How to tackle and profit from volatile markets

For investors seeking safety but unsure where to find it, we share ideas about how to avoid the chaos.

14th February 2019 10:13

by Cherry Reynard from interactive investor

For investors seeking safety but unsure where to find it, we share ideas about how to avoid the chaos.

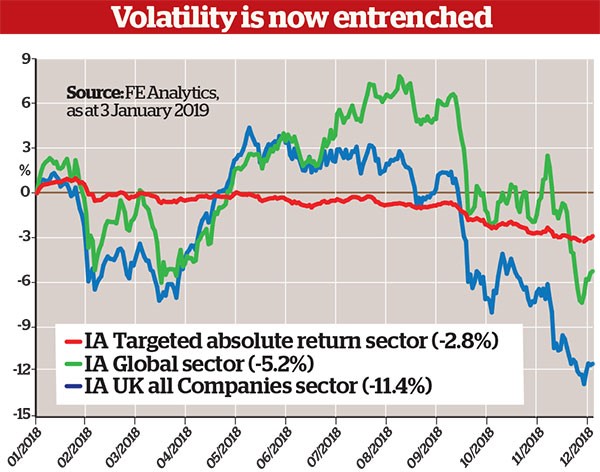

Investors in the stock market used to recognise that they had to take the rough with the smooth: stock markets could be a rocky ride. But investments usually worked out well if they were held for long enough. There has, however, been so much 'smooth' in recent years that many investors have forgotten about the 'rough' bit. The past year has been an abrupt reminder that stock markets are not without risk.

The current year doesn't look like being much better than 2018 for investors. There may have been a pause in the trade war between China and the US, but the underlying problem – the US's vast trade deficit with China – has not gone away. Resolving the problem is likely to be painful and may have negative economic implications for both sides. Meanwhile, there has been a notable slowdown in Europe, which creates a headwind for firms trying to grow their profits. The UK, of course, has its own idiosyncratic problems. All markets are suffering from the withdrawal of the low interest rate policy that has prevailed since the 2007 financial crisis.

The best way to tackle the widespread volatility is not immediately clear, as the assets investors would normally turn to in this type of environment may not work today. In previous difficult periods investors were able to rely on government bonds, defensive equities or corporate bonds to shore-up their portfolios.

Nowhere to hide

Over the past year, though, almost nothing has protected portfolio returns. Areas such as technology are up over the full year, but investors had to stomach a significant decline in the second half of the year. Traditionally defensive sectors such as gilts have provided limited protection more recently, but were weaker in the first half. The few assets that held up in both the first and the second half of the year have been in areas such as infrastructure, but this was partly because such assets started the year from a low base, reflecting concerns about UK politics and rising interest rates.

The options might be clearer if a decline in the global economy was certain, but that is far from the case. Gary Potter, co-head of multi-manager investment at BMO Asset Management, believes a continuation of the difficulties of 2018 is not inevitable. He says, the world economy is certain to slow, as China is prioritising quality growth over quantity of growth, and this will have an impact.

However, he adds: "The underlying health of the global economy remains reasonable. We are likely to get a relaxation of austerity measures in response to the rise of populism, and we believe a recession is quite unlikely in the near term. Meanwhile, the oil price is tumbling and that may help with growth."

The economy may simply pause and go again, as it did in 1994. He believes the decisive factor will be what happens to corporate profits. After a year when corporate profits were strong and stock markets weak, investors are getting more bang for their buck from the market today. Growth has not disappeared; it is just harder to come by.

No shelter in bonds

Pessimistic investors who would like to add a few protective holdings to their portfolios need to look beyond conventional defensive options. Bond markets appear to have little value. Yields from bonds – except US treasuries – remain unappealing and have continued to fall over the past couple of months. Corporate bond prices have fallen back this year, but they are still unlikely to appeal to those seeking defensive qualities. Potter points out that half of investment-grade bonds are now bottom tier – in other words, almost junk status. These assets are unlikely to do well in rocky markets, particularly if liquidity problems arise.

John Stopford, co-head of multi-asset at Investec Asset Management, defines the problem thus: "This is an issue of correlation," he says. "Investors need some things that go up when markets go down. Historically, investors have relied on government bonds to rise. This is fine if certain key drivers are pushing in different directions. However, you get into trouble when those drivers are pushing in the same direction. The common driver in this case is the unwinding of quantitative easing. This means everything de-rates at the same time."

At some point, he adds, central banks will stop raising interest rates and cutting back on quantitative easing, and the monetary policy environment will stabilise. A normal correlation will then establish itself. Until then, though, investors are stuck.

A key point, for Stopford, is not to own a lot of interest rate-sensitive assets. That means avoiding longer-duration government and corporate bonds, and those parts of the stockmarket that have bond-like characteristics. This might include areas such as utilities that have little potential for growth but compensate investors with higher dividends. These dividends looks less attractive in an environment of rising rates. Some funds specialise in less-vulnerable short-duration bonds – Royal London Short Duration Credit and AXA Global Short Duration Bonds, for example.

Chief quandary

For stock market investors, the big dilemma is whether to go for value or growth. The gap in valuations between firms with fast-growing revenues, offering growth, and those that are unloved, offering value, is wide by historic standards – as wide as it was during the technology boom and subsequent bust in 2000, for example. The fact that a growth-focused manager such as Fundsmith's Terry Smith can raise £822.5 million in the largest-ever fundraising for an investment trust suggests the balance may have gone too far one way.

Growth has been in the ascendancy, almost uninterrupted since the 2007 financial crisis. However, when markets wobbled in October and November 2018, value started to outperform. Mark Leach, portfolio manager at James Hambro and Partners, says: "Everything has a cycle. Everything points us in the same direction: value stocks are very cheap. That said, our approach has been to move to the sidelines. We don't fish around in deep value, so we have been taking money out of the market into cash."

The question for investors is whether delving into unloved areas can work at a time when disruptive technology is prevalent. If we consider high-street retailers, for example, it is difficult to argue that they have just hit a bad patch: their business model is fundamentally flawed in the face of the threat from firms such as Amazon (NASDAQ:AMZN). They will not revert to the mean eventually; they will simply go bust. Good 'value' managers such as the teams at Schroders and Jupiter will therefore do rigorous due diligence to ensure companies they invest in are sustainable.

Cash is certainly an option. Most investment platforms now offer a cash facility within their investment ISAs or normal investment accounts. Some will even pay interest on deposited cash. Fidelity FundsNetwork, for example, pays 1% below the Bank of England base rate, subject to a minimum 0.25%. Investors can put money into their ISAs until they feel more comfortable with the market environment.

The problem is that investors risk getting their timing wrong. They may get out in time to avoid volatility. But when do they return to the markets? A report by the CFA Institute shows that missing the best five weeks in the markets out of 2,411 (0.2% of all weeks) since 1970 would have taken an investor's overall return down from 2,151% to 1,223% – a 43% decline. Markets generally don't wait for an economy to recover before rallying.

Maike Currie, investment director at Fidelity International, says: "When volatility strikes, it can be tempting to press the panic button and sell your investments. However, as even the most seasoned investor will tell you, it can be very difficult to time exactly when to get out of the market. Just missing a handful of the best days in the market can seriously compromise your returns. This problem is compounded by the fact that the best and worst days very often tend to be bunched together during periods of heightened volatility."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.