A half-price high yielder tipped to grow profits

There’s evidence that shares in this former star have bottomed, and it’s winning new business.

22nd January 2020 11:52

by Rodney Hobson from interactive investor

There’s evidence that shares in this former star have bottomed, and it’s winning new business.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

All the attention in the motor world has been on cars, with private motorists getting stick over diesel and petrol pollution while manufacturers race to produce electric and self-drive cars. But what about buses? The largest manufacturer in North America has been in the doldrums for the past three years but a spate of new orders could help change all that.

NFI Group (TSE:NFI) is based in Winnipeg in Canada and it manufactures heavy-duty transit buses, medium-duty buses, low-floor buses and coaches in Canada and the United States. It also supplies bus and coach parts and support services. Its initials stand for New Flyer Industries, its name until 2018, and its main subsidiary in the US retains the full title.

As with carmakers, there will be considerable pressure on bus manufacturers from the green lobby and from transport operators to produce more efficient vehicles with lower emission. Well established companies such as NFI will have the advantage.

Revenue growth has been sluggish over the past three years and earnings per share (EPS) are actually down by around 10% in total, facts that have been reflected in the share price.

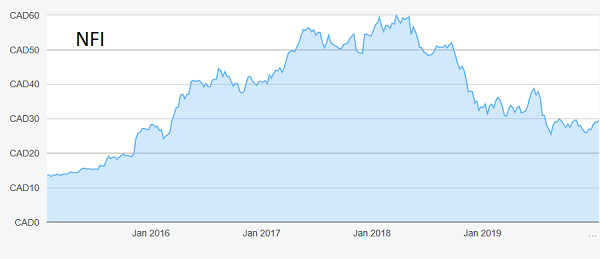

Source: interactive investor Past performance is not a guide to future performance

Paul Soubry, who became chief executive in 2009, has presided over a rollercoaster ride, with the shares zooming from C$13 five years ago to a peak of C$60 just under two years ago.

Then came the run of poorer figures and the shares slipped until they bottomed out at C$25.50 in 2019.

That could all be changing. Revenue was 5.1% ahead last year and a raft of new orders have been won in recent months. The new year was greeted by the Los Angeles County Metro Transit Authority exercising options for 70 Xcelsior 60-foot, heavy-duty compressed natural gas transit buses. The options are part of a contract with LA Metro for up to 400 compressed natural gas (CNG) buses originally announced in October 2017.

Just before Christmas New Flyer of America set in place production of 132 heavy duty transit buses for the Washington Metropolitan Area Transit Authority. This order is the third instalment of a five-year contract by Metro for a total of up to 694 diesel and CNG buses.

The NFI subsidiary was also selected as an approved supplier of zero-emission buses in California and other contracts have been won in New York, Edmonton and Philadelphia.

The shares have started to edge higher again and are currently trading at just under C$30, where they offer a generous yield of 5.74%, which is adequate compensation against any possible short-term slippage in the share price. The company bought back 0.5% of its shares during 2019, helping to underpin the share price and future earnings per share.

There is some justifiable concern over the sustainability of the dividend. NFI introduced a dividend only eight years ago so there is no solid long-term track record. Also, the payout was reduced after the first year, although it has been stable since. The latest dividend was not fully covered by earnings so the need for sales growth to feed through into profits is vital, otherwise the payout could be trimmed back.

However, analysts estimate that EPS did pick up in the final quarter of 2019 and will surge this year, with the improvement sustained into 2021. The price/earnings ratio is a little higher than cautious investors might like at 21.3, but that is not worryingly high.

Hobson’s choice: Investors conscious of the element of risk should consider buying at up to C$34. The downside, even with a reduction in the dividend, looks limited to the solid floor at C$26, while the upside is considerably greater if sales growth translates into higher profits.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.