Income tax or national insurance: which one might Jeremy Hunt cut?

As the Spring Budget edges closer, speculation mounts that the chancellor may cut taxes on income. But what’s the likelihood and how would this affect you?

1st March 2024 14:56

by Craig Rickman from interactive investor

The rumour mill for this year’s Spring Budget is starting to ramp up, with Chancellor Jeremy Hunt reportedly considering further cuts to workers’ national insurance contributions (NICs), rather than reducing income tax at this year’s first set-piece fiscal event.

Whatever Hunt decides to do – he could, of course, cut neither – will have some impact on your finances. While both income tax and NICs are charged on income, there are some key differences between them.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Let’s look at what’s going on and analyse what might play into the chancellor’s thinking.

What will influence Hunt’s decision?

This appears to hinge on how much headroom he has available. As you may recall, Hunt cut NICs for both workers and the self-employed at last year’s Autumn Statement, in move that will cost around £10 billion a year.

As a quick refresher, the main rate of employee Class 1 NICs dropped from 12% to 10% on 6 January, saving someone on the average UK salary of £35,000 around £450 a year.

Meanwhile, from 6 April this year, Class 2 NICs will be scrapped and the main rate of Class 4 NICs will reduce from 9% to 8%, which will save the average self-employed worker £377 a year.

However, it’s only employed workers who stand to benefit this time around, according to reports. Hunt is believed to be mulling a further cut to employee Class 1 NICs, with a reduction from 10% to 9% apparently on the cards.

So why NICs again and not income tax? Well, it seems the government’s pockets aren’t quite as deep as they were last autumn - and further cuts to NICs is the cheaper option.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Six ways to keep your tax bill low in retirement

Reducing the basic rate income tax to 19% would cost £7 billion a year, according to the Resolution Foundation, an independent think tank, whereas a one percentage point cut to the main rate of employees' NICs would cost around £4.5 billion per year.

In a report earlier this week, the Institute for Fiscal Studies (IFS) warned that there is “a weak economic case for another sizeable net tax cut in the forthcoming Budget”.

How do income tax and NICs differ?

Simply put, income tax helps to fund various public services such as the NHS and education, whereas NICs are used to pay for government benefits, such as the state pension and Universal Credit.

Both taxes are big earners for the government. In the 2022-23 tax year, the Treasury raked in £250 billion and £178 billion from income tax and NICs, respectively.

Income tax is paid on salaries, the business profits of sole traders and partnerships, the state pension, annuities, drawdown withdrawals, interest, and property rental income.

The table below shows the current income tax bands:

Band | Taxable income | Tax rate |

Personal Allowance | Up to £12,570 | 0% |

Basic rate | £12,571 to £50,270 | 20% |

Higher rate | £50,271 to £125,140 | 40% |

Additional rate | over £125,140 | 45% |

NICs, meanwhile, are solely paid by employees, employers and the self-employed. And the system is more complex than income tax.

There are currently four classes of NICs: Class 1 are paid by employers and employees based on earnings; Class 2 is flat rate paid by self-employed workers (although this will be kiboshed from April); Class 3 are voluntary, paid by those with gaps in their state pension record; Class 4 are based on sole trader and partnership profits.

Who would be the winners and losers?

If the chancellor opted for the less expensive route and cut NICs it would benefit a narrower audience.

Because you stop paying NICs once you hit the state retirement age (currently 66 but rising to 67 between 2026 and 2028) whether you’re still working or not, retirees would lose out. The same applies to savers, as income tax is paid on any savings interest outside tax wrappers that exceeds £1,000 a year if you’re a basic-rate taxpayer.

Landlords would also gain no benefit, as they pay income tax on rental income, but don’t pay NICs.

Should income tax and NICs be merged?

Despite the differences outlined above, there are plenty of similarities between income tax and NICs. As such, the idea of merging them hasn’t been overlooked.

In 2021, the IFS published a paper on the idea, examining both the benefits and differences that remain between the two taxes, and concluded there was a strong case for creating a single tax on income. However, successive governments have dismissed the idea.

- Use this lesser-known trick to cut your IHT bill

- The power of two: tax year end planning for married couples

The IFS found that the differences do not seem to form prohibitive barriers to integrating the two.

“Indeed, in many cases the existing differences could be retained as features of a merged tax: reduced rates of tax on particular forms of income, for example, or benefit entitlements based on tax paid on earnings only,” the IFS said, adding that while consolidating the two would come at a significant transitional cost it would allow for a “simpler merged tax”.

The continued threat of stealth taxation

While it would grab the headlines, any cuts to either income tax or NICs may provide only a temporary reprieve for households.

That’s because the government has chosen to freeze tax thresholds until 2028, tripping more people into higher bands in a process called fiscal drag, otherwise known as the “stealth tax”.

As the IFS recently noted: “Taxes this year will be around £66 billion higher than they would have been had their share of national income stayed at its 2018-19 level.”

“In the medium term, the cuts to the main rates of national insurance contributions announced in the Autumn Statement offset only about a quarter of the increase in the tax on labour income from consecutive freezes of thresholds income tax and NICs since March 2021.”

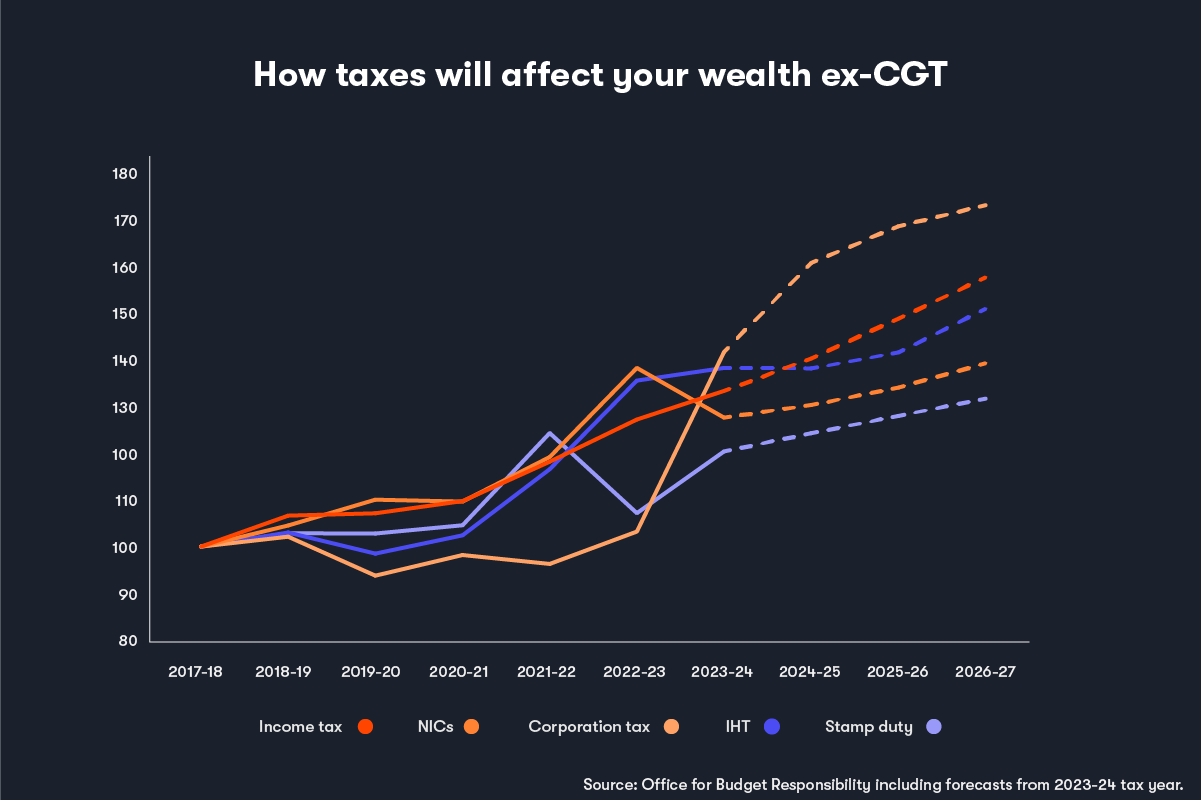

The chart below shows how the receipts of various taxes are expected to rise over the coming years. All taxes have been rebased at 100, and show their previous and expected future payments from 2017 to 2027.

Other data illustrates the punishing impact of fiscal drag on both workers and retirees.

According to HMRC’s latest personal income statistics, there were 6.74 million taxpayers of state pension age in 2021-22, a 4.3% uptick compared to the previous tax year. The numbers will have certainly increased further since, especially as the state pension hiked 10.1% in April 2023, and will rise 8.5% from April, thanks to the triple lock.

- How to make the most of your pension allowances before April

- Which ISA should I choose for my financial goals?

Elsewhere, the IFS calculates that by the 2027–28 tax year the number of people paying 40% income tax or above will reach 7.8 million – that’s one in five taxpayers.

Some have urged the government to use this year’s Spring Budget to row back on its decision to keep tax bands frozen. But given Hunt’s limited wiggle room, the prospect looks faint.

Wider implications of NIC cuts

A further consideration is that although a further cut to NICs is the more affordable option, it might put more pressure on the sustainability of the state pension. As NICs paid by today’s workers fund the pensions of today’s retirees, there would be less money going into the pot.

And the state pension is already heavily under strain. According to a report by the International Longevity Centre (ILC), published in February, the UK will have to increase the state pension age to 71 by 2050 to ensure it remains affordable.

Either way, the chancellor faces a big decision, especially with an election looming. The NIC cuts ushered in at the Autumn Statement seem to have made little ground on Labour’s polling lead - swaying voters may require policies with more clout. We’ll find out next week whether Hunt has the headroom to land a telling blow.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.