Is the growth investing boom about to end with a bang?

Growth investors have got rich on this strategy, but serious doubts are beginning to creep in.

26th September 2019 09:24

by Lee Wild from interactive investor

Growth investors have got rich on this strategy, but serious doubts are beginning to creep in.

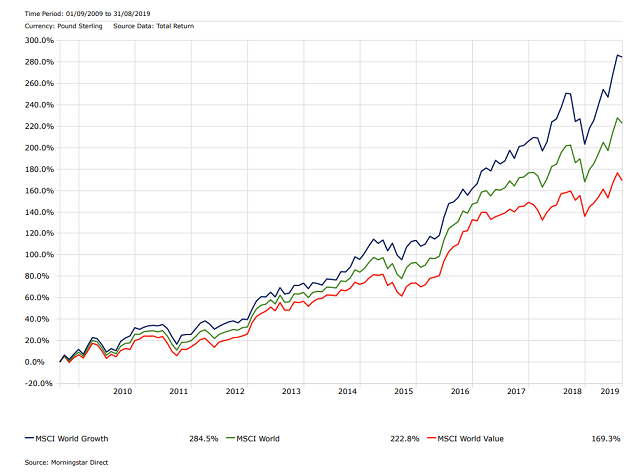

Growth investing has been the winning strategy for the past decade. But how did it usurp 'value' as the dominant trade? Why has it lasted so long, and is the great growth bull run over?

These slides help answer some key questions and illustrate what has happened since the Great Financial Crisis and what might happen next.

After global stock markets collapsed in 2008-09, growth became the investment strategy of choice as companies rebuilt earnings and equities rerated.

But the market mood now seems to shift with the sand and the argument in favour of growth is increasingly harder to make.

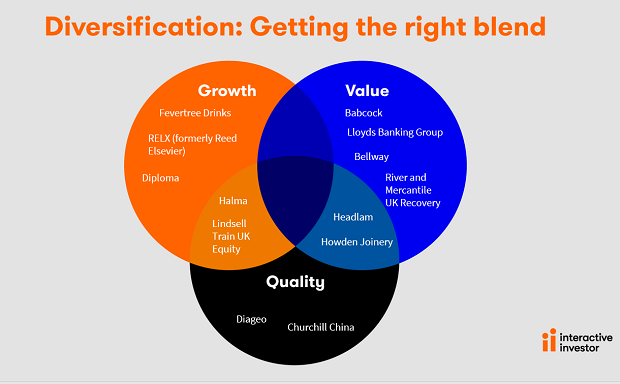

The debate over Growth vs Value strategies is no longer so straightforward, and investors are being asked to consider a third variable – Quality. It might seem obvious, but some businesses generate better-quality earnings than peers and are generally better-run.

This is often because they allocate capital more profitably. To find out which companies fit the bill, star investors like Warren Buffett and Michael Mauboussin look at metrics like return on equity (ROE).

ROE - calculated by dividing net income by book value of equity - measures how efficiently a company uses Shareholders' Equity to generate profits. A high ROE hints at a company with high-quality, moat-like business traits that Buffett loves.

But to find out how much longer growth might have as the dominant strategy, it's worth remembering what underpins its popularity.

So, the success of growth as a strategy owes it origins, in this cycle certainly, to the availability of cheap money after interest rates collapsed since the Great Financial Crisis.

But are the foundations of this growth boom finally beginning to crumble?

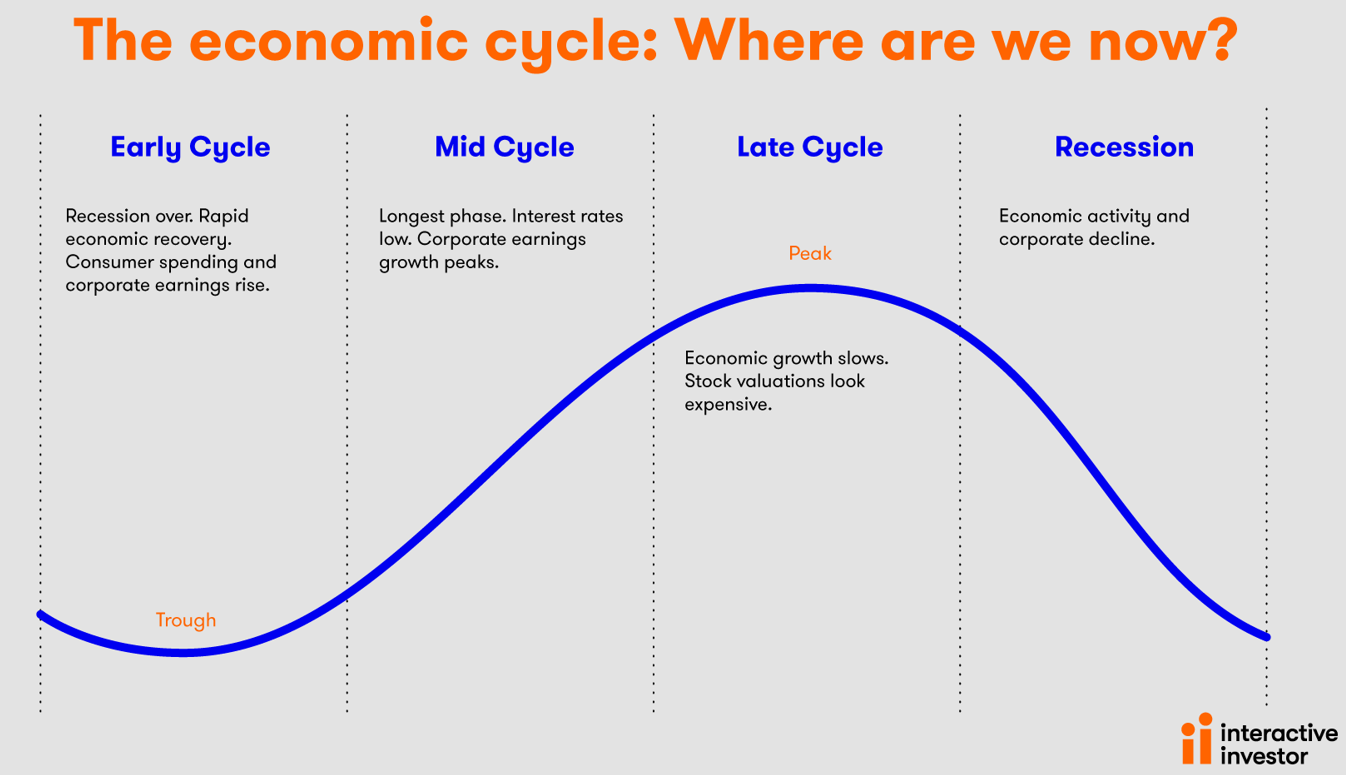

Before discussing the pros and cons of growth investing right now, it's worth looking at the economic cycle, and where we are in it.

You can see the early cycle where we exited the Great Recession in 2009. We've had the mid-cycle period of rapid earnings recovery and growth. Now we're late cycle – probably somewhere near the peak. And we all know what comes next!

But recession this year or in 2020 is certainly not inevitable.

Let's look at the arguments for and against a growth strategy in the current environment.

The argument in favour of growth looks compelling.

Each cycle is different, averages don't tell us much, and experts have a poor record of calling cycles correctly. Long-term structural drivers like population growth, climate change, robotics and artificial intelligence, and regulation are also at play here.

While the argument that the economic cycle has flattened is hotly disputed, 'value' has certainly become the 'pain trade'.

Negative Interest Rate Policies (NIRP) are meant to make banks lend more and companies and individuals spend and invest more, rather than pay to keep cash in the bank. This should make equities with 4-5% yield – and there are lots of them - hugely attractive. Christine Lagarde, who takes over at the European Central Bank on 1 November, is a big fan.

While earnings estimates have reduced over the summer months, consensus estimates for 2020 earnings growth are still reasonably bullish.

President Trump is also keeping the pressure on the US Federal Reserve leading up to the 2020 presidential election. Trump will not allow a recession before next year's election.

While this is convincing, there is an equally strong case to be made against a growth strategy currently.

Firstly, the end of any economic cycle is typically bad news for growth/cyclical sectors, and a recession is inevitable at some point. Growth underperforms value in a bear market, and the valuation difference between growth and value strategies is currently the most extended since 2004.

Concerns around valuation and profit growth are nothing new, but cuts to consensus forecasts will make third-quarter earnings season hugely significant.

That growth is slowing globally is a massive worry right now. China - the world's growth engine - is slowing fast - while Germany is stagnating and the UK hobbled by Brexit uncertainty.

Without a sensible resolution, the impact of the US - China Trade war could be severe. It's already causing pain and, like Brexit, the longer it rumbles on the greater the uncertainty, fear and volatility.

An inverted yield curve infers lower inflation, or deflation and anaemic growth. It's when interest rates on short-term bonds are higher than rates paid by long-term bonds. Fear about the near-term future forces investors to pile into safer long-term investments. Japanification - the country's decades long battle against deflation and anaemic growth - is proof this is a real risk.

You might also ask that, if negative rates haven't had the expected multiplier effect of increasing bank lending and consumer spending, surely the experiment has failed? We'll have to see if negative rates become the norm for the general public first.

Recession risk is at its highest since August 2009, according to Bank of America Merrill Lynch latest fund manager survey – is a fair measure of current sentiment. And that sentiment is shifting in favour of the pain trade of buying value. Value is already pricing in a downturn - and growth stocks trade close to all-time valuation highs relative to Value names. The feeling is, the tide is already shifting toward value.

Mean reversion of growth rates happens. A company cannot grow rapidly forever. At some point growth will slow and this drags valuations back toward the mean.

In addition to points made on the two previous slides, growth fans will know that we're in the historically volatile autumn months, after which equities have tended to outperform.

interactive investor has run a pair of winter portfolios for the past five years. These have demonstrated how high-quality stocks outperform in the six winter months from end of October to end of April – our aggressive portfolio has doubled over a five-year period.

The anti-growth faction point to a sharp reduction in us share buybacks in the second quarter. This will reduce earnings, although it could also mean that companies are just deploying capital in different ways – perhaps by investing in the business, or takeovers

So, what are the consequences of low rates?

There are plenty of cheap 'value' stocks around, but private equity and overseas buyers are driving a boom in UK merger & acquisition activity. The UK could remain a very attractive hunting ground while the pound remains weak and private equity is awash with cash.

And then there's what we call risk–off trades.

There is good evidence of institutional money being withdrawn from risk assets, or certainly moved to safer areas of the equity market. That's because, as global growth slows, central bank easing provides clear benefits to income strategies like bonds.

However, this late cycle is not typical - inflation is under control and government bond yields are at historic lows. So central banks do have plenty of firepower to stimulate growth.

And this should limit the downside to global equities – UBS says a 15% correction rather than 25%.

Who's right and how should investors position themselves?

The strength of logical argument on both sides demonstrates just how hard it is to favour a single strategy right now.

Indeed, Morgan Stanley recently expressed a "moderate preference for Value," but believed that, "This is not a conducive environment for aggressive sector or style bets".

"Put simply, we think it risky for investors to run with a strong style bias at this time."

The diagram below makes it easier to decide a strategy which fits an individual investor's own take on events and outlook for equity markets.

Growth

We've looked at what could go wrong for growth, but, of course, growth as an investment strategy could well survive a while longer. Seasonal bias and success of interactive investor's Winter Portfolios certainly suggests this market may have one last burst left in it.

Value

Few think 'value' is really dead. And there are a number of good reasons why.

The derating of value is driven largely by sentiment than company performance - growth delivers better returns in a bull run. Buying well-managed companies, with strong balance sheets and a track record of growing the top line - it shows that people like what you produce - is always a sensible strategy.

The human traits of greed and fear will ensure the cycle survives and that will always provide value opportunities. And, if you believe the recession risk indicators, the resurgence of value as a winning strategy over growth is very likely.

Quality

It's especially important to buy quality when the cycle turns. so look for sustainable earnings growth, high profitability and efficiency, all good indicators of companies with competitive advantages, or moats.

Quality is rarely cheap, but legendary investor Warren Buffett is happy to pay a fair price for it. So should you be if you have the right investment horizon.

The right strategy

It looks a dead-cert that rates will stay lower for longer, and that economic growth is slowing, so investors must position for a low rate, low growth environment.

As always, a well-diversified portfolio smooths out changes in investment fashions through the cycle.

Most investors will take a core-satellite approach to portfolio construction, starting with a big index tracker, then adding other funds (like Scottish Mortgage (LSE:SMT), Lindsell Train (LSE:LTI) etc) to diversify away risk.

Key here is to blend styles and focus on quality with stock and fund ideas. Blend growth funds with value if you believe valuations are stretched and think growth just got too risky.

With no single strategy standing head and shoulders above the rest, this remains the most sensible approach in what is an increasingly unpredictable world.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.