interactive investor cuts dealing charges by 25%

1st August 2022 09:44

by Jemma Jackson from interactive investor

Investment platform delivers even greater value for customers.

- Standard online dealing charge to be cut from £7.99 to £5.99 from 1 September.

- Widens the gap with comparable platforms when trading UK and US shares, ETFs and investment trusts.

- Customers in ii’s Investor and Super Investor service plans will continue to get their first trades free each month.

- Free monthly, regular investing across all of ii’s plans remains unchanged for funds, investment trusts, ETFs and popular UK shares.

interactive investor, the UK’s second-largest investment platform for private investors and number one flat-fee provider, today announces that from 1 September 2022 its standard online dealing charge will be cut by 25% – benefiting hundreds of thousands of customers nationwide.

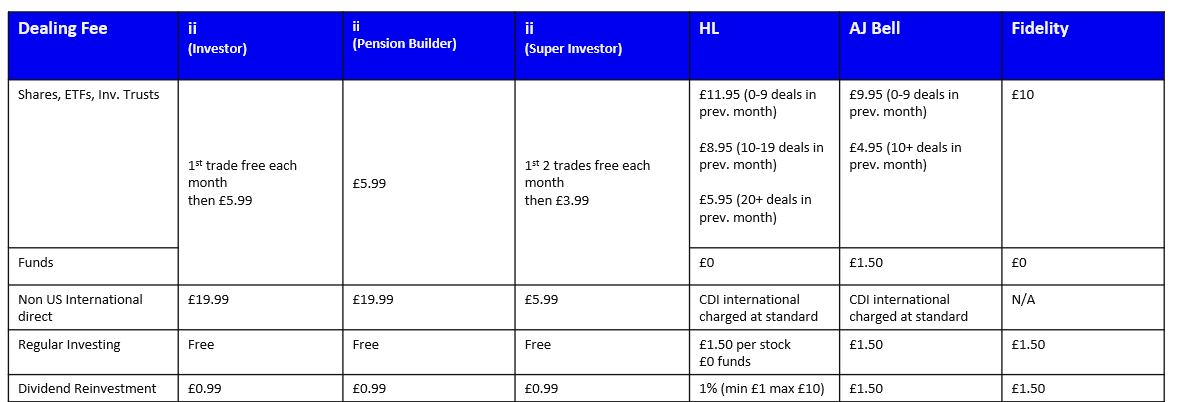

The reduction in dealing costs means ii will compare even more favourably with other major platforms, including Hargreaves Lansdown, AJ Bell YouInvest and Fidelity, when trading UK and US shares, ETFs and investment trusts.

The charge for UK and US trades using ii’s standard Investor plan and its Pension Builder self-invested personal pension (SIPP) will be cut from £7.99 to £5.99 from 1 September. This commission reduction will also apply to members of ii’s Friends and Family service, who benefit from a free ii subscription.

Read about: Free regular investing | Opening a Stocks & Shares ISA | Interactive investor Cashback Offers

Customers in ii’s Investor and Super Investor service plans will continue to get their first trades free each month. From 1 September, the expiry date on the free monthly trades will move from 90 days to 31 days. Free monthly, regular investing across all of ii’s plans remains unchanged for funds, ETFs, investment trusts and popular UK shares.

Customers in ii’s Super Investor service plan are also seeing commission fees slashed, with a 40% cut in the cost of online trades in non-US international shares from £9.99 to £5.99 per trade. This follows price reductions in February 2022, when ii reduced US trading costs from £4.99 to £3.99.

Richard Wilson, CEO of interactive investor, says: “We work constantly to bring better value, choice and service to the UK retail investor. And with our standard trading charge now reduced to £5.99, our great value simple fixed fee subscription service just got even better.

“Our trading charges remain proudly impartial, with no preferential treatment for shares, funds, investment trusts or ETFs so the right choice is always what is right for the customer.

“Investors can’t control the markets, inflation or interest rates. But they can control their investment costs – and over the long run the savings can be huge.”

Interactive investor and competitor trading comparisons from 1 September 2022

Source: interactive investor

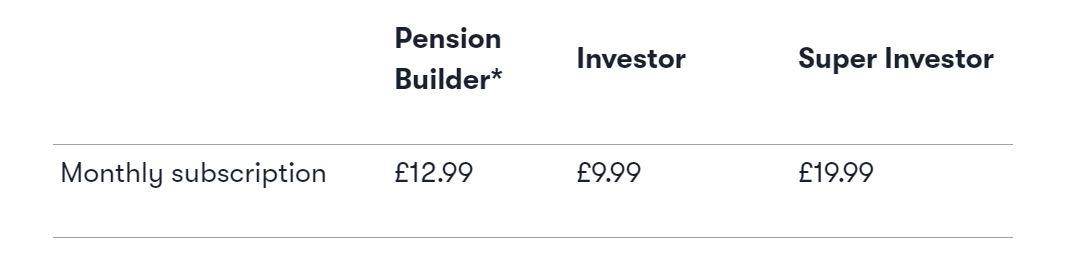

Interactive investor flat fee subscription price plans

*Pension Builder does not come with a free monthly trade

The ii Investor and Super investor subscription plans also come with as many free Junior ISAs as customers have children. Super Investor also includes a free subscription to Friends and Family (otherwise £5 extra per month) and allows customers to gift a free subscription to ii for up to 5 people.

Richard Wilson adds: “Cutting investment platform costs is a simple, effective and reliable way to get the most out of your investments. We encourage investors to compare platforms and find the service that delivers the best value for them. We know that ii can deliver very substantial savings over the long-term as wealth grows through our pension and investment accounts.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.