How trend investing with funds wins

Staying in the market through thick and thin has its benefits, but it is not always the best approach.

4th July 2019 10:25

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Staying in the market through thick and thin has its benefits, but it is not always the best approach.

Like all great travellers, "I have seen more than I remember, and remember more than I have seen."

This was Benjamin Disraeli's description of hindsight and shows how unreliable he thought it was as a guide for making decisions about the future. I have to be very careful not to wander into 'Alice in Wonderland' territory when making decisions about my own fund investments.

It is only too easy to remember what you would like to remember, rather than what really happened. It's said that instinct is the nose of the mind, but surely it must be better to use reliable, regularly produced performance numbers and graphs to assist your choices, and let instinct take second place.

Active momentum

At Saltydog Investor we use an active momentum approach (sometimes called 'trend investing') to choose the Investment Association sectors and funds for our portfolios. The basic idea is that when money is invested into a fund or sector its value will rise, and as it attracts more and more investors the impetus will increase. The opposite is also true.

We are not day traders; however, we do have time-based achievement and volatility rules that mean we buy and sell funds according to their performance. When there are no opportunities to make gains, and the markets are falling, we would expect to be invested in low volatility funds and cash. We treat cash as a sector in its own right.

Generally, the financial industry does not promote this active momentum approach, especially when using unit trust funds; instead, it encourages private investors down the route of 'buy and hold'.

This is where a selection of funds are chosen with the intention of hanging on to them, the theory being that over the long term equity markets will outperform other investments. It's a low-maintenance, lazy strategy, but it keeps trading costs down.

During times of market disruption, you are encouraged to cling on to the funds because, even if there is a collapse, their pedigree is strong enough for them to claw back the losses when markets recover. To me, though, that is a pointless exercise when your investment could be safely in cash or making a return elsewhere.

According to this year's 'Spot the Dog' report from wealth manager Tilney, £54.6 billion is languishing in funds that have consistently failed to beat their benchmark over the past three years. The list includes the £4.9 billion Woodford Equity Income fund (as it was valued at the time – we all know what happened there), the £3.9 billion Artemis Global Income fund, and the £1.94 billion Threadneedle UK fund. Even the best fund managers can have long periods of underperformance, and there are no rewards for loyalty.

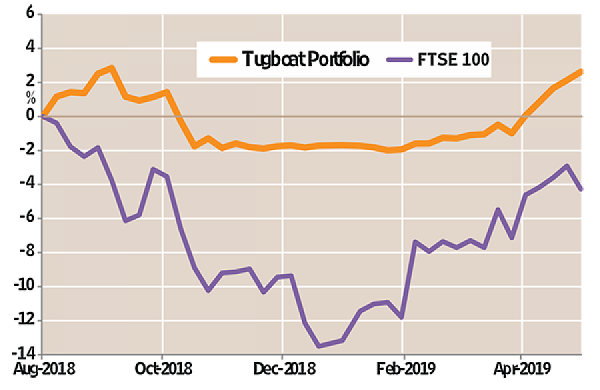

The graph below shows the performance of our actively managed Tugboat portfolio for the nine months from the beginning of August 2018 to the end of April 2019.

Tugboat beats the FTSE 100 by 7.5%

Source: Saltydog Past performance is not a guide to future performance

At first glance you might say that the Tugboat was only up 2.5% over the nine months and there is nothing clever about that, but it is 7.5% better than the performance of the FTSE 100 index.

More importantly, as active private investors we were able to go into cash as stock markets around the world started to fall.

We only went back into funds at the beginning of this year when they started to recover. That is how we managed to avoid most of the drop. By using a low-cost trading platform the costs were negligible.

It's easy to forget, but huge market crashes happen with alarming frequency. There was the bursting of the dotcom bubble in 2000/03, and then in 2008/09 the financial crisis.

Both times stock market investment values could have been halved. Since then we've seen smaller, but not insignificant falls: in 2011 the eurozone debt crisis and in 2015 a panic over China's growth.

More recently we've had concerns over Brexit, the end of low interest rates and quantitative easing, and the trade war between the US and China. They are like rogue waves at sea – they are just going to happen.

Tugboat portfolio

| Date purchased | Fund name | % of portfolio |

|---|---|---|

| Cash | 21 | |

| 07/02/2019 | Liontrust SF Managed | 17 |

| 21/02/2019 | Janus Henderson Global Resp | 16 |

| 11/04/2019 | Royal London Sust World | 12 |

| 24/01/2019 | Axa Fram UK Mid Cap | 9 |

| 07/02/2019 | Baillie Gifford UK Equity Alpha | 9 |

| 21/03/2019 | TM Cavendish AIM | 8 |

| 24/01/2019 | Fidelity Global Technology | 9 |

Sink or swim

But what would have happened if the correction last year turned into another investment tsunami?

It was John Maynard Keynes who said: "Markets can remain irrational longer than you can remain solvent". In that event the Tugboat would have sailed along on an even keel while the "buy and hold" flotilla headed for Davy Jones's locker. I know which system makes me feel more comfortable.

Douglas Chadwick is a founder director of Saltydog Investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.