FTSE for Friday: prospects for the index and Argo Blockchain

16th July 2021 08:10

by Alistair Strang from Trends and Targets

After another uninspiring week for the top index, this studies charts for the FTSE 100 and a popular tech stock.

Given the state of the UK market since June, we fear there’s an expectation of us coming up with magic words to signal the point at which the FTSE 100 actually does something sane.

The FTSE opened June at 7,022 points. It closed Thursday 15 July at 7,018 points! Despite the index making a few attempts upward, some sort of gravity has ensured the market returns to the 7,000 level on eight out of 31 trading days. This sort of glass ceiling behaviour, when witnessed against shares, often indicates a hiatus prior to positive news being announced. Thereafter, any surge upward will tend to prove interesting and sharp.

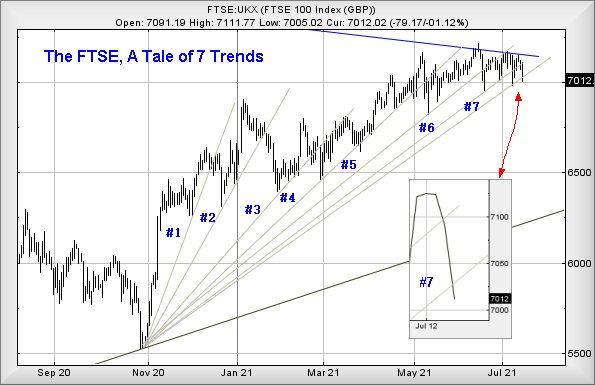

Unfortunately, this is the FTSE, an index which rarely boldly goes anywhere. The market now has broken seven uptrends since November last year, without actually crashing. The most recent trend breaks provide slight cause for worry, due to the index also failing to exceed prior highs.

- UK stocks are a bargain after record slump in company revenue

- Top 20 most-bought UK shares in Q2 2021

- The UK stock market's 10 most-shorted shares

- Why reading charts can help you become a better investor

An argument can be made for weakness settling into place, despite the UK nervously hopping from foot to foot as we count down the seconds to ‘freedom day’ on Monday. Equally nervously, we note the media carefully mentioning Covid-19 infections reaching new highs, and we wonder if the UK government intends to press the brakes on the supposed concept of imminent freedoms.

It’s funny how, using the UK criteria to define what exactly a “Red Zone” country is, the UK would already completely ban any travel to the UK! Perhaps this is where the hesitancy across the FTSE 100 comes, as there are a few quite contradictory signals evident. The market has now closed below its seventh uptrend (see chart below).

Source: Trends and Targets. Past performance is not a guide to future performance

The immediate prospect for the FTSE is fairly straightforward. We should anticipate the worst is coming were it not for the market’s serial behaviour of breaking uptrends, bouncing from the 7,000-point level.

If things are about to become serious, the index needs to drop below 6,993 to convince us as this risks imminent reversal to an initial 6,963 points. If broken, our secondary works out at 6,890 points, taking the index into a truly nasty area where it’s difficult to ignore the potential of 6,500 making an appearance eventually.

Of course, there’s always the visual promise the FTSE shall, once again, rebound from the 7,000 level. We shall not be inclined to trust any bounce unless the market exceeds 7,030 points as this calculates as capable of triggering movement to an initial 7,044 points. If bettered, our secondary works out at 7,073 points. We’re not immune from noticing both “rebound” targets are pretty lame, the FTSE really needing above 7,100 to convince a true attempt to escape the gutter is upon us.

Argo Blockchain

We reviewed Argo Blockchain (LSE:ARB) as recently as April, asking the question ‘Is Argo Blochchain sinking’. It appears we know the answer, with the price attaining a low of 86p, closing the session around 87p.

This is not good, thanks to our prior report giving a secondary drop target of 92p and hopefully a bounce. By breaking below our 92p and closing below such a level, from our standpoint, any bounce becomes less probable.

- Argo Blockchain: don’t bet on a sudden rebound

- Blockchain ETFs: a way to gain bitcoin exposure?

- Check out our award-winning stocks and shares ISA

The situation now for ARB has a few tweaks implemented, due to price movements over the last few months. Next, below 86p introduces the possibility of weakness to an initial 73p. If broken, our “ultimate bottom” remains at 63p, presenting a level by which the price almost must bounce. This is due to a single salient detail. We cannot calculate anything below 63p!

To escape this mess, the share price needs to exceed 110p to tick a pretty major box for any recovery to prove genuine. Such a movement should allow recovery to an initial 127p, with secondary, if bettered, calculating at an eventual 170p.

For now, as mentioned in our original article: “For the cautious, perhaps worth keeping a weather eye on it, just in case 63p makes a guest appearance in the weeks ahead.”

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.