operations already and will remove the rest by 2030.”

Housebuilder Persimmon (LSE:PSN) has “commitments to have zero-carbon homes in use by 2030 and for our own operations to be zero carbon from 2040”.

But dividend stock British American Tobacco (LSE:BATS) will take until 2050 to reach net zero. It says: “We recognise the importance of looking beyond the operations we directly control – especially considering that supply chain carbon emissions represent around 90% of the group’s total carbon footprint. So, in 2021, we pushed ourselves further with an even more ambitious target: to be carbon neutral across our value chain by 2050.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.