ii expands ‘quick-start’ funds range for beginners

Three actively managed, low-cost, sustainable funds from BMO added to ‘quick-start’ selection.

14th September 2020 15:40

by Moira O'Neill from interactive investor

A trio of actively managed, low cost, sustainable funds from BMO added to ‘quick-start’ selection.

Beginner investors get set, go: interactive investor expands ‘quick-start’ range with a trio of sustainable selections from BMO.

- The BMO Sustainable Universal MAP range joins the three Vanguard LifeStrategy funds in interactive investor’s ‘Quick Start’ funds range for beginner investors.

- interactive investor has been given access to a discounted share class for its customers, who can buy the three BMO funds on the ii platform for an ongoing charge of 0.35% (plus platform costs).

While this year will be defined by Covid-19 and all the devastation and uncertainty that has come with it, it has also been the year where many younger, and perhaps less experienced, investors dipped their toe in the stock market.

interactive investor has added a trio of actively managed, low cost, sustainable funds to its best in class ‘Quick Start’ funds range for beginner investors from the BMO Sustainable UniversalMAP range.

- How to choose between our six starter funds

The Quick Start funds aim to help aspiring investors get started with a ready-made global portfolio across a range of risk profiles, stock markets and asset classes. The new BMO funds complement the three VanguardLifeStrategy funds already in the Quick Start range – which have also been reviewed to ensure that they still deserve their place in the starter line.

Moira O’Neill, head of personal finance at interactive investor, says: “One of the key barriers to investing is knowing where to begin – there are so many funds it can be overwhelming. Our enhanced Quick Start range offers well diversified, multi-asset portfolios that are very competitively priced. With passive, active and sustainable options covering a range of risk profiles, these are a good starter option and should appeal to a broad range of needs.

“Investors can choose from the six-strong range of one stop shop solutions, depending on their attitude to risk. Investing is a marathon not a sprint, and the funds in the ‘Quick Start’ range are great propositions to help get the foot over the starting line for novice investors and put them on a surer footing.”

The BMO Sustainable Universal MAP range, which brings together BMO’s capabilities in multi-asset and responsible investment, normally has an ongoing charge of 0.39%, but interactive investor has been given access to a discounted share class for its customers, who can buy each of the three funds on the ii platform for an ongoing charge of 0.35% (plus platform costs).

- BMO Sustainable Universal MAP Cautious. The lowest risk of the three funds. It targetsan annualised return of 2% above inflation over five years and can hold as little as 20% and as much as 60% in equities.

- BMO Sustainable Universal MAP Balanced. The medium-risk option.The fund targets an annualised return of 3% above inflation over five years. The fund can hold as little as 30% and as much as 70% in equities.

- BMO Sustainable Universal MAP Growth. The most adventurous, higher risk of the three but with potential for higher gains. The fund targets an annualised return of 4% above inflation over five years and can hold as little as 40% and as much as 80% in equities.

- Bear in mind that each target for the funds is just a target and not guaranteed.

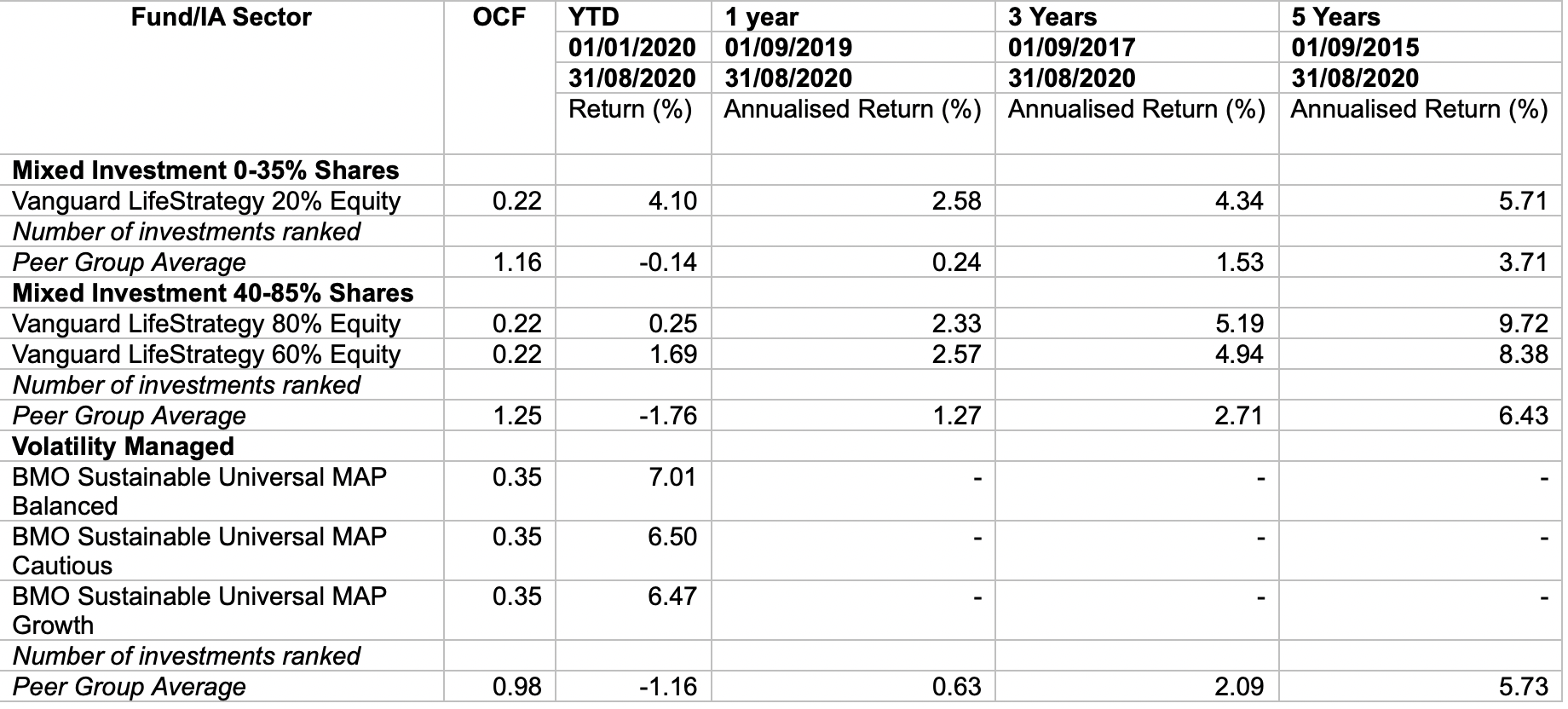

When it comes to passive options in the interactive investor Quick Start range, the Vanguard LifeStrategy 20%, 60%and 80%funds remain in the line-up, but there has been no resting on laurels. The Vanguard funds have been put through their paces and assessed against the wider multi asset passive and active universe to ensure they are still delivering on cost and performance against peers. And with an ongoing change of 0.22% and their performance edge maintained, they have certainly done that – see table below.

Dzmitry Lipski, head of funds research, interactive investor, says: “We have scoured the multi-asset fund universe for the best Quick Start options. In the case of the active options, these have a sustainable overlay – although it is still important for investors to make sure any ethical offering matches their own values.

“In looking for a sustainable overlay, we have not sought to compromise on performance. Although the new BMO sustainable Quick Start funds were only launched in December 2019, the BMO team has a successful long-term track record of producing strong risk adjusted returns in running multi-asset ESG products since the launch of what is today known as BMO Responsible UK Equity in 1984.

“The three BMO funds stood out from the competition due to their sustainable investment philosophy, how the funds invest and manage risk, as well as BMO’s focus on low costs. Other funds we considered are not as competitive on fees.

“The Vanguard LifeStrategy funds remain in our Quick Start range, but this was not a given. We reassessed the entire multi asset universe and these funds continue to hold their own against peers on cost and performance. Each of these Vanguard funds have between 6,000 and 20,000 underlying holdings and are globally diversified in equities and bonds, helping to reduce risk, with a full range of sectors including technology, media and energy.”

The selection process

- An initial review of the active and passive fund universe

- interactive investor conducted an evaluation of fund provider’s range based on three primary attributes: Philosophy, People, and Process

- A thorough screening including analysis of manager success relative to peers was undertaken, risk adjusted returns, downside protections and value for money.

- Clear differentiators were found in the philosophy and approach of BMO in their management style.

Teodor Dilov, fund analyst, interactive investor says: “The BMO Sustainable Universal MAP range ismanaged by the multi-asset team led by Paul Niven, with Simon Holmes as lead manager on the sustainable range. The team has a long and successful track record of running ESG products since launching the BMO Responsible UK Equity Fund in 1984. More recently the team has developed and now manages several ESG-related funds and mandates, led primarily by Simon and Paul Niven.”

The Quick Start Range – performance comparison

Past performance is no guide to the future and the value of investments can go down as well as up and you may not get back the full amount invested. Funds in the BMO Sustainable Universal MAP range do not have a five-year track record as they were only launched in December 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.