Last year’s top sector can keep delivering

Douglas Chadwick examines the best-performing Investment Association sector in 2024 and considers prospects for an area with a heavy weighting to the US.

27th January 2025 15:20

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

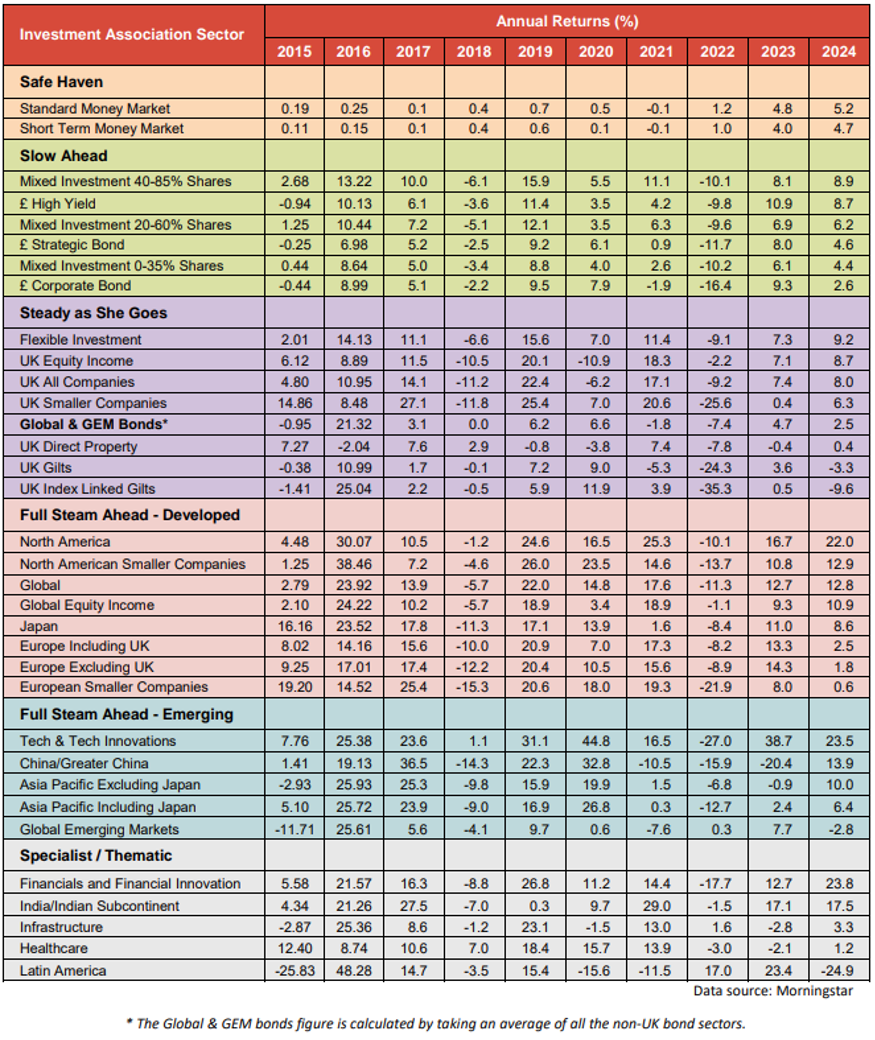

The best-performing Investment Association (IA) sector last year was Financials & Financial Innovation, with an annual return of 23.8%.

As you can see from the table below, the relative performance of the IA sectors has varied significantly over the past 10 years.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

However, there are certain consistent patterns. The funds that have on some occasions seen the largest one-year returns, are also the ones the have sometimes suffered the greatest losses.

Past performance is not a guide to future performance.

For example, the Technology & Technology Innovation sector rose by 44.8% in 2020, but fell by 27% in 2022. At the opposite end of the spectrum, are the money market funds – over the past 10 years the Standard Money Market sector’s only one-year drop was 0.05% in 2021, and its greatest gain was 5.2% last year. For something in the middle, the UK All Companies sector fell by 11.2% in 2018, but went up by 22.4% in the following year.

At Saltydog, we believe that understanding these relationships is very useful for any investor; that was the inspiration behind our own Groups, where we compare sectors that have had similar levels of volatility in the past. That is also why the sectors in the table above are first sorted into our Groups, based on their historical volatility. Starting with Safe Haven, and then moving up through Slow Ahead, Steady as She Goes, etc.

From time to time, the IA review the sectors and may add or remove some. In 2021, they introduced six new “thematic” sectors: Financials & Financial Innovation, Healthcare, Infrastructure, Commodities/Natural Resources, Latin America, and India/Indian Subcontinent.

The reason why they introduce new sectors is usually because more funds are now focused on these themes in the markets. That, in turn, is probably because that is where they see future growth. There is no guarantee that they will be right, but it is a good reason to keep an eye on how any new sectors perform.

The India /Indian Subcontinent sector had a good run in 2023 and for most of 2024. I have written about it on several occasions, and our demonstration portfolios benefited by holding the Jupiter India I Acc fund. However, I would now like to focus on the Financials & Financial Innovation sector.

- Where to invest in Q1 2025? Four experts have their say

- Funds and trusts four pros are buying and selling: Q1 2025

Although it was only launched in 2021, it is possible to work out what its sector performance would have been in previous years. Over the past 10 years, it has dropped only twice, which is comparable with most sectors in our “Full Steam Ahead” Groups or the Specialist/Thematic sectors.

What is particularly noteworthy is that its best year was last year, when it was also the top-performing sector.

The sector definition for the Financials & Financial Innovation sector is: “Funds that invest at least 80% of their assets in equities of financial services companies and related sectors including industries such as banking, insurance, capital markets, fintech and consumer finance in any country. Some funds in the sector may have a specific focus such as an industry focus (e.g. insurance, money management), country focus (e.g. US) or thematic focus (e.g. fintech). These funds may exhibit different characteristics to diversified financial funds, and investors should take extra care when making comparisons.”

Although funds in this sector can invest anywhere in the world, they tend to focus on the US, investing in banks, insurance companies, and businesses providing financial services. This makes them particularly susceptible to any changes that the recently elected Trump administration may make.

During his election campaign, Trump promised that he would help the financial sector by reducing regulation and unnecessary bureaucracy. It is early days, but it looks as though he will be true to his word.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Why we are betting on the banks

Gary Gensler, chair of the Securities and Exchange Commission (SEC), resigned on the 20 January, not that he really had much choice.

The SEC is an independent federal government agency responsible for regulating the securities markets in the United States. The SEC was created in 1934, following the stock market crash of 1929, and was tasked with protecting investors and maintaining fair, orderly, and efficient markets.

On his first day in the Oval Office, President Trump appointed Mark Uyeda as the acting chair of the SEC. He is expected to lead the SEC until Paul Atkins, President Trump’s nominee for permanent SEC chair, obtains Senate confirmation. Uyeda is known for being a vocal critic of Gensler’s policies, and in the past has called for a rehaul of the SEC.

Atkins was a former SEC Commissioner during the George W. Bush administration, and is well-known for advocating a business-friendly, light-touch regulatory philosophy. This is in stark contrast to Gensler, who was known for his aggressive regulatory approach.

So far this year, the Financials & Financial Innovation sector has gained a further 6.1%, suggesting that the markets are generally in favour of this change in emphasis.

Both our demonstration portfolios currently hold the Janus Henderson Global Financials fund.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.