Ian Cowie: tomorrow’s big winners in Asia

China’s loss may see others gain. Our columnist looks at trusts geared to rival Asian economies.

28th May 2020 09:15

by Ian Cowie from interactive investor

China’s loss may see others gain. Our columnist looks at trusts geared to rival Asian economies.

It is an ill wind that blows no good and even rising hostility between both the world’s biggest economies, America and China, might create unexpected winners at the periphery. While the big boys engage in a war of words that may end in something worse, it could pay investors to watch patiently for opportunities to emerge from the edge of the scrum.

For example, some Asian emerging economies may survive the coronavirus crisis stronger than they were when it began. One reason is that China’s loss is their gain as American companies and consumers increasingly prefer competing low-cost, high-productivity countries.

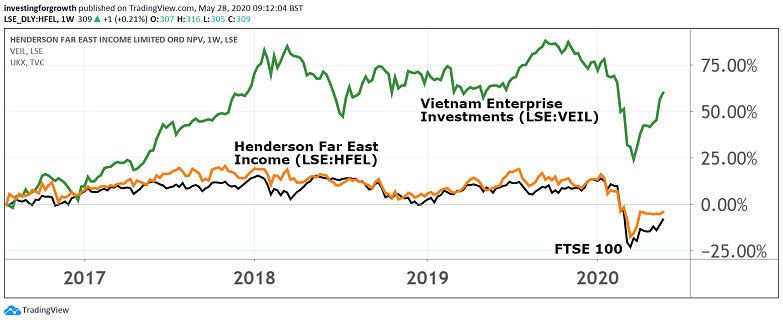

This investor in Henderson Far East Income (LSE:HFEL) (stock market ticker: HFEL) and Vietnam Enterprise (LSE:VEIL) hopes that some of Asia’s smaller economies will be among its bigger winners from the coronavirus crisis. The shock to global supply chains is already being reflected in sourcing strategies, sometimes described as “China plus one”.

Apple’s switch of some of its AirPods production from China to Vietnam is an example of that trend, following factories built or bought in the latter country by Google and Samsung. The world’s biggest computer company is responding to rising consumer criticism.

Bloomberg recently reported that 40% of Americans questioned said they would not buy made-in-China products. Another 78% claimed they would be willing to pay more for products manufactured outside of China.

Another factor in Vietnam’s favour is that it took bolder action to fight the virus sooner than more developed rivals. For example, it imposed comprehensive tracing and compulsory quarantine - including locking down Hanoi’s largest hospital for 14 days - that would have been more difficult in a democracy.

Source: TradingView. Past performance is not a guide to future performance.

Dominic Scriven, the fund manager of VEIL, told me: “There is no complacency in Vietnam, especially given a further dose of imported Covid-19 cases in returning compatriots.

“But equally, there is a cautious confidence that the country has played the situation with a firm and straight bat. People, broadly, are in support of the swift actions taken by their government.

“The country will pick up substantial crumbs that fall from China’s table in the rejigging and diversification of supply chains – indeed, the price of industrial land is well up since year-end.”

Andy Ho, the fund manager of VinaCapital Vietnam Opportunity Fund (LSE:VOF) agreed: “The government has done a good job of communicating regularly with its population whether through text messages, TV commercials, and community announcements.

“At the moment, international arrivals are still restricted and the tourism sector, which represents about 15% of GDP, remains depressed.

“Vietnam has been able to control the spread of Covid-19 and thus been able to remove most restrictions and open the domestic economy.”

Scriven summed it up succinctly:

“The whole country is now more or less back at work and play. The karaoke venue across from my house is in rude health!”

- Watch our interview with Andy Ho at VinaCapital Vietnam Opportunity Fund

- Be first to see our upcoming fund manager interviews by clicking here now

One karaoke bar does not make a booming economy - even an emerging one - but Mr Market seems to share in rising optimism. Shares in VEIL and VOF are both up by 10% over the last month, although VEIL remains down 5% over the last year and VOF has fallen 11% over the same period.

On the other hand, VEIL has a high cost base with ongoing charges of 2.16% and yields no dividends, while VOF charges a more mainstream 1.17% and yields 2.8%. Income is a major attraction of HFEL, which yields 7.3% and has raised its dividend in each of the last 11 years.

While nearly 30% of HFEL’s assets are invested in China, that stake is matched by a combination of its next two biggest country allocations; Australia and Taiwan with 17% and 13% respectively.

Anyone seeking diversified exposure to Asia and the Pacific region may also be attracted by HFEL’s other major holdings in South Korea, Thailand, Hong Kong, Singapore and New Zealand.

HFEL fund manager, Mike Kerley, claimed: "We are confident of the ability of the companies we own to pay dividends, even factoring in worse case scenarios on revenue and cash flow, as most sit with net cash balance sheets and low dividend pay-out ratios.

“Asia has a dividend pay-out of only 35%, which is far lower than western peers and has more companies in net cash than net debt. Earnings undoubtedly will come under pressure but the large gap between earnings per share (EPS) and dividends per share (DPS) should ensure shareholders’ income is more sustainable in Asia than elsewhere.”

- Why investors should not despair over the investment trusts that have cut dividends

- This fund continues to shine in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Whether or not this part of the world proves to be first into the coronavirus crisis and first out - sometimes called the FIFO principle - HFEL’s dividend yield pays investors to be patient. Meanwhile, more uncertainly, VEIL or VOF might reward those going for growth.

It is often said that the best time to buy shares is when you least feel like doing so, because that’s when confidence and prices will be low. That holds doubly true away from the mainstream and especially in emerging markets.

Ian Cowie is a shareholder in HFEL and VEIL as part of a diversified portfolio of global equities.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.