Fund Spotlight: where to turn for quality growth outside the US

The ii Research Team offers an update and view on the Fidelity European fund.

17th April 2024 12:17

by ii Research Team from interactive investor

Investors looking for quality-growth companies find themselves in a quandary: while the US is the most natural hunting ground for growth companies, this market has delivered stellar returns recently and is now very highly concentrated and expensive.

You can certainly make the argument that valuation premiums versus history and versus other regions are justifiable, given the exciting American companies driving global indices and the perceived divergence in the growth trajectories of developed regions in favour of the US.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

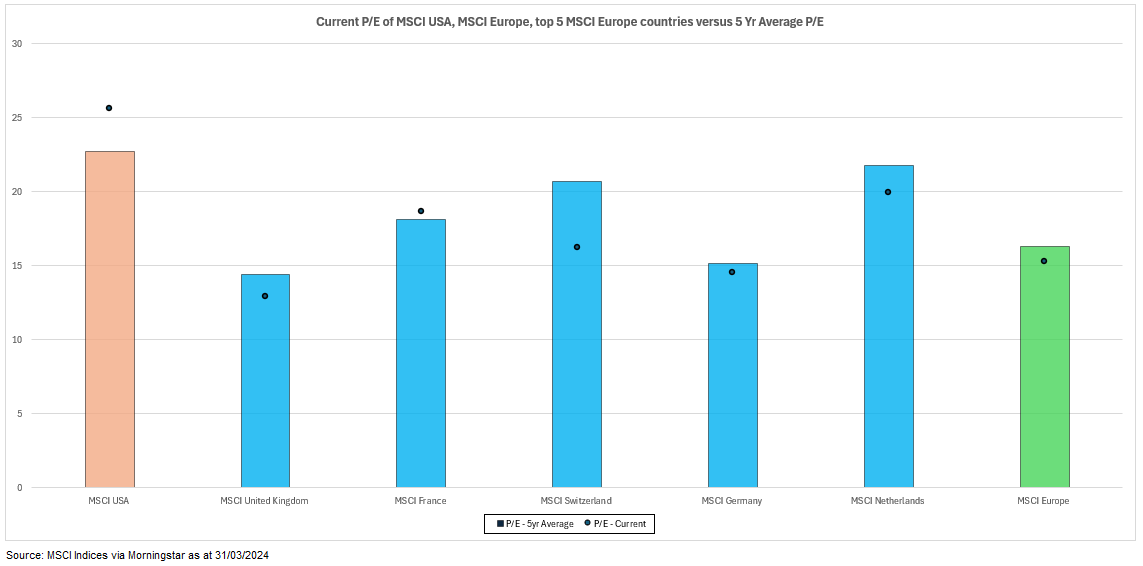

However, investors who feel valuations are looking stretched may consider diversifying in other regions where quality-growth opportunities are still ample, but share prices don’t look so lofty. One such region is Europe where earnings multiples now across the top five countries of MSCI Europe sit near to or marginally below five-year averages, versus more premium valuations commanded in the US.

While European equities might not have drawn in anything like the attention or inflow that the US has over the past year, the Continent’s exchanges are still home to a number of multinationals with global outreach and growth potential through exciting, as well as some more mundane, themes.

Many such businesses derive their revenues from all corners of the world. For example, MSCI Europe ex UK generates 23% of revenue from the US. This figure rises to 26% for Fidelity European, which actually generates slightly more revenue from US companies than from eurozone companies. So, while Europe may not appear so in vogue, the region still touts globally focused growth opportunities that can be found at multiples closer to historic levels versus American counterparts that broadly command a premium versus their historic valuations.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Merryn Somerset Webb: investing doesn’t have to be all about America

Fidelity European takes a bottom-up approach to investing in Europe, focusing on large, attractively valued companies with good growth prospects to hold over the long-term. While the fund’s yield is not a predominant focus, the preference is for businesses with the ability to grow their dividends over the next few years, as that is indicative of a company capable of sustaining growth.

The approach is very much focused on fundamentals and the managers look for financially sound companies, backed by strong balance sheets and cash generation, that are trading at reasonable valuations. The selection process is very benchmark aware, and doesn’t take bets on sector positioning, rather staying within the +/- 5% guardrails of the benchmark’s (MSCI Europe ex UK) allocation.

The fund has been managed since 2009 by Sam Morse, who first joined Fidelity in 1990. Since 2020, the fund has also benefited from having a co-manager in Marcin Stotzel, formerly an analyst working alongside Morse. Morse and Stotzel are long-term investors, and look to hold companies for generally five years or more. They maintain for each stock a list of “three good reasons” that justify its initial purchase and are updated to challenge and justify its ongoing place in the portfolio. It’s a simple but effective driver of selling discipline and ensures the portfolio doesn’t carry any unneeded excess.

What does the fund invest in?

The fund is relatively concentrated, typically across 40 to 50 names (currently 46), holding nearly 45% of its assets in the top 10 positions. The approach is high conviction, and rather than hold any underweight positions in a company versus the benchmark, Morse and Stotzel avoid the company entirely, meaning all holdings represent relative overweight positions.

The fund picks mostly from a universe of European-listed companies forming the MSCI Europe ex UK index. However, as mentioned, this portfolio of almost entirely European-listed businesses derives just a quarter of its revenue from European countries.

- Read our Research Team's other Fund Spotlight articles

- Where ISA early birds have invested their cash

Alpha is generated not through top-down bets on countries or sectors, but rather through stock selection. From a sector perspective the portfolio is well diversified, and looks much like its index, with most substantial weightings being towards financials (20%), healthcare (18.3%) and industrials (13.6%).

Country allocation deviates from benchmark to a slightly greater degree, but maintains the broad bias towards northern Europe, holding a notable overweight position in France of 28% (+4.4% over index). The main off-benchmark holding is the fund’s 4.1% UK allocation, comprising the portfolio’s largest overweight position, 3i Group Ord (LSE:III). The UK-based private equity company is UK-listed, although its portfolio of companies, as is the case for many of the fund’s holdings, derives much of its revenue from overseas.

Stylistically, Morse has maintained a persistent preference for higher multiple, growth businesses versus benchmark. This factor became more pronounced throughout 2021, and again throughout the back half of 2023, as strong performance of overweight positions in businesses such as ASML Holding NV (EURONEXT:ASML) and Novo Nordisk A/S ADR (NYSE:NVO) reached high multiples on account of excitement towards AI and weight-loss solutions.

How has the fund performed?

The fund boasts a strong track record over the short and long term. Over five years, the fund has returned 11.1%, leading its benchmark and peers by an annualised 1.5% and 1.8% respectively.

What is impressive also is risk-adjusted performance of the fund. The fund consistently demonstrates less volatility than the wider market, with a beta of less than 1, yet still has outperformed over one, three and five years versus its benchmark. The fund demonstrates good resilience of returns, with lesser drawdowns versus its comparators in the harsh markets of H1 2020 and 2022. For example, when European markets were rocked by Russia’s invasion of Ukraine in 2022, the fund lost just 2%, while its index and peer group drew down nearer 8% and 9% respectively.

| Investment | 01/04/2023 - 31/03/2024 | 01/04/2022 - 31/03/2023 | 01/04/2021 - 31/03/2022 | 01/04/2020 - 31/03/2021 | 01/04/2019 - 31/03/2020 |

| Fidelity European Fund | 13.9 | 9.1 | 10.4 | 25.7 | -1.9 |

| MSCI Europe Ex UK Index | 12.7 | 8.6 | 5.5 | 33.5 | -8.3 |

| Europe ex-UK Equity Sector | 11.8 | 6.0 | 4.5 | 37.3 | -8.2 |

Source: Morningstar Total Return (GBP) to 31/03/2024. Past performance is not a guide to future performance.

While the minor bias towards growth has been a small tailwind for Morse, given the rigidity with which the fund aligns with the sector allocation of its benchmark, outperformance can be largely chalked up to stock selection.

Why do we recommend this fund?

Fidelity European offers investors a time-tested approach to picking a diversified portfolio of financially strong European companies on track to continue their growth over the long term. Given the proximity with which the fund is managed to its benchmark, returns are unlikely to differ enormously from the market over the short term, and therefore are unlikely to astound in a rising market.

However, the strategy has shown great resilience on the downside, aided by the emphasis on looking for quality attributes on companies’ balance sheets. While the approach is conservative in not taking substantial sector or country bets, over the long term the team’s process of building a concentrated portfolio of best-in-sector companies has led to consistent outperformance of both index and peers, and has done so with minimal turnover of constituents.

Morse brings over 30 years of experience within the industry and Stotzel is a welcome addition given his experience across European equity sectors. With both managers supported by Fidelity’s immense analyst resource, the team is well primed to navigate European markets from the bottom up. The fund therefore is a strong option for investors seeking quality-growth exposure from European markets.

Fidelity European is one of interactive investor’s Super 60 investment ideas.

Please find the factsheet here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.