Interest rates rise to 5.25%: what does this mean for me?

3rd August 2023 13:26

by Craig Rickman from interactive investor

The base rate continues to march upwards, but the latest hike is lower than many expected. Craig Rickman examines the potential impact on your savings, investments and borrowings.

The Bank of England has continued its battle to get inflation under control, raising interest rates for the 14th consecutive time to reach their highest level since February 2008.

The UK central bank’s Monetary Policy Committee (MPC) voted by a majority of 6 to 3 for a 0.25 percentage point increase, lifting the base rate to 5.25%.

Two members of the MPC voted to increase rates by 0.5 percentage points, to 5.5%, and one member preferred to stick at 5%.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Inflation is not just a problem in the UK, but across the globe. The Bank of England’s move today followed similar activity in both the Eurozone and across the Atlantic.

Last week the European Central Bank (ECB) raised rates 0.25 percentage points to 3.75% - the ninth consecutive time rates have gone up, with the ECB saying it expects inflation to be “too high for too long”.

Also last week, the US Federal Reserve increased interest rates to their highest level in 22 years. This was the 11th uptick since early 2022, lifting the benchmark rate to a range of 5.25% to 5.5%.

BoE rate rises since December 2021

03 Aug 23 5.25%

22 Jun 23 5.00%

11 May 23 4.50%

23 Mar 23 4.25%

02 Feb 23 4.00%

15 Dec 22 3.50%

03 Nov 22 3.00%

22 Sep 22 2.25%

04 Aug 22 1.75%

16 Jun 22 1.25%

05 May 22 1.00%

17 Mar 22 0.75%

03 Feb 22 0.50%

16 Dec 21 0.25%

Why are rates still going up?

The UK central bank is hiking rates in a bid to tame inflation, which despite starting to fall, continues to pose a major threat to the UK economy, and particularly your finances.

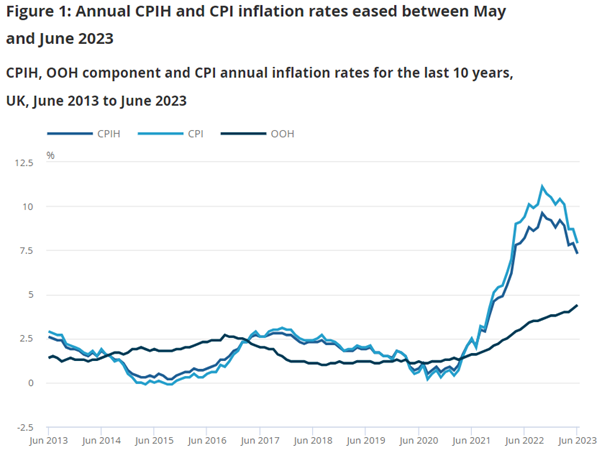

UK inflation dropped to 7.9% in June, a promising development given how sticky it’s been this year. But there is still some way to go before it returns to a level deemed acceptable.

From food to petrol to travel, everything is much more expensive than it was a couple of years ago. And unless inflation starts to tame, this trend will continue. The Bank of England believes that hiking interest rates is the most effective tool to correct the UK’s inflation problem.

Source: Consumer price inflation from the Office for National Statistics. Consumer Prices Index including owner occupiers' housing costs (CPIH). OOH is owner occupiers' housing costs.

Have rates now peaked?

That looks unlikely. Further rate rises are very much on the cards. The Bank of England expects rates to peak at just over 6%, and average just under 5.5% over the next 3.5 years.

Inflation is still four times higher than the BoE’s 2% target, and earlier this year Prime Minister Rishi Sunak pledged to get inflation below 5% by the end of 2023.

- Cash rates are rising, but lag inflation: here’s where to invest instead

- What an inflation shock really looks like

- Bond Watch: tumbling US inflation sparks bond and stock rally

While the Bank of England expects to hit Sunak’s target, due to lower energy, “and to a lesser degree, food and core goods price inflation” it said that services price inflation is projected to remain elevated in the near term.

Who are the winners and losers?

I’m sure most of you are familiar with the drill by now: when interest rates go up, your savings (should) earn more interest, but your borrowings get more expensive. But let’s examine in closer detail how your finances might be affected by the latest rise and explain what steps you can take to protect your finances.

Mortgages and debt

Off the back of today’s rate rise, anyone on a variable rate or tracker mortgage will see their monthly repayments rise immediately.

If you’ve tipped onto your lender’s standard variable rate (SVR), you will also see your costs go up. Most lender’s SVRs are currently around the 8% mark, so unless you have a small mortgage that you’re looking to clear soon then it might be financially savvy to hunt for a better deal.

Meanwhile, if you recently locked into a fixed-rate mortgage, then your payments will be unaffected, at least until the term ends.

But if your fixed-rate deal is about to expire, the mortgage deals on offer could get more expensive. You may be wondering whether to secure another fixed deal or opt for a tracker.

Which one is right for you will depend on how much you value certainty. With a fixed-rate mortgage, your repayments cannot change throughout the selected term, no matter if it’s two, five or 10 years. This can be helpful from a budgeting perspective.

- Investors like Taylor Wimpey's half-year results

- UK household costs rocket to highest in 30 years

- The UK's coming mortgage crunch

However, if rates start to come down in the future, which may happen if inflation falls sharply, it could be more expensive than if you had locked into a tracker or variable rate mortgage.

Whether you’re a first-time buyer or looking to remortgage, the best thing to do right now is take your time and shop around.

Savings and investments

The interest that you can earn on your cash savings should increase in response to today’s announcement.

And things have improved dramatically on this front since the Bank of England began raising rates in December 2021. The best easy access accounts now pay north of 4.5%, while if you’re prepared to tie your savings up for at least a year, you could get more than 6%.

That said, banks have been sluggish to pass on rate rises in past 18 months, so you might have to wait a bit before better deals enter the market. But with the Financial Conduct Authority’s consumer duty regime - which demands financial institutions offer ‘fair value’ to their customers - now in force, there is more pressure on banks to act quickly here.

One thing you should consider is the impact of rising rates on your savings allowance. At present, basic-rate taxpayers can earn £1,000 on their cash savings before paying income tax, while higher-rate taxpayers can earn £500. If you pay additional-rate tax (which means your income exceeds £125,140), you don’t get an allowance.

In a nutshell, if you pay basic-rate tax and have more than £20,000 in cash savings, you might start paying tax on some of the interest you receive.

A solution to this problem is to use your ISA allowance. You can invest or save a maximum of £20,000 a year, with any interest, gains and dividends sheltered from tax.

It’s also worth noting that even though cash savings rates have improved, the best ones still lag UK inflation. And if the interest you earn is lower than inflation, your savings will erode in real terms.

- Will investors keep buying during historically weak August?

- Why the outlook for dividends in 2023 has brightened

- Insider: FTSE 100 CEO takes share purchases above £600,000

On a brighter note, with inflation falling and cash rates rising, the gap has started to narrow. If this trend continues, it is possible that we might reach a point where some cash savings outstrip inflation.

When it comes to your investments, as rising interest rates tend to have a dampening effect on share prices, your portfolio may suffer. However, it is not always that straightforward. Global markets performed positively in July, despite the trajectory of interest rates.

In any case, when investing in stocks and shares, your focus should be on the long term. Bumps in the road, like the volatility we’ve experienced so far this year, go with the territory. The key is to keep faith in your long-term investment strategy and have the confidence to ride things out. Either way, now might be good time to review your investment strategy to make sure your financial goals are still on track.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.