'Healthy pullback' for bitcoin?

Our award-winning cryptocurrency analyst brings you all the latest developments in the world of crypto.

18th July 2019 13:22

by Gary McFarlane from interactive investor

Our award-winning cryptocurrency analyst brings you all the latest developments in the world of crypto.

Bitcoin has retreated below the psychologically important $10,000 mark, witnessing its second-largest fall of the year with a drop from $11,021 to $9,410 on 16 July.

The previous largest fall of the year was on 27 June which began the pullback from the year's high at $13,800.

The leading cryptocurrency has now lost around a quarter of its value after briefly breaking though $13,000 on 10 July last week. Bitcoin is currently trading at $9,808 on Coinbase.

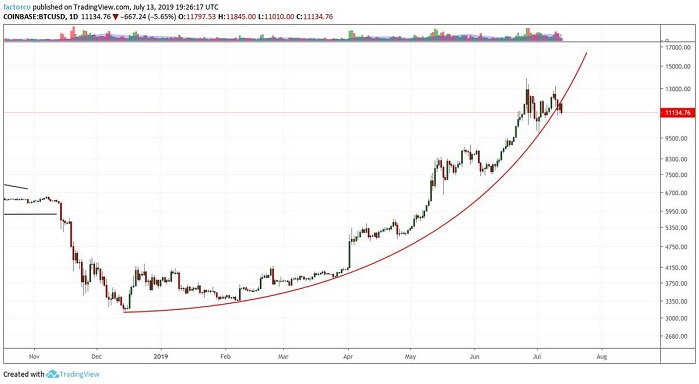

BTC/USD 1-day candles, Coinbase 18 July (Source: TradingView)

"Healthy pullback" for bitcoin?

Thomas Lee co-founder of Wall Street analyst firm Fundstrat Global Advisers, although not exactly welcoming this latest correction, said "it's healthy to see bitcoin pullback here", adding that the low level of Google searches for bitcoin showed that the recent rally "has not been unaccompanied by massive hype".

Make of that what you will, but it does support a picture previously assumed that institutional money was the key driver behind the upturn and not retail investors.

But the chief executive of the Binance exchange, Changpeng Zhao, begs to differ. Extrapolating from the trading activity seen on his exchange, which is the largest non-derivatives crypto-to-crypto exchange globally, he estimates that 60% of trading is by retail investors.

Zhao told Bloomberg that "what we've seen is pickup in both places" although the institutional trading volume "has not increased tremendously in 2019".

He expects to see heightened volatility ahead, citing the greater margins available to traders. He expects the majority of his exchange customers to be borrowing money for their trades by the end of the year. Since 11 July Binance has allowed its customers to access 3x margin.

Zhao didn't mention in his comments – perhaps for competitive reasons – that the unregulated derivatives markets may also be adding to volatility, as business booms on exchanges offering crypto futures and options products such as BitMex.

Also, perhaps missing from Zhao's equation is the impact of over-the-counter trading (OTC) – a trade agreed by two parties and not made on a formal exchange - which by may not show up on reported exchange trading volumes. Institutions favour OTC trades for large buy orders.

Commodity trader Peter Brandt has pointed to the possible violation of the parabola that he had previously posited as a possible flight path for bitcoin, previously pencilling in a possible price of $40,000 for May next year.

"If current parabolic phase is violated, we could expect either an 80% correction of 7-month advance or much smaller correction w/ definition of new parabola w/ shallower slope," Brandt tweeted to his 298,000 followers.

And here's a chart he posted on 13 July showing the violation he had in mind.

It's still all about Libra

The backdrop to the latest declines is the same as that which framed the advance – Facebook's (NASDAQ:FB) Libra cryptocurrency. Specifically, the furore it has kicked up with financial regulators and politicians around the globe is now deflating some of the optimism that may have helped boost bitcoin.

This week's US Senate banking committee hearing on Libra, which was followed by the House financial services committee's own hearing on Wednesday, will likely be guiding market participants' behaviour over the next few days.

Those hearings come after US president Donald Trump laid into Libra and cryptocurrencies more generally last weekend, castigating them for being based on "thin air", insisting that they were not money.

His Twitter storm was followed by remarks from Treasury secretary Steve Mnuchin in which he said Facebook had "a lot of work to do" to convince politicians and regulators before its plan could go forward. G7 finance ministers meeting this week said much the same thing.

Facebook's David Marcus goes to Washington

At the Senate hearings David Marcus, Facebook's payments supremo who is heading up the Calibra organisation that will provide wallet and other services for Libra, was given a rough ride.

Marcus for his part attempted to be conciliatory. He said that Libra would be compliant and wouldn't launch until all the issues that Congress was concerned about had been addressed. Critics might say that’s nothing more than to be expected, namely obeying the law of the land, but Facebook could of course launch in another jurisdiction in which it operates.

Countering that, Marcus said Switzerland was not chosen “to evade any responsibilities of oversight” and that Libra would be regulated by US financial authorities.

On the issue of trust, Marcus emphasised the independent nature of the Libra Association, which currently has 28 launch partners with the aim of eventually having 100, would mean Facebook would have a voting weight of 1%.

That is strictly correct but Facebook as the initiator of the project and the owner of the world’s largest social network is likely to have an outsized influence. Marcus admitted that to date Facebook has to date carried all the costs of developing Libra.

Staying on the Switzerland front, the Swiss privacy regulator is yet to have heard from Facebook, according to a report by CNBC, but is following the "public debate".

Libra is "dangerous" says congressman

Marcus explicitly answered questions about the monetisation of financial data by saying that it is "not the intention at all" to do that, but might ask for permission from users, in conjunction with Libra partners, for consent to use that data.

In response to questioning around why Facebook wants to enter financial services given the scandals on data misuse and privacy, Marcus pulled out the innovation card.

Sherrod Brown, the senior Democrat politician on the committee described Libra as "dangerous", saying it would be "crazy" to let Facebook into banking.

Indeed, a bill has been brought before Congress with the intention of barring US Big Tech from entering financial services.

"They are like a toddler who has gotten his hands on a book of matches. Facebook has burned down the house over and over and called every arson a learning experience," said Brown in no uncertain terms.

Marcus said that Libra isn't intended to be a competitor to traditional bank accounts, although he at the same time said he would be happy to be paid in Libra.

Libra and Calibra "won’t make money at the outset"

He also emphasised that Libra and Calibra would not be expected “to make money at the outset,” but instead the project was aimed at stimulating more e-commerce on Facebook-owned networks and thereby increasing ad spend by companies, as well as addressing financial exclusion.

The Calibra chief added that Libra was not envisaged as a competitor to sovereign money. "The Libra Association, which will manage the reserve, has no intention of competing with any sovereign currencies or entering the monetary policy arena," said Marcus, but intentions are one thing and actual outcomes another.

In comments provided to the Financial Times, a Libra spokesperson said that, although Calibra is being built to comply with current anti-money laundering, anti-terrorist financing and know-your-customer rules and processes, the same could not be said for other wallets from third parties.

In response to the paper's queries, a Libra spokesperson said:

"Typically it is not the developer of blockchain technology that is regulated, but the service providers that build on the technology and interact with consumers and merchants."

At the House financial services committee, Marcus avoided providing the chairwoman of the committee, Maxine Waters, with a commitment to halt development work on Libra.

Refusing to directly engage with the question, Marcus said:

"Chairwoman, I agree with you that this needs to be analysed, understood and the proper oversight needs to be set up before Libra can launch."

The committee wants Facebook to run a pilot with one million users with oversight from US financial regulators and US Federal Reserve.

China may green light Libra-style digital currencies from "commercial entities"

The US is behind the curve on mobile payments by some distance, lagging both Asia and Europe. Playing to that theme, Marcus focused on the "inevitability of blockchain" technology being deployed to improve efficiency in financial services and other industries.

If the US stymies development of the technology it will leave the door open for others "out of reach of our national security apparatus" the Facebook executive claimed.

Obviously, Facebook has its own reasons for raising the China bogeyman, but it does speak to a wider truth – namely how crypto and digital payments are opening another arena of competition between the main economic blocs.

The former governor of the People's Bank of China Zhou Xiaochuan said in a speech last week that China could not risk seeing its lead in digital payments eroded and Libra could be a threat in that respect.

Zhou also worried that Libra could strengthen the already dominant position of the US dollar in the global economic system.

He raised the possibility of "commercial entities" being allowed to issue digital currencies much in the same way that three banks in Hong Kong – Bank of China (HongKong), HSBC Holdings (LSE:HSBA) and Standard Chartered (LSE:STAN) – are allowed to issue their own banknotes backed by hard currency.

As we reported last week, there are moves afoot in the European Union to explore the creation of euro-backed stablecoin issued by either member states in the first instance and later the European Central Bank.

In the same way that Trump in his anti-crypto tweets talked up the dollar, Zhou eyed strengthening the yuan.

Zhou said

"Libra has introduced a concept that will impact the traditional cross-border business and payment system" and that China needed to take this opportunity to leverage blockchain technology to “make good preparations and make the Chinese yuan a stronger currency".

The South China Morning Post, which broke the story on the former PBOC governor's speech, reported that at least one senior analyst thought that Zhou's reference to "commercial entities" being allowed to create crypto money was with an eye to Tencent (SEHK:700) and Alibaba (NYSE:BABA) – both companies have highly successful mobile payments ecosystems.

China trading volumes much larger thought

Another part of the story behind bitcoin's rise was the mounting concern regarding the China-US trade dispute. Chinese investors were thought to be buying as a hedge against economic uncertainties and a way of circumventing capital controls

Following the G20 summit in Japan worries subsided a little, helping to boost equity markets, as did hopes for interest rate cuts from the Fed.

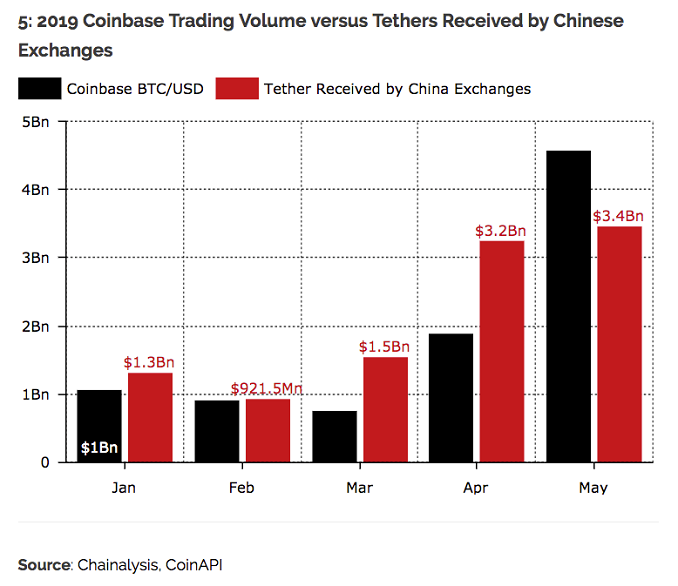

Diar Research has produced a report in conjunction with Chainalysis, which has some findings that fly in the face of perceived wisdom.

Although China has clamped down on exchanges in the country, they are still doing a lot of yuan business. The research found that usage of the Tether stablecoin on China-focused exchanges far outstrips any other markets, with China accounting for 60% of on-chain transactions.

It also provides evidence suggesting that volumes on exchanges previously thought to be massaged to show inflated numbers, may be much more accurate than an influential Bitwise report had claimed.

The Diar report, entitled China Stablecoin and Trading Appetite Dwarfs Global Demand, states: "Massive amounts of funds are being moved into exchanges in China for no other purpose than trading. Even a single trade of Tethers moved onto Chinese exchanges would equal daily volumes equivalent to $215 million for the month of April (the period Bitwise analysed), which is three times as much as Coinbase and on par with Binance (see chart below)."

interactive investor reached out to Diar about the report's finding, given that Chinese crypto trading volumes through exchanges were thought to have collapsed following the ban introduced in 2017.

So, are the yuan-accepting exchanges referred to by Diar offshore and accessible only via VPN or onshore P2P? Assuming the latter, other than localbitcoins, which are the largest venues?

A Diar spokesperson said: "When we say Chinese exchanges we meant exchanges that are primarily geared towards addressing that market. LocalBitcoins and the such are not included in the analysis as we looked at Tether as the trading unit. Some of these are the likes of Huobi, and ZB.com, the latter of which also runs mining operation out of China."

Video app YouNow token sale gets go-ahead

Following the recent public filing of Props by YouNow's RegA+ utility token, that ii had previously reported on, the US Securities and Exchange Commission has approved the Props token which to be distributed to 47 million users of fast-growing video app YouNow users.

A press communication said:

"YouNow becomes just the second company in history to receive this approval for a crypto token and the first as a consumer-grade crypto token."

Binance challenging Coinbase?

Binance has announced that it will be "burning" [removing from circulation] 50% of its team allocation of BNB tokens that were granted in the exchange’s initial coin offering. This should help support the price of the token but it comes after Binance has previously hinted that the buyback programme for the token may come to an end.

Binance is opening a fiat-to-crypto exchange in Singapore and may be planning to enter the South Korean market.

All that comes on the back of plans to open a fiat-to-crypto exchange in the US, the world's largest crypto market. Regulatory issues make that difficult for Binance, given the SEC’s attitude towards initial coin offerings and the issue of whether tokens sold through ICOs are unauthorised securities sales.

The Malta-registered exchange business is seeking to challenge Coinbase's position as the market leader among fiat-to-crypto trading venues.

France introducing regulations for ICOs this month

According to a Reuter's report, France will introduce rules for crypto-related firms later this month.

Anne Marechal, executive director for legal affairs at the country's Financial Markets Authority, said:

"France is a precursor. We will have a legal, tax and regulatory framework. We are in talks with three or four candidates for initial coin offerings (ICOs)."

France's plan is thought to be in line with those that will be rolled out internationally following recommendations by the Financial Action Task Force. France is also pushing for the G7 countries' central banks to set up a task force to look at regulation of Libra.

Japan's Bitpoint exchange hacked

Licensed Japanese crypto exchange Bitpoint was hacked to the tune of $32 million. It has suspended its services while it investigates. The security failure relates to unauthorised access to the hot wallets in which the exchange kept the crypto funds that provide liquidity for the exchange.

China crypto mining machines impounded

China has arrested 22 people and impounded 4,000 ASIC mining machines in its latest clampdown on cryptomining in the country. $3 million worth of electricity had been used in the mining operation, which was spread across nine factories. It is not illegal to mine crypto in China, but the electricity usage has to be authorised. The country still accounts for around 70% of all bitcoin mining activity.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.