The fund we just sold and how we invested the proceeds

Despite the Euro elections, Saltydog analyst held his nerve and only made one change to his portfolios.

28th May 2019 13:17

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Despite the Euro elections, Saltydog analyst held his nerve and only made one change to his portfolios.

Holding our nerve

The Conservative Party came fifth in the recent European elections with less than 10% of the vote. That's certainly their worst performance in any European elections, and some are saying their worst performance ever.

This follows on the back of the announcement that Theresa May will stand down on the 7th June, having failed (several times) to secure MPs' backing for her Brexit plan.

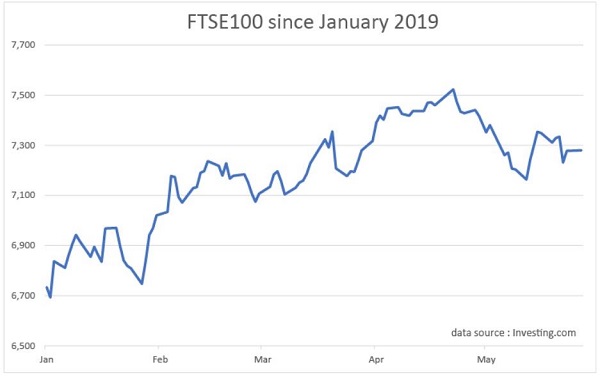

With the UK government in such disarray you might think that the markets would be going into freefall, but they seem to have grown immune to the dramas in Westminster. Since the beginning of the year the FTSE 100 has gone up by over 8%.

It started dropping back at the end of April, but that was more to do with the US-China trade war than what’s happening over here. It has recovered a little in the last couple of weeks.

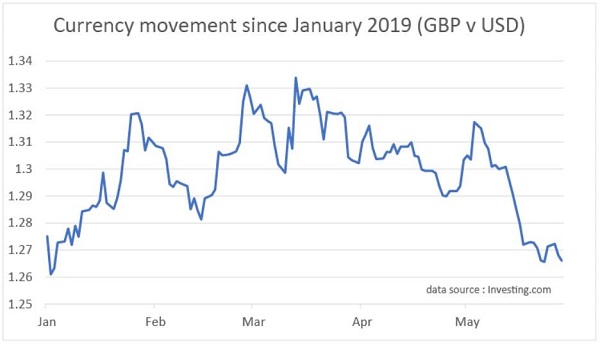

During the year so far we've seen the value of sterling rise and then fall against the US dollar.

The perceived wisdom is that when a Brexit deal with Europe looks likely, or that we won't even leave at all, then the pound strengthens.

Since the beginning of May we've seen the pound weaken as the European elections got closer and the country's support for the Brexit Party became obvious – the possibility of leaving with no deal suddenly became an option again.

The fact that the Brexit Party was expected to be the clear winner, probably explains why markets haven't reacted to the actual result.

When we reviewed the Investment Association sector performance last week the only sector showing a one-week loss was Global Emerging Markets, which had fallen by 0.6%.

Most sectors were also showing gains over four weeks, and they were all up over 12 and 26 weeks. We decided to hold our nerve and only made one small change to our portfolios.

At the end of January we invested in a couple of funds from the UK All Companies Sector, the Investec UK Special Situations fund and the AXA Framlington UK Mid Cap fund. Since then the Investec fund has gone up by 2.7%, but the AXA Framlington fund has gone up by 11.1%. We've already reduced the Investec fund and last week sold the balance and replaced it with the AXA Framlington fund.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.