ii Private Investor Performance Index: Q4 2023

Youngest investors biggest winners at the tail end of the year as average portfolio weighting to cash wanes.

22nd January 2024 13:33

by Camilla Esmund from interactive investor

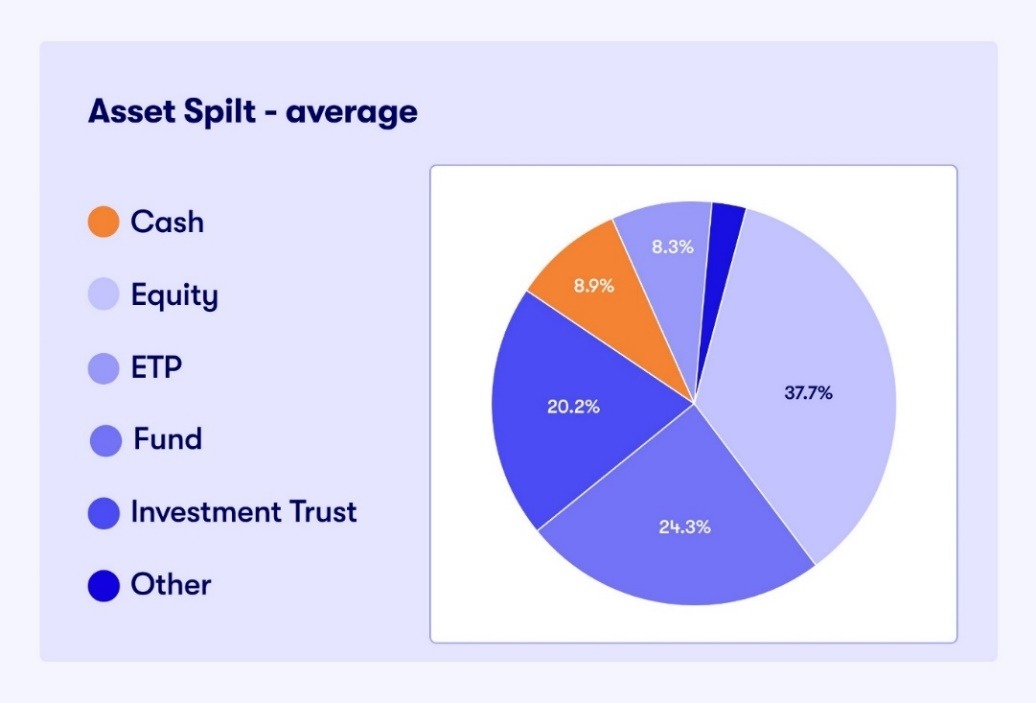

- Cash is not king: the average portfolio weighting to cash waned in 2023, falling to 8.9% in Q4, down from 9.6% in Q3, 10% in Q2 and 10.3% in Q1

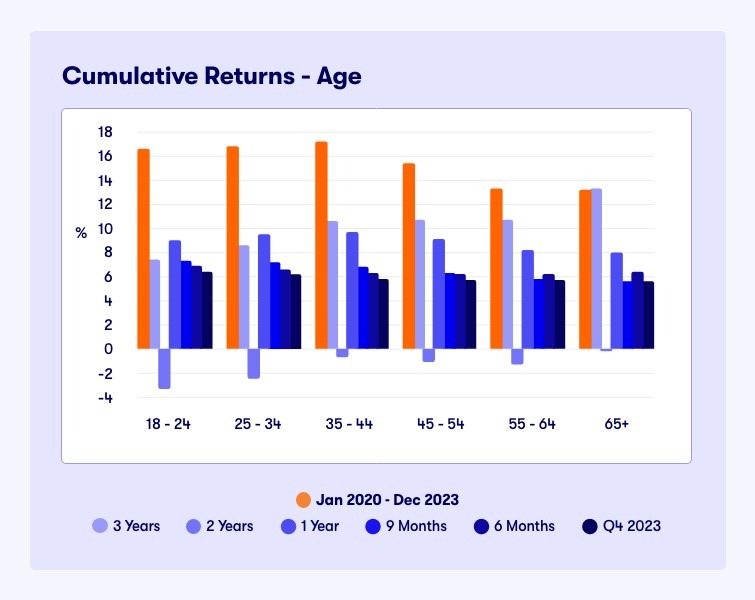

- Youth is served: 18-24 year-old ii customers outperformed in Q4 and over six- and nine-month periods to 31 December, buoyed by narrowing investment trust discounts

- Female ii customers outperformed men over a four-year time frame (since January 2020, up 14.6% versus 13.5% for men in median terms.)

- Over each time frame recorded, ii customers have either levelled with or beaten the IA Mixed Investment 40-85% shares sector benchmark

- Passives continue to dominate

Now with data going back four years, interactive investor, the UK’s second-largest investment platform for private investors, has published its latest Private Investor Performance Index* - a barometer of how investors are faring - to 31 December 2023.

In what was a volatile year for investments, stoked by high interest rates, elevated (yet slowing) inflation, and geopolitical tensions among other factors, the youngest investors on interactive investor enjoyed the highest returns at the tail end of 2023, with 18-24-year-olds leading the pack, up 6.4% in Q4 2023 alone.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

But for the 12-month period covering 2023, the 35-44 age group performed best, returning 9.7% compared to 8.4% for the average ii customer.

More broadly, the averageii customer marginally outperformed professional investors in 2023, as measured by the IA Mixed Investment 40-85% shares sector (8.4% versus 8.11%). The IA sector can be a useful comparator with private investor portfolios, with its mix of bonds, cash, and equities.

Over each time frame recorded, ii customers have either levelled with or beaten the IA Mixed Investment 40-85% shares sector benchmark.

Richard Wilson, chief executive, interactive investor, says: “Our Private Investor Performance Index offers a useful barometer of how private investors are faring, whatever the weather.

“One of the key takeaways from our research is even when markets are choppy, it is still worth keeping your money invested. Despite having to navigate through some dizzying twists and turns in the investment landscape in 2023, the typical ii customer portfolio generated inflation-beating returns that also trumped returns on cash savings.

“Of course, investing is a long-term discipline, and this index won’t always make comfortable reading, given the intrinsic ups and downs in markets, but the key to success is avoiding knee-jerk decisions and maintaining a well-diversified portfolio.”

A deep-dive into the data

Cumulative Returns since 1 Jan 2020 - end Dec 2023

Source: interactive investor - index performance: Morningstar Total Returns (base currencies) to 31 December 2023.

Source for tables above: interactive investor. ii customer returns with income reinvested. Past performance is not a guide to the future.

Investments, not cash, is king

The average portfolio weighting to cash waned in 2023, falling to 8.9% in Q4, down from 9.6% in Q3, 10% in Q2 and 10.3% in Q1.

The average cash position among ii customers is now lower than the level in 2020 (9.9%), 2021 (8.9%) and 2022 (11%).

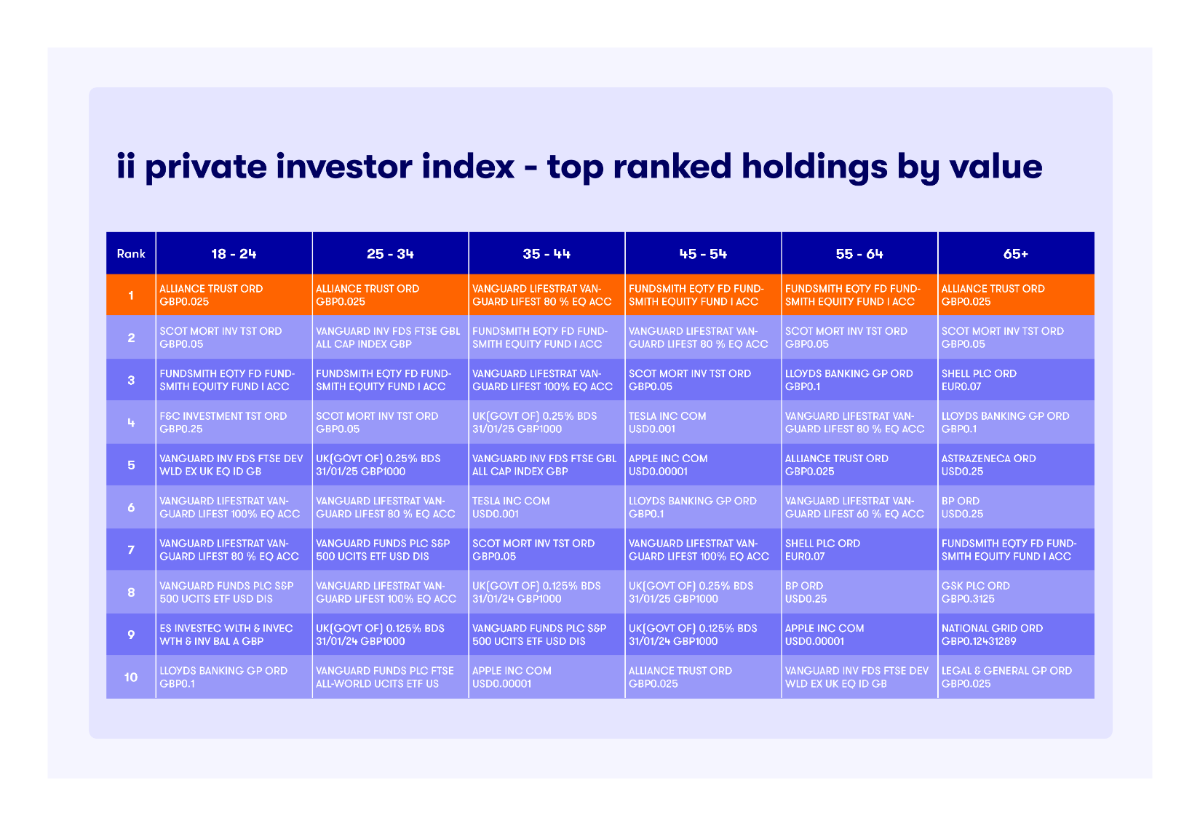

Conversely, the popularity of gilts and bonds have spiked recently. Two gilts broke into the top 10 most-held investments among customers aged 45-54 in Q4 2023, and both climbed higher among the 25-34 and 35-44 age groups too.

Meanwhile, customers with allocations to instruments in the ‘other’ category (meaning fixed income and corporate bonds) was just 0.6% in 2020, 0.8% in Q4 2022, increasing to 2% in Q3 2023, then 2.5% in Q4 2023.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Interestingly, the average cash holding as a proportion of ii customer’s overall portfolio is a similar proportion, give or take one or two percentage points, as it has been for the past few years - even when interest rates were very low.

“This suggests that while cash forms an important part of a well-diversified portfolio, our customers are intrinsically investors - often favouring to have easily accessible cash to invest where they see opportunity with minimal delay and faff.

“Waning cash positions could point to growing confidence in equities following the easing of factors that have weighed on markets – namely inflation.

“While many of our customers are likely to have separate savings accounts, a large number have also sought to reap the benefit from the high interest rates environment via gilts and bonds while they still can, with interest rates now tipped to fall quicker than initial predictions.

“In addition, our recent monthly platform bestsellers updates show that the Royal London Short Term Money Mkt fund has emerged as a popular proxy for cash among our customers. The fund comprises of a diversified basket of very low-risk bonds that are due to mature soon, normally in under a year – so, investors can earn an income on their cash with relatively low risk.”

Source: interactive investor

Source: interactive investor

Narrowing investment trust discounts boost young investors

interactive investor customers aged 18-24 also outperformed the other age cohorts over the six- and nine-month periods to the end of December 2023, returning 6.9% and 7.3%, respectively.

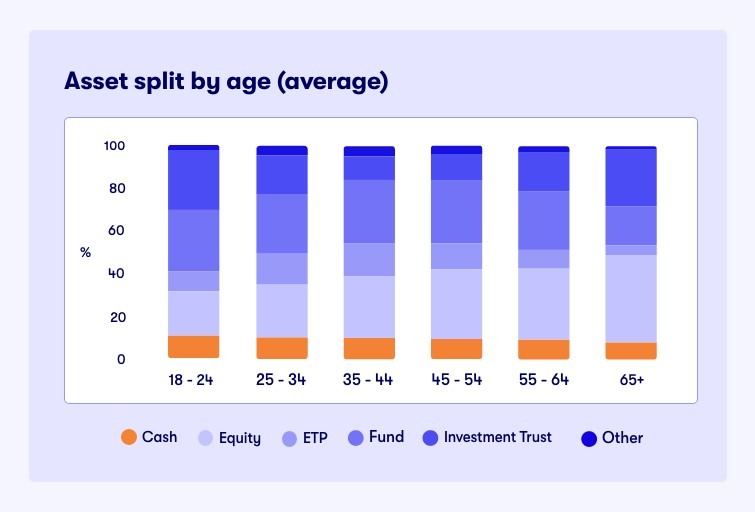

The secret sauce appears to have been a higher-than-average allocation to investment trusts, accounting for 27.7% of the average portfolio among the age cohort – greater than the average across the age cohorts of 20.2%.

They have seemingly benefited from the narrowing of investment trust discounts over the year. According to the Association of Investment Companies (AIC), the average discount started the year at 11.7% and hit a post-2008 trough of 16.9% at the end of October before recovering to 9.0% on 31 December.

Older investors (65+) fared better over longer time frames, outperforming younger investors over two and three years to the end of December 2023. The 35-44 age group is the top performer over since 2020 when ii first started collating this data, up 17.2% compared to 14% for the average ii customer and 13.94% for the IA Mixed Investment 40-85% shares sector benchmark. This group tends to have a higher exposure to passives and US stocks.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “High volatility was once again a defining feature of the investment landscape in 2023, pegged to inflation uncertainty and, in turn, interest rates. Against this backdrop, our customers have broadly stuck to their knitting, maintaining well-diversified portfolios, with fingers dipped in different investment pies across the globe.

“Younger investors have seemingly benefited from their higher-than-average exposure to investment trusts, many of which have seen discounts reduced off the back of an improved economic outlook. Holding investment trust shares when they are trading at a discount while the ability for investment trust managers to gear can potentially produce a better return on the capital invested – although losses can be exacerbated during periods of underperformance.”

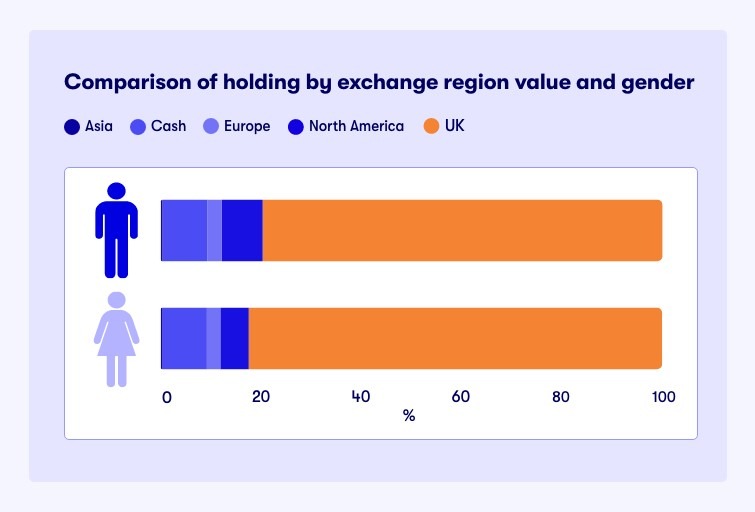

Female investors outperform men over longest time frame

While there was nothing to separate the sexes performance wise in Q4 2023, ii’s female customers have outperformed male customers since January 2020, up 14.6% versus 13.5% for men in median terms.

Men and women run their accounts among broadly similar lines, but women tend to have a discernibly higher exposure to investment trusts (22.6% versus 17.9% for men) which may have contributed to this longer-term outperformance over the four years.

Source: interactive investor

Passives continue to dominate

Passive funds from asset manager Vanguard continue to dominate the top 10 most-held investments list across every age category bar 65+. Passively managed funds from the Vanguard stable are particularly popular among young investors, accounting for five out of the top 10 most held investments among 25–34-year-old ii customers and four among 18-24 and 35-44 age groups.

Meanwhile, exposure to exchange traded products (ETP), which are overwhelming passive, ticked higher again in Q4 2023 to 8.3% from 8.1% in Q3 2023 and up from 6% in 2020.

Notes to Editors

*ii customer performances quoted are median values to avoid the influence of outlier performance skewing the data.

The performance is calculated using the Time Weighted Rate of Return with returns calculated before each money transaction, then the results compounded over the reporting period. The time-weighted rate of return (TWR) is a measure of the compound rate of growth in a portfolio. It eliminates the distorting effects on growth rates created by inflows and outflows of money.

Then median averages are calculated independently for each group we analysed – so that outlier performances did not skew the results.

Index performance, unless otherwise stated, is ii using Morningstar, total return in GBP, to end December 2023.

Portfolio values under £20,000 were stripped out to keep the sample representative of ii’s core customer base.

Source: interactive investor - index performance: Morningstar Total Returns (base currencies) to 31 December 2023.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.