FW Thorpe: Keeping faith in quality

2nd November 2018 15:51

by Richard Beddard from interactive investor

Economic headwinds are building, so what does happen when an irresistible force meets an immovable object? Companies analyst Richard Beddard tries to unravel the paradox.

As I write up one of my favourite businesses, FW Thorpe, a quote from one of my favourite books on strategy, Good Strategy/Bad Strategy by Richard Rumelt, is weighing heavily on me.

Rumelt says people, "... rarely predict that a business or economic trend will peak and then decline. If sales of a product are growing rapidly, the forecast will be for continued growth, with the rate of growth gradually declining to "normal" levels. Such a prediction may be valid for a frequently purchased product, but it can be far off for a durable good. For durable products - such as flat-screen televisions, fax machines, and power mowers - there is an initial rapid expansion of sales when the product is first offered, but after a period of time everyone who is interested has acquired one, and sales can suffer a sharp drop. After that, sales track population growth and replacement demand.

Predicting the existence of such peaks is not difficult, although the timing cannot be pinned down until the growth rate begins to slow..."

FW Thorpe manufactures a durable good, LED lighting systems. They last at least 10 years and sales have started to slow. The company believes the boost it received from the introduction of LED lighting systems has peaked. Because of economic uncertainty, particularly in the construction industry, it doubts it will perform as well in the year to June 2019 as it did in 2018.

As usual, I'm scoring FW Thorpe to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

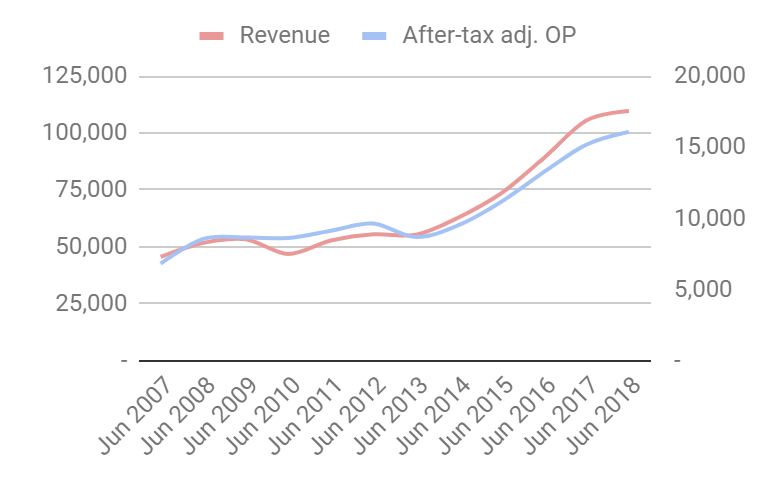

Forgive me if I skip over the charts, I believe they are self explanatory. Judging by the past, FW Thorpe is a highly successful business:It has grown:

Source: interactive investor Past performance is not a guide to future performance

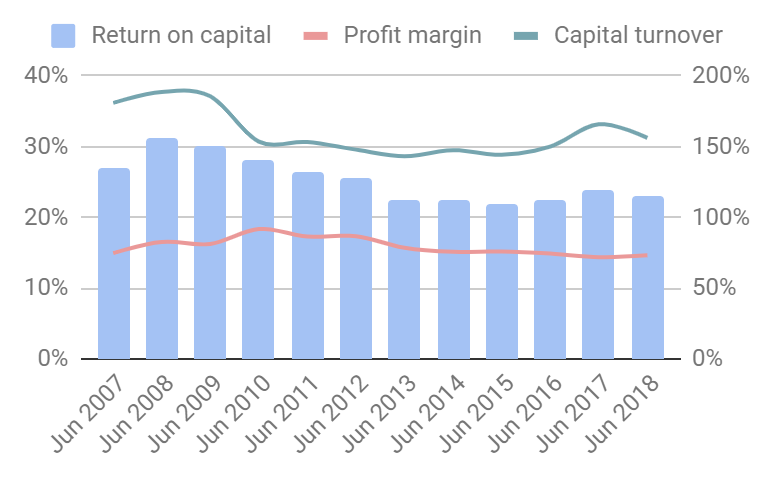

It has been highly profitable:

Source: interactive investor Past performance is not a guide to future performance

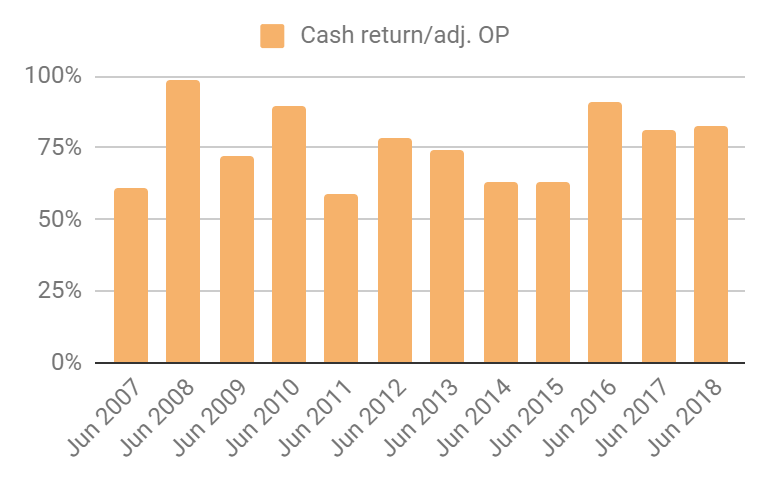

It rakes cash in:

Source: interactive investor Past performance is not a guide to future performance

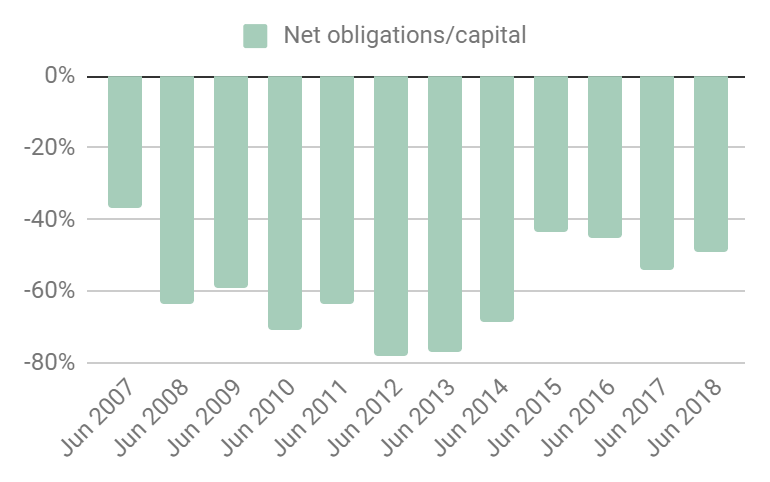

And it is a financial fortress. FW Thorpe's cash balance far outweighs its lease obligations and for the nth consecutive year, where ‘n' is a large number, it had no debt at the year end.

Source: interactive investor Past performance is not a guide to future performance

The investment case for Thorpe does not rest on interpreting its historical results, which speak for themselves, it rests on to what extent it can sustain them.

Adaptable: How will it make more money?

Score: 2

Co-chief executive Mike Allcock says each year he sits down and thinks about what to do next: "I wonder which products we will find to differentiate ourselves from the cheaper competition."

This is exactly what a long-term investor wants to hear. To earn outsized profits for any length of time, a company must be different, in a good way. Those differences stem from the choices it makes.

Thorlux, by far the biggest of FW Thorpe's subsidiaries does not supply cheap lighting systems. Its mantra is to supply at the lowest lifetime cost to customers willing to pay up-front for reliable, durable and efficient lighting that will save them money in the long run through lower energy and maintenance bills.

But I sense a different approach at TRT, FW Thorpe's outdoor lighting company down the road, where it is trying to get the up-front cost down too. For the first time, revenue at the fledgling operation fell in 2018 because of price competition, so TRT is introducing a new one-product-fits-all streetlight, Optio, with selectable light distributions and power settings, and adjustable column mounting. A generic product may allow the company to produce large volumes cheaply, reducing costs and improving revenue and profit margins.

The company is also increasing the amount of technology it puts in lighting systems. Revenue from SmartScan, Thorlux's wireless control system doubled compared to last year, when it was introduced. The system reduces a customer's lighting bill by dimming lights when there is bright ambient light, and by switching lights off when a space is not occupied.

During the year, Thorpe augmented some lighting systems to provide new benefits stemming from the fact that lighting is almost ubiquitous in buildings. It now supplies warehouse lighting systems that track people, and emergency lights that report humidity, temperature and carbon dioxide concentration levels. Customers can adjust the colour temperature of lamps, which may improve the wellbeing of, say, office workers and hospital patients.

Innovation is the cornerstone of FW Thorpe's strategy, but it is also trying to recruit customers in Europe, particularly the Netherlands. Thorpe, which earns 64% of revenue in the UK, has acquired two Dutch companies, Lightronics, a manufacturer of outdoor and vandal resistant lighting in 2015, and Famostar, which manufactures emergency lighting, in 2017. Both companies are performing well enough, but Lightronics has been slow to find European customers for Thorlux's industrial lighting systems, which is the big prize.

On a recent tour of FW Thorpe's headquarters and Thorlux's factory, what struck me most (apart from how well lit it is), was the firm's self sufficiency. It could have outsourced production of the printed circuit boards that house LED's but in 2014 it chose to build its own PCB production line, and now it has three. It bashes sheet metal into fixtures and machines diecast fixtures to meet customer specifications.

It doesn't do everything, but by retaining critical capabilities in house it has "optionality", the ability to provide something special if customers want it. The company is replicating many of the capabilities of its Thorlux factory at TRT to provide redundancy, and it has a fleet of seven trucks and vans so it can deliver rush jobs.

In addition to the products, I believe customers, particularly the end users it targets like Jaguar Land Rover and the NHS, favour Thorpe because of its can-do approach, its heritage, and its super-strong finances which mean it will be around in decades to come to support them.

Resilient: What could go wrong?

Score: 1

Three things can go wrong, potentially all at the same time. Demand for lighting will probably fall at some stage because, enticed by the energy saving credentials of LEDs, customers brought forward their plans to replace or upgrade lighting.

We may be approaching the stage Rumeld identified, where everybody who wants it has it, and demand declines to the normal replacement cycle and new builds. Confidence in the construction industry is low and reportedly it is getting more difficult to finance large projects. Finally, as the LED lighting industry matures, standards will homogenise, and it may be more difficult for FW Thorpe to differentiate lighting systems.

I have little doubt Thorpe's strategy addresses the risks, since it is constantly innovating, it is a high quality operator, and it has an excellent reputation. New innovations will encourage customers to upgrade and pay more for lighting, and Thorpe's overseas expansion will shield it somewhat from construction industry problems here. It also owns manufacturing facilities in the Netherlands and part owns a facility in Spain, so it is in a good position to handle any deterioration in the terms of trade resulting from Brexit. It will probably become more efficient as it retires fluorescent systems.

I am not sure if Thorpe can do any more than it is already doing by extending the product range geographically and functionally, but that may not be enough to mitigate a post-peak fall in demand for LED lighting systems. In retrospect, upgrading to LED was a no-brainer for customers, they were getting better lights at lower cost. Newer innovations may be more discretionary.

Developing Rumelt's example of flat screen TVs, the shift to LED lighting is a revolution, like the shift from boxy CRT televisions to flat screen LCDs. Within a few years, nobody bought CRT's. Since then, some of us have replaced our flat screen TVs with high definition flat screens or curved ones, but many of us, to our children's disgust, have just stuck with what we originally bought.

Equitable: Will we all benefit?

Score: 2

FW Thorpe's annual report is exemplary. The accounting generally eschews fudges like exceptional items. The company explains what it does well, and shows us in case studies, but it is also realistic about its prospects.

The board is unconventional but experienced. Mike Allcock, chairman and co-chief executive joined FW Thorpe as a technical apprentice in 1984. Craig Muncaster, finance director and co-chief executive joined in 2010. Andrew Thorpe, the grandson of founder FW Thorpe, has worked at all levels in the business and retired as chairman and chief executive in 2017. He is a non-executive director, as is his brother Ian. These men, and two other executive directors whose careers at Thorlux date back to the 1980's, have deftly guided the company through a revolution in lighting. I cannot imagine better people to face up to the challenges ahead.

The Thorpe brothers own 45% of the company, which makes them by far the biggest shareholders and stewards of the business. The next generation is also represented on the board in James Thorpe, who became business development director in 2017. Typically, family businesses are concerned to preserve prosperity for future generations, aligning their interests with other long-term shareholders.

The fourth plank of Thorpe's strategy is to develop "high quality people", through training and apprenticeships and although reviews of the company on employment sites are few (there is only one positive review on Glassdoor.com), the 11 reviews on Indeed.com are all complimentary.

Perhaps Mike Allcock is an example of how far good people can rise in the firm.

Cheap: Is the firm's valuation modest?

Score: 1

It is not immodest. The shares value the enterprise at about 18 times adjusted profit in 2018.

A total score of 8/10 means I recommend Thorpe for long-term investors.

But I'm also scared by the confidence the score implies. I am asking myself what happens when powerful industry headwinds meet an impeccably managed firm with a fabulous track record. Implicitly, I am saying the impeccably managed firm wins, but the powerful forces might prove irresistible.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.