Interactive investor interest on cash balances from 1 February 2024

We explain the interest paid on customer cash balances in ISAs, SIPPs and trading accounts.

25th January 2024 10:27

by Camilla Esmund from interactive investor

- interactive investor (ii) increases interest paid on cash balances, effective from 1 February 2024

- ISAs, Trading Accounts, and SIPPs will all receive additional cash interest

interactive investor (ii), the UK’s second-largest platform for private investors and number one flat-fee platform, is raising the interest paid on customer cash balances across ISAs, SIPPs, and Trading Accounts from 1 February 2024.

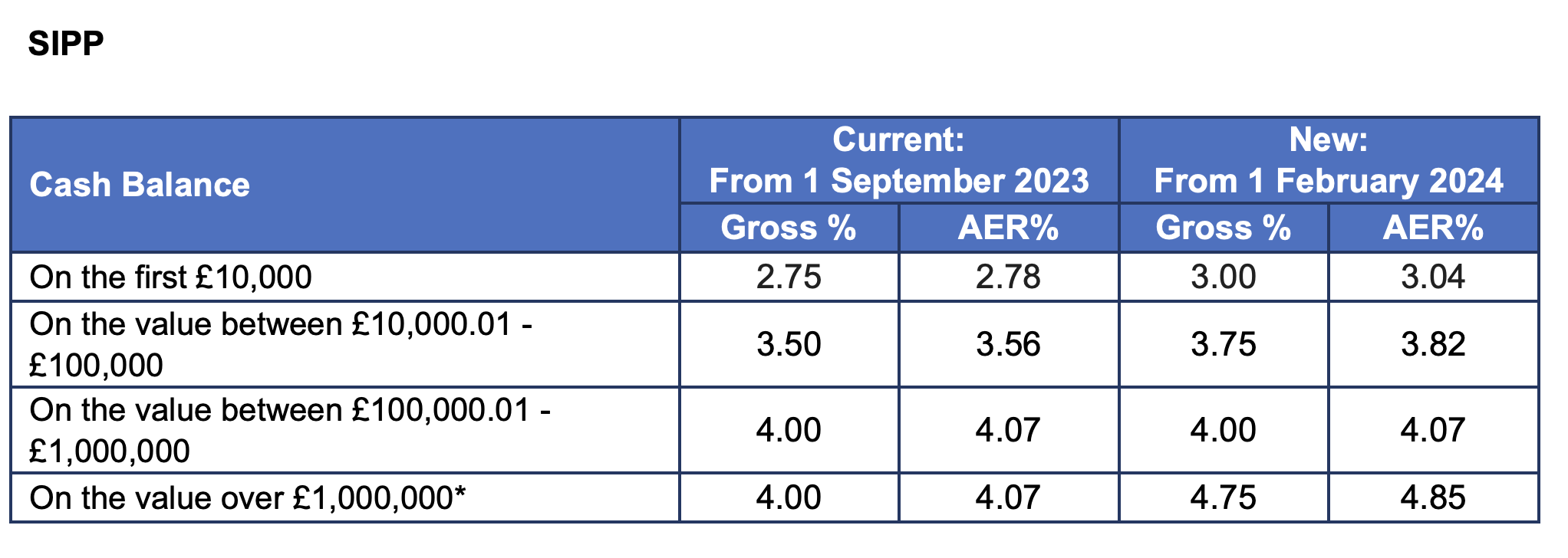

For SIPPs, the interest paid on the first £10,000 of cash balances in the interactive investor SIPP will increase from 2.75% to 3.00% gross. Interest paid on the balance between £10,000.01 to £100,000 will increase from 3.50% to 3.75% gross. The rate of interest paid on the balance between £100,000 and £1,000,000 remains unchanged at 4.00%. For British Pound balances in SIPPs above £1,000,000 interactive investor is introducing a new tier paying 4.75% gross. For US dollar balances above £1,000,000 this new tier will pay at 5% gross.

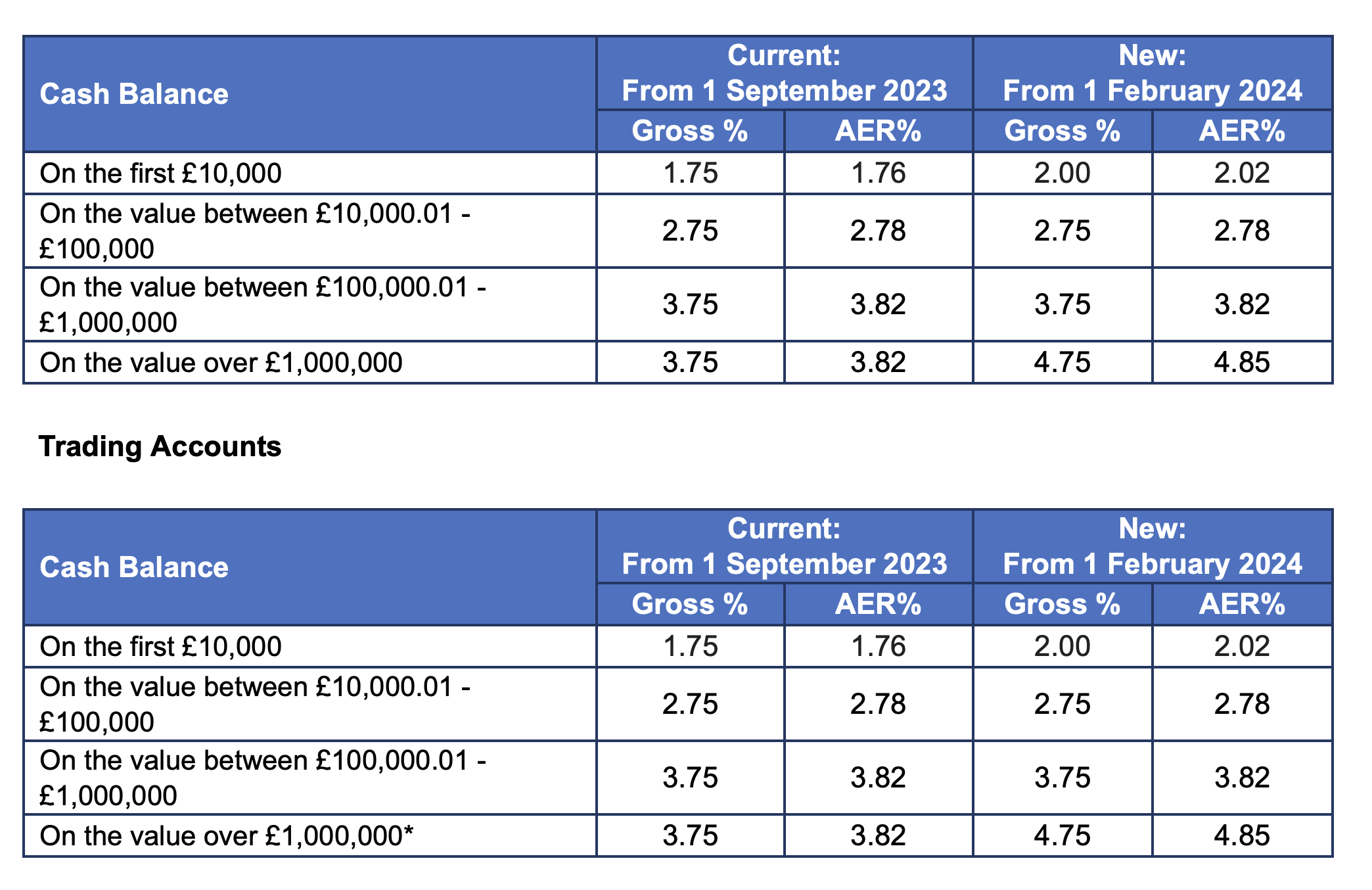

The annual interest paid on the first £10,000 of cash balances in ISAs and Junior ISAs is increasing from 1.75% to 2.00% gross. Interest paid on the value between £10,000.01 and £100,000 remains the same at 2.75% gross, as does the interest on the value between £100,000 and £1,000,000 which continues to be paid at 3.75% gross. For British Pound ISA balances above £1,000,000 interactive investor is introducing a new tier, paying 4.75% gross.

The interest paid on cash balances in interactive investor Trading Accounts is receiving the same increase as ISAs and Junior ISAs. That means the first £10,000 of cash balances will receive 2.00% gross interest, up from 1.75%, and balances on the value of £10,000.01 to £100,000 and the value over £100,000 to £1,000,000 will also receive 2.75% gross and 3.75% gross respectively. For British Pound balances in Trading Accounts above £1,000,000 interactive investor is introducing a new tier paying 4.75% gross. For US dollar balances above £1,000,000 this new tier will pay at 5% gross.

For Euro balances held in Trading Accounts, interactive investor will pay 2.00% gross from 1 February for all value ranges, up from 1.75% gross. For Euro balances held in SIPPs, the interest paid on cash will be 3.00% gross on all value ranges, up from 2.75%.

Richard Wilson, chief executive, interactive investor, says: “We are an investment platform, our customers come to us to invest, and there are many sound reasons why they may choose to maintain cash balances with us in the short term. We routinely assess our service offering, and we will continue to actively monitor and respond to the interest rate environment.

“We are fully committed to transparency on rates and in our customer communications. interactive investor offers a full range of investment options, including an array of cash alternatives such as fixed income, money market, and a cash deposit service.”

ISA and Junior ISA

*For US dollar balances held in Trading Accounts and SIPPs, ii will pay 5% (5.12% AER) on the value over £1,000,000.

- On Euro balances held in Trading Accounts ii will pay 2.00% (2.02% AER).

- On Euro balances held in SIPPs ii will pay 3.00% (3.04% AER)

All the new rates are based on British Pounds, or the equivalent value in US dollars, unless stated otherwise. Interest is applied at account level. Cash balances held in ISAs and JISAs, Trading Accounts, and SIPPs are treated separately.

Notes to editors:

Information about interest rates

Beyond the specific subscription fee(s) for operating one of more of our Services, there are no charges for customers to hold money in their Account(s). We receive interest from the bank(s) with which we deposit client money. Any interest received on such balances belongs to us. Separately, we will pay interest on customers’ daily cleared credit balance at rates determined by us, as are set out from time to time on the Website.

*AER stands for Annual Equivalent Rate and shows the interest rate received over the year taking into account the effect of compounding interest payments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.