How this investor reacted to the latest market sell-off

Amid ongoing market volatility, Saltydog analyst explains his approach and a 30% profit since June.

12th August 2019 13:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Amid ongoing market volatility, Saltydog analyst explains his approach and a 30% profit since June.

Déjà vu

Over the last few years there have been several recurring themes that have been driving the markets. Quantitative easing and low interest rates, the US/China trade war, and Brexit.

At the end of July, the US lowered interest rates by 0.25%, the first reduction in 10 years, and also ended its so-called quantitative tightening program two months early. Normally, this would have boosted the markets, but it had been so widely anticipated that any benefit was already priced in.

The fact that Jerome Powell, Chair of the Federal Reserve, went on to say that he didn't see the cut as the "beginning of a lengthy cutting cycle" left the markets, and the US President, decidedly underwhelmed.

The next day President Trump announced that the US would be adding additional tariffs on Chinese imports from 1 September. China responded by halting its imports of US agricultural products and allowing its currency to devalue to its lowest level since 2008. This had a much more dramatic effect on global markets.

Within a few days the S&P 500 and the Dow Jones had both fallen by 4%. The Nasdaq was down 5%, along with the Nikkei 225, the Paris CAC40 and the Frankfurt DAX. The FTSE 100 and the Shanghai Composite dropped 6%, and the Hang Seng was down 8%.

Donald Trump was talking about imposing tariffs on China back in 2016, when he was campaigning for the White House. In April 2017 he agreed to a 100-day plan for trade talks to reduce the US deficit with China, but these failed and so he started threatening tariffs.

In January 2018 he started by imposing tariffs on all imported washing machines and solar panels, not just the ones coming from China. He then went on and included all steel and aluminium imports.

In April 2018 he began targeting China specifically with tariffs of 25% on $50 billion of imports starting in July. At that point he announced a plan for a further 10% on $200 billion of imports - this was imposed in September and due to be increased to 25% on the 1 January 2019.

Last year ended up being the worst for equity markets since the Financial Crisis, with the FTSE 100 losing 12.5%. Much of this was blamed on the trade wars.

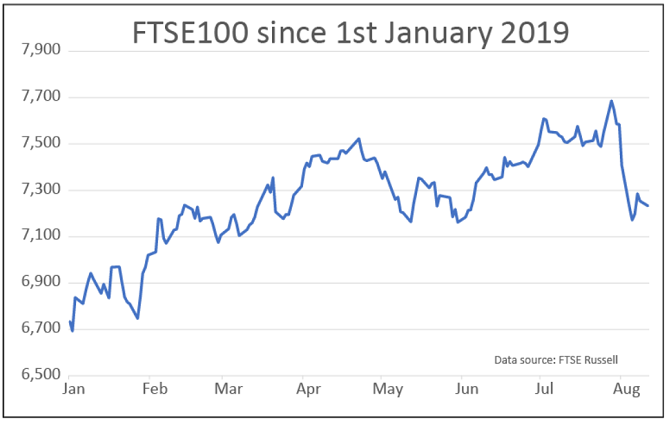

At the beginning of December, the US agreed to delay any increase in tariffs until March, and in February it was delayed further. This corresponded with an upturn in markets around the world and between the 1 January 2019 and the end of April the FTSE 100 went up by over 10%.

Past performance is not a guide to future performance

Then on 5 May the President had a change of heart and tweeted that he intended to go ahead and raise the tariffs on $200 billion of Chinese goods from 10% to 25% on the 10 May. And that's what happened. He also threatened to impose further tariffs on the remaining $300 billion of Chinese imports and put new tariffs on Mexican imports.

Investors panicked and $4 trillion was wiped off global stock markets during May.

A disastrous month was followed by a strong recovery in June and July. The Mexican tariffs were suspended 'indefinitely' and at the June G20 meeting in Japan, Donald Trump had a meeting with China's President Xi Jinping and they agreed to resume trade talks. He also withdrew the threat that the US would add tariffs on the additional $300 billion worth of Chinese imports.

The week before last, there were brief talks between the US and Chinese negotiators that didn't make any substantial progress. That's when Trump said he would go ahead with the 10% tariff on the remaining $300 billion of Chinese imports starting at the beginning of September. Initially, stock markets around the world fell sharply, but they have now levelled off.

Only time will tell if we will see another rebound like we did in June.

At Saltydog Investor, we don't usually react to a single week of disappointing data and so didn't make many changes to the portfolios last week. We sold the Baillie Gifford American fund, which we only bought at the end of June, but it had been struggling for a few weeks. Overall it went up 3.6%.

The gold funds, which I mentioned a couple of weeks ago, have continued to perform well. The Investec Global Gold fund went up by over 6.5% last week and has now gained more than 30% since we bought in June.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.