Stockwatch: should you buy on this second profit warning?

Shares in this popular small-cap stock haven’t been this low in over 10 years, and analyst Edmond Jackson is intrigued by an old City adage about profit warnings.

22nd July 2025 10:32

by Edmond Jackson from interactive investor

Corporate warnings are starting to expose the broader market rally from early April, where industry fundamentals are deteriorating. Can these be excused as industry-specific, or do they imply an economic trend?

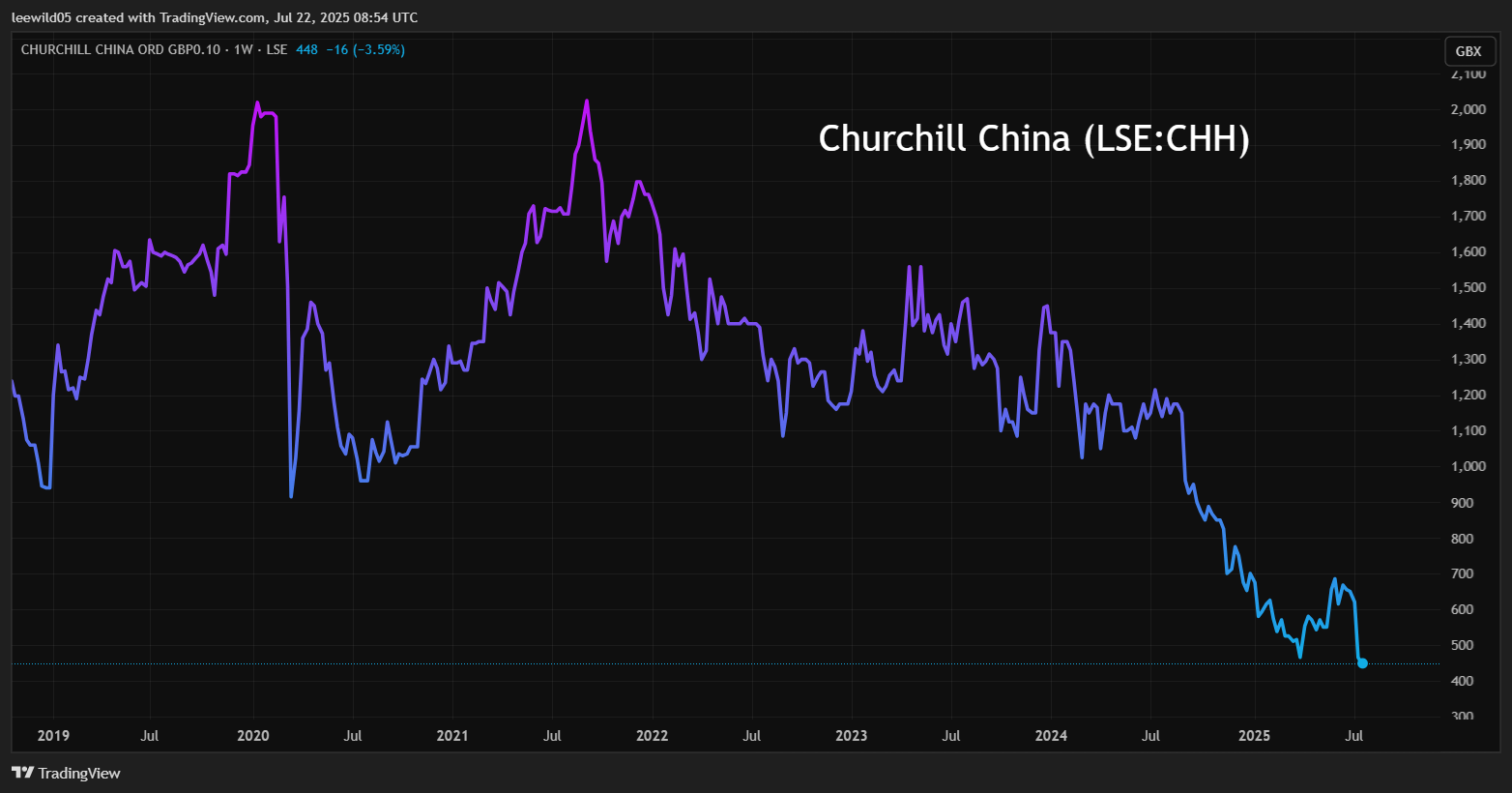

After recruitment and advertising companies – classic cyclicals – have cautioned, ceramics manufacturer Churchill China (LSE:CHH) has reminded us of tough conditions in hospitality. This is relevant in a macro sense, given that restaurants, hotels and the like are key employers in the modern service economy.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

A 17 July update involved quite a major warning, which followed others citing a deterioration in the second quarter. May and particularly June were “materially below” target, hence interim net profit will be significantly below last year’s £3.6 million. Admittedly, this is an AIM-listed company capitalised at just £51 million with its shares at 450p, albeit a useful example.

Should you wait for a third profit warning?

It marks a second warning in the procession of updates, hence also a test of the old adage how “profit warnings come in threes”. Yet a 2023 study of 245 UK small-caps found 64% issued one profit warning, while 36% experienced multiple warnings, within which 11% warned three or four times.

Mind also that a need to warn investors also reflects how bold or cautious a company has been with its guidance and the extent of visibility in an industry.

The context for Churchill has involved a disappointing trend since the second half of 2024. That first half-year had shown revenue down 8% but profit measures slightly ahead, and management anticipated good seasonal demand. But it did not materialise and on 20 November came a profit warning.

- Shares for the future: a speculative FTSE 100 investment

- Stockwatch: is it ‘darkest before dawn’ for this cyclical share?

On 5 February, the company then maintained full-year 2024 guidance and at the 9 April annual results avoided specifics beyond saying, “a more robust hospitality market is required for a step forward in our market penetration and profitability”.

The shares still joined the global bull party from April, but the price has retreated, now less than the 465p low after President Donald Trump announced “Liberation Day” tariffs on 2 April.

Source: TradingView. Past performance is not a guide to future performance.

Despite fears that both the UK and US economies risk stagflation, for Churchill these have been “robust” markets, and weakness has instead manifested in Europe, especially Germany, and the rest of world.

There is still a common theme of structural pressure in the restaurant industry. Churchill says: “We continue to be the supplier of choice, but it is the restaurants, particularly the independents, where cost pressures are creating market contraction, new installation projects remaining at lower levels and increased competitive intensity.”

Perhaps there was over-expansion of restaurants anyway, on the back of money created after the 2008 financial crisis. They then hit Covid, causing inflation such that input costs soared and rises in the cost of living meant that people had to cut back on eating out, especially at finer outlets more likely to be buying Churchill’s ceramics. These plates are also a discretionary purchase for restaurants, most likely when a new outlet opens.

So, I think there are exceptional factors in this industry, but it’s still interesting how the second quarter has manifested further weakness.

How long will the downturn last?

It is the crux, if speculative, question. We have yet to see the economic effects of higher US tariffs, but interest rate cuts are supposed to be in the offing.

Despite its market weakness, Churchill says that it continues to defend share, and its longer-term financial record shows respectable double-digit operating margins and returns on total capital employed.

Churchill China - financial summary

Year end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 51.1 | 53.5 | 57.5 | 67.5 | 36.4 | 60.8 | 82.5 | 82.3 | 78.3 |

| Operating profit (£m) | 6.4 | 7.8 | 8.7 | 11.4 | 0.2 | 6.1 | 9.7 | 10.3 | 8.0 |

| Net profit (£m) | 5.3 | 6.4 | 7.2 | 9.1 | 0.1 | 4.2 | 7.9 | 7.7 | 6.4 |

| Operating margin (%) | 12.5 | 14.5 | 15.1 | 16.8 | 0.5 | 10.1 | 11.7 | 12.5 | 10.2 |

| Reported earnings/share (p) | 47.8 | 58.0 | 65.0 | 81.8 | 1.0 | 37.8 | 71.8 | 70.2 | 57.9 |

| Normalised earnings/share (p) | 47.7 | 55.4 | 70.7 | 80.8 | 5.5 | 37.8 | 67.7 | 70.1 | 57.8 |

| Operational cashflow/share (p) | 54.3 | 59.8 | 63.7 | 86.4 | 9.0 | 88.5 | 36.1 | 77.1 | 33.2 |

| Capital expenditure/share (p) | 22.7 | 20.0 | 19.0 | 50.9 | 22.3 | 34.0 | 42.7 | 49.2 | 28.5 |

| Free cashflow/share (p) | 31.6 | 39.8 | 44.7 | 35.5 | -13.3 | 54.5 | -6.6 | 27.9 | 4.6 |

| Dividend per share (p) | 21.1 | 24.6 | 29.0 | 10.3 | 0.0 | 24.0 | 31.5 | 36.0 | 38.0 |

| Covered by earnings (x) | 2.3 | 2.4 | 2.2 | 7.9 | 0.0 | 1.6 | 2.3 | 2.0 | 1.5 |

| Return on total capital (%) | 16.8 | 19.2 | 19.7 | 23.4 | 0.3 | 11.8 | 15.7 | 15.5 | 11.8 |

| Cash (£m) | 12.7 | 15.6 | 17.4 | 15.6 | 14.0 | 19.1 | 14.7 | 13.9 | 10.1 |

| Net debt (£m) | -12.7 | -15.6 | -17.4 | -15.2 | -13.6 | -18.6 | -13.9 | -12.9 | -9.2 |

| Net assets (£m) | 28.6 | 33.9 | 38.0 | 41.8 | 37.1 | 42.7 | 56.6 | 59.9 | 61.3 |

| Net assets per share (p) | 261 | 309 | 347 | 381 | 337 | 387 | 515 | 545 | 557 |

Source: historic company REFS and company accounts.

The table also shows years of substantive capital expenditure, although it’s unclear what extent is necessary to sustain competitiveness or add value longer term.

This is from the latest update: “Capital projects initiated in the first half, focused on increasing agility and improving our cost base, our now broadly complete. We have also identified capital projects to pull forward to further reduce our cost base.” This does have a flavour of what businesses may need to do anyway amid shifting economic winds.

More positively, Churchill adds: “New product introductions, utilising inkjet and pressure cast, are being accelerated to restore growth, exploiting our investment in these processes.”

- Insider: three big property firms on the buy list

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Consensus already looks to have shifted down to expect £4.5 million net profit this year from £6.4 million in 2024, with £6.9 million pencilled in for 2026 – but that could be previous bulls of the shares clinging to hopes of a rebound.

Due to barely 11 million shares issued – a healthy sign after more than 20 years as a listed company – this implies earnings per share (EPS) around 41p, hence a five-month forward price/earnings (PE) ratio of 11.0x. Given this share was delivering EPS over 70p – with zilch gap between reported and normalised figures – in 2022 and 2023, the PE is near 6x such level.

Selling Churchill shares now would therefore assume a permanent diminution in performance, and not even an industry consolidator would be interested in the brand, with ability to shear off further costs.

More likely the total dividend will be cut

Within the 9 April annual results, a final dividend of 26.5p per share was declared despite lower profitability “highlighting the board’s belief the company can continue to make sustainable cash flows, and that the underlying performance of the business has the potential for sustainable growth”.

There was no subsequent guiding down in either the AGM statement or 17 July update, but consensus already expects a near halving of the total dividend to 21p in respect of this year and also 2026, implying a 4.7% yield covered nearly twice by the earnings forecast.

Strong balance sheet appeals to contrarian buyers

At end-2024, Churchill had net tangible assets of £60.6 million equivalent to 550p per share, there being no debt beyond £550,000 leases. The ratio of current assets to current liabilities was also very strong at 4.0x and the income statement benefited from £541,000 net income from £10.1 million period-end cash.

A fall in cash from near £14 million at end-2023 is explained by the timing of income tax paid and also £3 million of investment, relative to a 39% drop also in cash generated from operations last year.

Admittedly, there are no signs of institutions buying materially, nor Churchill insiders, although the company may now be in a restricted period ahead of half-year results due in early September.

Rathbone Investment Management sold 1.1% of the company to own 11.9% the day before the dire 17 July update - cute or coincidental? Invesco Asset Management sold a third of its holding early last March to own 5.0%, and Charles Stanley – presumably its discretionary management side – also sold 10% of its holding to own 7.5%.

Portmeirion Group is a partly relevant comparator

Last March, I noted how Churchill shares, and also Portmeirion Group (LSE:PMP), had plunged to 493p and 155p respectively, despite rather different customers – the former, global hospitality, the latter more consumer-oriented.

I thought trading needed to “significantly worsen and for some time” on both, to justify their low ratings. But my sense of “contrarian buy” was (as yet) premature, despite three Portmeirion directors buying nearly £250,000 worth of shares at 157p to 180p in early April.

Yesterday, the shares edged up 4% to 139p after a first-half trading update cited sales just about matching inflation albeit hit in the US by tariff disruption. Modest growth is anticipated in the traditionally stronger second half albeit with no guidance numbers.

A dilemma for Portmeirion was cancelling its final dividend amid tight finances such as negative free cash flow and possible pension deficit recovery payments. Net debt has edged up to near £15 million, although net tangible assets per share were anyway 327p at end-2024. Mind, 83% of such was debt-funded inventories.

Given the worsened trading environment, of the two I am inclined to favour Churchill China, given its stronger overall finances, but at least Portmeirion directors have bought meaningfully. I retain “buy” stances although consider how unless a takeover approach rekindles interest, it looks like a long haul.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.