Global dividend growth hit, but some regions still bright spots

Growth figures were not gloomy for all regions, with some breaking new records.

22nd August 2019 09:24

by Tom Bailey from interactive investor

Growth figures were not gloomy for all regions, with some breaking new records.

A slowing global economy is starting to weigh on corporate profits, with global dividend growth declining to its slowest pace in two years, according to the latest Janus Henderson Global Dividends index.

The big positive is that companies around the world have handed out a total of $513.8 billion in dividends in the second quarter of the year, a new record for the second quarter.

But, against that, growth in payments was slower than in previous years. Headline growth stood at 1.1%, primarily held back due to the appreciation of the dollar. Meanwhile, underlying growth, which strips out special dividends and currency fluctuations, was 4.6%. While still a strong figure, this is slower than in the past.

Growth figures, however, were not gloomy for all regions. Emerging markets, for instance, saw headline growth of 12.6% and underlying growth of 12.7%. Driving this growth was Russia, which made up a fifth of emerging market dividends paid, with Sberbank (LSE:SBER) and Gazprom (LSE:OGZD) boosting payouts.

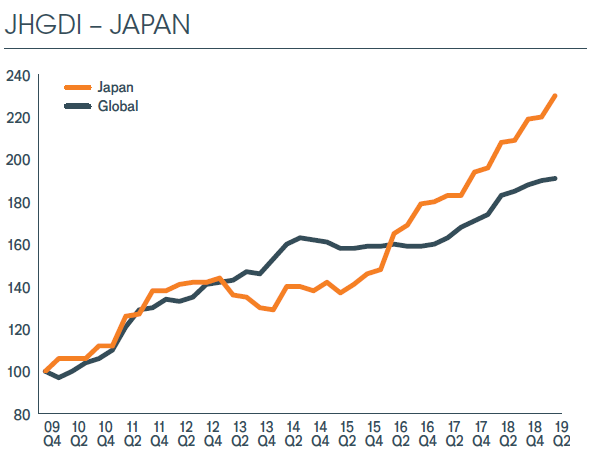

Elsewhere, Japan's dividends payouts reached a new record for the second quarter, at $39.6 billion. This represented an increase in 10.1% in headline terms and 6.8% underlying, with the difference primarily the result of the strength of the yen.

Asia Pacific ex Japan, meanwhile, saw more mixed results. With payments totalling $43.2 billion in the second quarter, underlying growth was only 2.2% compared to the same quarter in 2018. On headline terms, dividends declined by 2.9%.

The biggest drag on Asia Pacific ex Japan came from China Mobile (NYSE:CHL). The Hong Kong-listed company was forced to cut its dividend following poorer than expected profits. Meanwhile, Samsung (LSE:SMSN), South Korea's largest dividend payer, was unable to make any year-on-year dividend increases owing to lower chip prices and weaker demand for smartphone components.

When it comes to the UK, dividends rose by 8.6% on a headline basis for international investors, bringing in a quarterly record of $35 billion. This was led by a $4.2 billion worth of special dividend payouts from both Rio Tinto (LSE:RIO) and The Royal Bank of Scotland Group (LSE:RBS).

Underlying growth was more moderate, at 5.3%. Banks help to boost underlying growth, with Royal Bank of Scotland restoring its dividend and Barclays doubling its payout. In total, three-quarters of UK companies raised their dividends year-on-year.

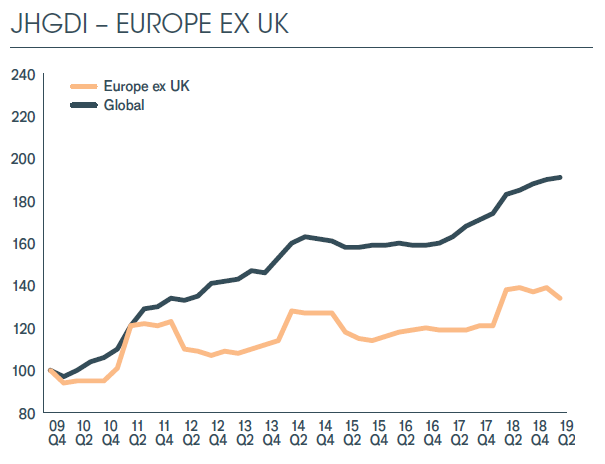

Europe ex UK continued its trend of underperformance, with payouts declining by 5.3% year-on-year on an underlying basis. In headline terms, dividends edged up by 2.6%.

Europe's poorer than usual performance was primarily the result of the global slowdown. European companies attempt to keep dividends more correlated to profits than in other parts of the world, meaning that poor economic performance translates more directly into poor dividend payouts.

Finally, North America paid out dividends totalling $132 billion, a new record, with underlying growth coming in at 5.6%. Canada, however, was primarily responsible for this, with the country achieving a fourth successive quarter of double-digit growth, primarily as a result of the strong performance of energy companies.

The US, meanwhile, saw its slowest headline growth in three years at 3.9%, with payments totalling $121.7 billion.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.