Glencore windfall and what the analysts think

Investors prepared to back the commodities firm have done well, but what’s the outlook? City writer Graeme Evans reveals what the experts think.

22nd July 2025 15:36

by Graeme Evans from interactive investor

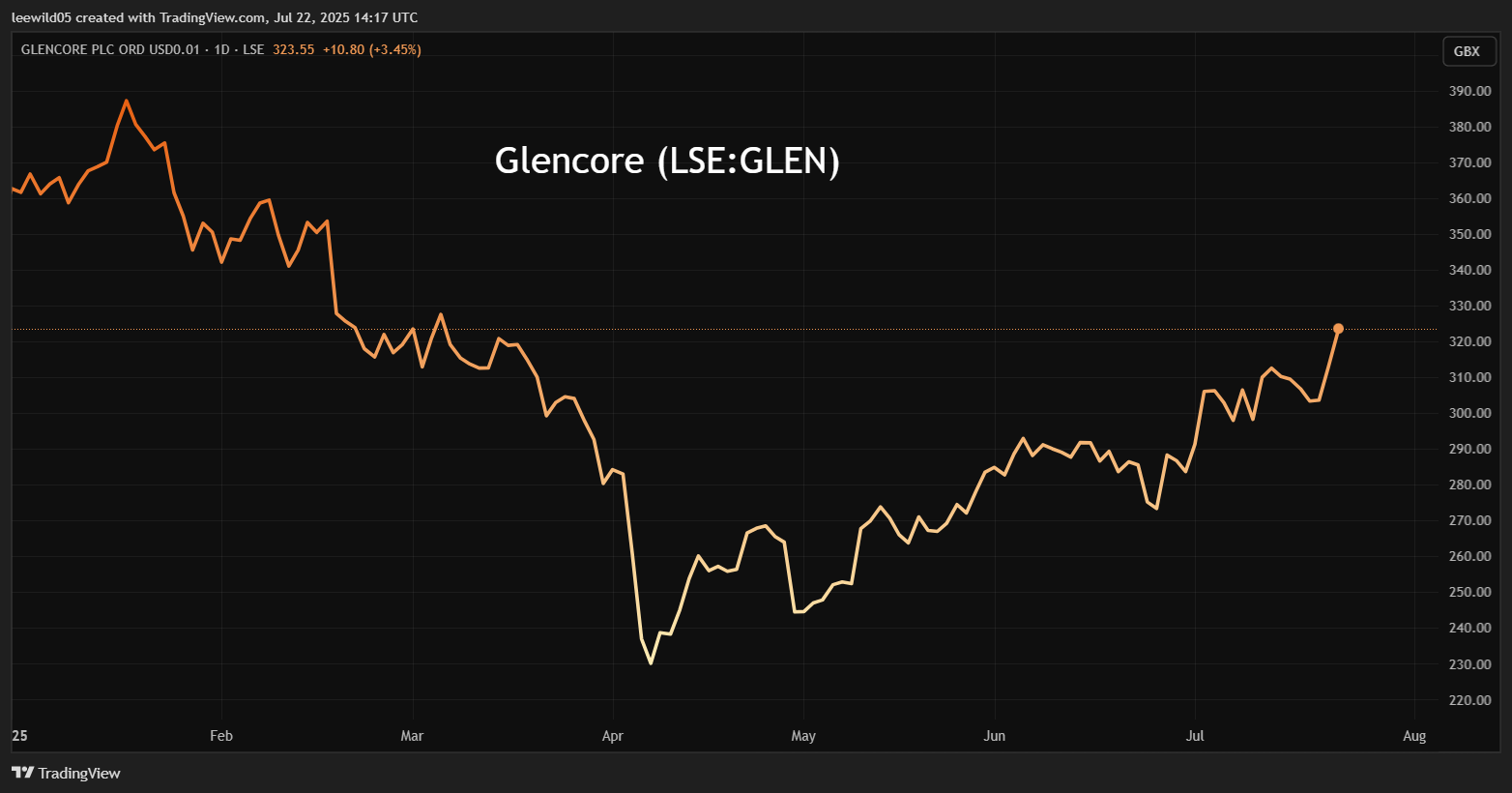

Retail investors who bought Glencore (LSE:GLEN) shares in April’s tariffs turmoil are sitting on a paper profit of 30% or more after the mining giant’s valuation recovery continued today.

Glencore closed at 230.5p on 7 April after prices of copper, thermal coal and other key commodities in the group’s portfolio were hit by fears over the demand impact of tit-for-tat tariffs by the US and China.

- Invest with ii: Open a Trading Account | Cashback Offers | Free Regular Investing

The turmoil led to a flurry of orders on the ii platform as Glencore became the sixth most-bought ISA stock in the week to 4 April and second in the final week of that month.

Bargain-hunting ii customers were joined by Glencore’s own finance boss Steven Kalmin, whose £1.4 million buy-the-dip investment took place at a price of 233p.

The shares are today 38% higher at 322p after a de-escalation of trade tensions boosted the prices of key commodities and industry sentiment benefited from the resilience of recent trading updates.

Source: TradingView. Past performance is not a guide to future performance.

Glencore is due to post its half-year production figures on Wednesday 30 July before the release of interim results a week later on 6 August.

Morgan Stanley warned recently that output of copper and zinc may disappoint during the period, leading to a 5% downside risk to the City’s first-half earnings expectations.

But with operating momentum showing improvement at the start of the second half, the bank expects a renewed focus on potential capital returns at the year end.

- FTSE 100 vs FTSE 250: one of them is in a ‘sweet spot’

- Rio Tinto and Antofagasta both benefit from Q2 production boost

Earlier this month, Glencore launched a share buyback programme worth up to $1 billion (£741.6 million) after completing an agribusiness merger involving its interest in grain handler Viterra.

Morgan Stanley maintained an Overweight rating on Glencore shares but trimmed its price target to 370p, mostly to reflect the appreciation in the pound to dollar exchange rate.

UBS and Deutsche Bank sit at 400p, having recently joined analysts on a field trip to inspect Glencore’s newly acquired Elk Valley Resources coking coal operations in British Columbia.

Glencore presented a positive long-term outlook for the high-quality assets, reflecting the impact of supply constraints and expected demand growth in India and South-East Asia.

However, the near-term picture is more uncertain due to a structural decline in Chinese steel demand as well as supply growth caused by some mines returning to operation.

Deutsche Bank said: “Coal-market conditions remain tough with the risk of further price weakness in the third quarter, but prices are close to a cyclical trough, in our view, and the division should remain a cash cow for the group moving forward.”

- Stockwatch: should you buy on this second profit warning?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Jefferies, which has a price target of 380p, added: “Integration with the rest of Glencore's global coal business has gone well, but metallurgical coal price weakness since the acquisition of Elk Valley closed has been a clear negative.

“While the met coal market will likely be relatively weak for the near/medium-term, an improving economic outlook could be an offsetting positive, and met coal prices should eventually significantly increase.”

Berenberg added that shares have underperformed peers on the back of the coal price weakness and sentiment, but adds that the company has an attractive self-help thesis that can drive outperformance in the shares. It has a price target of 380p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.