A healthy outlook for one of the largest companies on earth

The world's biggest health firm has had a few niggles, but profits are growing faster than expected.

16th October 2019 10:52

by Rodney Hobson from interactive investor

The world's biggest health firm has had a few niggles, but profits are growing faster than expected.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

News has come fast and furious at health and consumer goods supplier Johnson & Johnson (NYSE:JNJ) this year, not all positive, so it was good to see better-than-expected third-quarter results and an upgrading of full-year guidance. The shares moved higher, but are still below recent highs.

The strong third quarter performance was driven by pharmaceuticals and medical devices as sales rose 1.9% to $20.7 billion and underlying net earnings improved 1.5% to $5.7 billion. Earnings per share climbed 3.4%.

J&J now expects sales for 2019 to rise 0.2-0.7% to top $80 billion. That may not sound much but it is a big improvement on previous guidance given after the second quarter, when, the company thought sales would be flat at best compared with 2018 and might actually fall as much as 1%. Earnings per share are seen as growing by as much as 6%.

Chairman and chief executive Alex Gorsky cites "disciplined" management of products in the firm's portfolio and a focus on innovation in developing products as well as manufacturing and selling them.

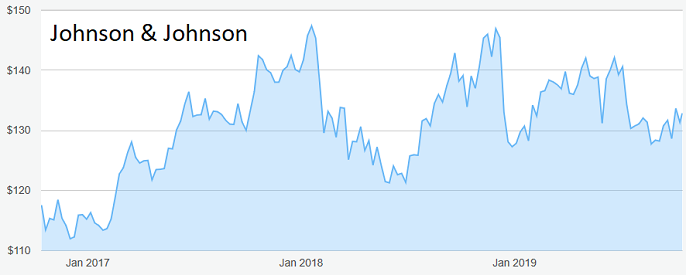

Source: interactive investor Past performance is not a guide to future performance

One part of the empire offering hope is the Janssen Research & Development arm which has, with German pharmaceutical company Bayer as development partner, just won approval from the US Food & Drug Administration for their product rivaroxaban for preventing blood clots in acutely ill patients in hospital and immediately after discharge.

Janssen has also this month applied to use Stelara as a treatment for children aged from six to 11 suffering from the distinctly unpleasant autoimmune skin disease psoriasis, which affects 125 million people worldwide. Stelera is currently approved in several countries for adults and children over the age of 12 and can also be used for Crohn's disease and ulcerative colitis.

Days earlier it was granted Breakthrough Therapy Designation for niraparib by the FDA as a treatment for prostate cancer. That means the drug gets favourable consideration in regulatory reviews as a potential treatment for a serious condition.

Other putative winners highlighted in the past few months include possible treatments for multiple sclerosis, lower respiratory tract disease, blood cancer and tuberculosis.

The other side of the coin is J&J's battle with accusations that it aggressively promoted its opioid patch and pill painkillers to the point that patients became addicted. This kind of legal action tends to be expensive and J&J is one of several drug companies that have been accused of causing, between them, the deaths of more than 4,600 people in the state of Oklahoma alone over a 10-year period.

The company's defence is that there was government oversight over the drugs and there were warning labels on the products.

An Oklahoma judge ordered J&J to pay $572 million in damages, mercifully somewhat less than the $17 billion that the state had demanded. The company is to appeal against the decision. More recently a jury in Pennsylvania ordered J&J to pay $8 billion in damages and interest in a parallel case. Again, an appeal has been lodged and it is likely that the excessive amount will be reduced at least.

J&J shares slipped ahead of the third-quarter results, falling below $131, but jumped 2% after the figures to just below $133. At one point they were well above $134 before running into profit taking by day traders. However, they are still well short of the $148 peak reached at the end of last year. At current levels the yield is 2.8%.

Hobson's choice: The better outlook is not fully reflected in the share price, which has pretty much moved sideways for more than two years.

The downside looks limited to $128 even if the fourth quarter falls short of expectations. Buy up to $134.

For anyone attending the London Investor Show on 25th October at the Novotel London West, please do come up and say hello.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.