German stock market index could make another record high

23rd June 2021 07:39

by Alistair Strang from Trends and Targets

Analyst Alistair Strang thinks there's enough indication in the charts that the German DAX is heading higher. Here's why.

UFO’s, in becoming ‘UAP’s, are now deemed acceptable topics, even on the nightly news. The German DAX index opens itself up to a whole nest of conspiracy issues, thanks to a couple of circled gaps on the chart below.

Folk sometimes think “The Market is out to get me!” and at times, it feels like it’s out to get us too.

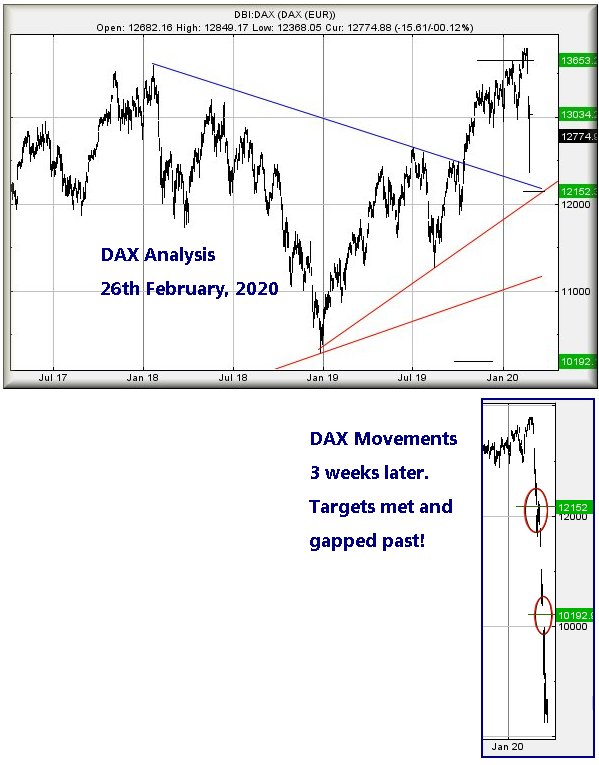

The chart below is interesting. We obviously remain bemused when encountering market manipulation gaps, but this series from Germany left us wide eyed. Our analysis on the DAX from 26 February introduced some pretty large drop targets.

The first one suggested the potential of a 600-point reduction to 12,152 points. Our target was achieved just four sessions later but the method by which the success appeared was strange. The index was gapped down, breaking below this target level. Assuring ourselves this was just one of these things, our secondary target came to fruition a couple of weeks later, the German index again gapped down to our target level.

Happening once could easily be written off as coincidence. When this nonsense happened again within such a short timeframe, it became clear our software had been mapping the correct trend. And the manipulation gaps strongly suggested the market wanted the German index pretty firmly below our logical target levels, hence manipulation gapping the index downward. The DAX was to eventually bottom around 8,250 points in the middle of May.

Source: Trends and Targets. Past performance is not a guide to future performance

Paradoxically, this forced reversal has given voice to another, usually erroneous, stock market cliché.

Every now and then, someone will advance the theory of something needing to go down before it can go up. Most folks, anxiously clutching shares where the price is trashed, face a fruitless period of years, if awaiting an inevitable price recovery. But there can be a kernel of truth in the saying. If something has crashed illogically, then is given reason for a rise, the results can prove flamboyant when the value of an overcooked drop is, essentially, paid back.

We believe this is happening with the DAX and suspect the index shall prove capable of an attempt at further all-time highs.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Why reading charts can help you become a better investor

- Check out our award-winning stocks and shares ISA

The index is closing on what we think shall be an important trigger level. Presently trading around 15,640 points, the DAX needs exceed 15,670 to give some early warning for some reasonable movement. We can calculate 15,966 points as our initial target. If bettered, a longer-term cycle toward 17,488 points calculates as possible, and we suspect some market hesitation should such an amazing number make an appearance.

For everything to start going convincingly wrong for German, the index needs break Red, roughly at 14,700 points. Such a scenario risks a tumble to the 14,000 level, perhaps even 13,100 points.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.