Insider: chiefs spend £1.6 million on this recovery play

After a terrible five years, TalkTalk Telecom directors are backing themselves to lead a turnaround.

22nd June 2020 10:06

by Graeme Evans from interactive investor

After a terrible five years, TalkTalk Telecom directors are backing themselves to lead a turnaround.

A near-record low for TalkTalk Telecom (LSE:TALK) shares has prompted a flurry of buying among its directors, including a £1.4 million spree by former Carphone Warehouse boss Roger Taylor.

His purchase of TalkTalk stock over the last week at prices ranging between 87p and 95p was accompanied by CEO Tristia Harrison picking up £200,000 worth of shares at 89p.

The pair swooped after full-year results showed TalkTalk's focus on part-fibre and full-fibre broadband had benefited from a surge in data consumption by households and business.

Operationally, the company also appears better equipped to cope with Covid-19 disruption. Its headline earnings rose 9.7% to £260 million on the back of better cost controls in the last year, while the 2021 outturn is forecast to be stable despite a £15 million hit from the pandemic.

Concerns among investors remain though, with net debt still at £775 million and the company reporting higher-than-expected working capital outflows. Shares weakened as far as 83p after the results, not far from the all-time low of 70p seen during the market sell-off.

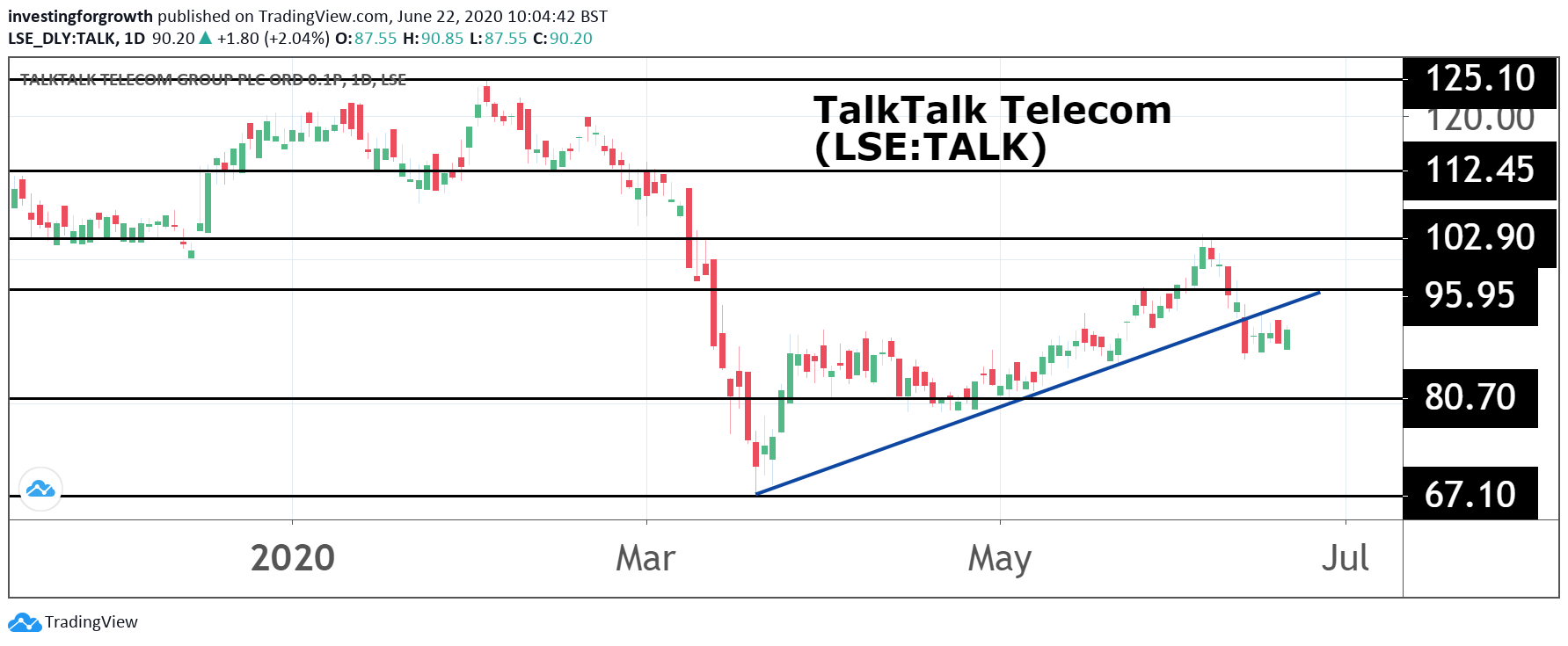

TalkTalk had been at 122p in early February, compared with an all-time high of 400p in 2015. Analysts at Deutsche Bank said on Friday that shares had the potential to reach 175p, with the company's focus on value pricing seen as an advantage in uncertain economic times.

Source: TradingView. Share price performance only. Past performance is not a guide to future performance.

It is the first time since TalkTalk's £200 million share placing in 2018 that Taylor has bought company shares. He joined the board as non-executive director in 2015, having been its deputy chairman for the two years after TalkTalk demerged from Carphone Warehouse in 2010.

From 1999 until the merger to create Dixons Carphone (LSE:DC.) in 2014, Taylor filled a variety of Carphone roles including CEO, chief financial officer and deputy chair. Sir Charles Dunstone still owns 29% of TalkTalk, having created the business in 2002 before returning in 2018 as its executive chairman in a bid to revive its struggling fortunes.

Harrison joined Carphone in 2000 and was MD of TalkTalk's consumer business before joining the board in 2014 and later replacing Dido Harding as boss in May 2017. She also bought shares in late January, having not done so since the summer of 2018.

She is three years into a strategy to focus TalkTalk on higher bandwidth part-fibre and full fibre broadband as legacy copper infrastructure becomes not fit for purpose. Consumers are demanding higher speed and more resilient broadband, with data usage up 40% year-on-year from activities including video streaming, online gaming and cloud storage services.

Harrison said in the recent results that TalkTalk was well placed for the current economic climate, given it was the only scale, value provider. She has also overseen a drive to simplify TalkTalk towards fewer products and “a leaner, more efficient business”.

- TalkTalk’s full-year results

- The AIM chiefs buying shares in their own companies

- Richard Beddard gives this top AIM share the thumbs up

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Deutsche Bank noted that TalkTalk had struck an attractive wholesale deal with CityFibre — to whom it sold its Yorkshire-based Fibrenation network for £200 million in January — and there was also the prospect for healthy volume discounts with BT's infrastructure arm Openreach.

The bank said: “Ex Covid, we are upbeat about TalkTalk's prospects as it begins to sell full-fibre products (higher revenues and lower churn) to consumers during the 2021 financial year.”

Former high-yielding TalkTalk reset its dividend to 2.5p in 2018, when it said a return to a more normalised dividend policy would only be possible once earnings growth returns and leverage is back near to 2x net debt/headline EBITDA.

Deutsche now expects the ratio will be met in the 2023 financial year rather than in 2022, meaning that a forecast dividend increase back to 7.5p is put back by a year to 2023.

First purchase in years

The posting of full-year results and an ailing share price also provided a suitable point for the CEO and chairman of engineering company Renold (LSE:RNO) to buy shares last week.

The supplier of industrial chains and related power transmission products has been hit hard by Covid-19, with factory closures and the inevitable impact on demand patterns. The timing was particularly unfortunate, given that the Stockport-based group had been on track to deliver an improved adjusted operating margin in the financial year to the end of March.

All sites are now operational, albeit with some at reduced capacity, and the company's financial position has been aided by the flexibility of lenders and the trustee of the UK pension scheme.

Together with cost and cash actions already taken, Purcell is confident the company will be able to manage its way through the current period of disruption.

He added: “Renold holds a leading position in many of its markets and the strategic programme that has been undertaken over the past years has delivered a business far more resilient and better placed to overcome the current challenges.

“Having successfully completed the substantial infrastructure change programme, we will have greater cash resources with which to accelerate our growth initiatives.”

He backed up his comments last week by purchasing 405,263 shares at an average price of 9.83p — worth a total of £40,000 — for his first purchase since the year he joined the group in 2013. Chairman Mark Harper also bought £21,500 of Renold stock at an average price of 10.5p.

Last week's results and share purchases had a positive impact on the Renold share price, which climbed from 7.3p last Monday to 12.4p on Friday — the highest level since early March.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.