Market snapshot: tech stocks and central banks hog headlines

Tech stocks are back in focus, among them three of the biggest. ii's head of markets looks at latest developments and how events this week could affect share prices.

19th March 2024 08:20

by Richard Hunter from interactive investor

In investment terms, the song remains the same with central banks and hype around AI continuing to share the spotlight.

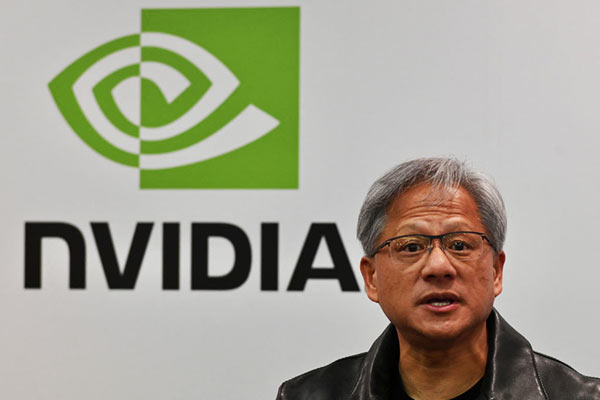

US markets edged higher after a more sober recent run, with technology shares attracting most interest. The beginning of the GTC conference, where NVIDIA Corp (NASDAQ:NVDA) is expected to exhibit its latest progress on AI applications, is being met with enthusiastic anticipation and it remains to be seen whether much will be added to the stratospheric rise of 240% to its stock price over the last year.

Meanwhile, Alphabet Inc Class A (NASDAQ:GOOGL) shares rose by almost 5% after reports that it was in talks with Apple Inc (NASDAQ:AAPL) to potentially include its Gemini AI in iPhones in what could be something of a groundbreaking collaboration.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Such optimism was tempered slightly by uncertainty ahead of the latest Federal Reserve policy meeting. While there is next to no expectation whatsoever for a rate cut this week, the latest accompanying comments will have a meaningful effect on sentiment.

The current consensus has become less certain on a June rate cut, with opinion almost evenly split following the latest set of consumer and producer numbers which revealed that inflation levels remain stubborn.

A reiteration of the previous higher for longer mantra would not be well received by investors, and with the economy apparently largely undamaged by rate rises so far, the outcome of the meeting is more likely to be met by a negative rather than positive reaction.

The opposing forces of AI enthusiasm and Fed uncertainty led to net gains during the trading session, leaving the indices well in the black for the year to date, with the Dow Jones now ahead by 2.9%, the S&P500 by 7.9% and the Nasdaq by 7.3%. Given the strength of recent rises, particularly within the tech sector, expectations are ratcheting higher, which will place more pressure on the quarterly reporting season when it begins next month.

- Will ‘Electric Eleven’ stocks outshine the Magnificent Seven?

- What Terry Smith thinks about investing in artificial intelligence

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

In Asia, the Nikkei rose by 0.7% to finish above 40,000 following the Bank of Japan’s decision to hike interest rates for the first time in 17 years from minus 0.1% to a range between 0% and 0.1%. The muted market reaction reflected the fact that the move had largely been priced in, with the next steps now becoming the focus of discussion.

The central bank highlighted a number of uncertainties, including the vital level of exports, housing investment and some weakness in industrial production which has left the economy teetering on the brink of a technical recession. By the same token, it pledged to retain an accommodative policy which has led to investors assuming that rates could remain at these levels for the time being, and the vague possibility of a marginal rise to 0.3% by the end of the year.

In early exchanges in the UK, Unilever (LSE:ULVR) shares were the focus of buying interest as the shares rose by almost 5% on the open. Unilever announced that it would be demerging its Ice Cream business, which houses the likes of Magnum, Wall’s and Ben & Jerry’s within its stable, and which had turnover of €7.9 billion last year. At the same time, the group will be accelerating its Growth Action Plan partly through the launch of a productivity programme.

The share price bounce goes some way in reversing what has been a difficult last year, as investors have fretted over a company with limited high growth prospects and in need of streamlining despite its reputation as a solid defensive play.

- Can we be sure of Shell?

- 10 hottest ISA shares, funds and trusts: week ended 15 March 2024

- Will Scottish Mortgage’s plan to tackle its discount work?

The positive reaction also potentially led to some switching out of sector peer Reckitt Benckiser Group (LSE:RKT), which lost over 3%. Elsewhere, AstraZeneca (LSE:AZN) shares eased slightly after the announcement of its acquisition of Fusion Pharmaceuticals Inc Ordinary Shares (NASDAQ:FUSN) for up to $2.4 billion in a bid to boost its development of specialised cancer treatment products.

On the whole, the FTSE100 was left treading water given the conflicting moves, although some more recent stability has largely written off the early year losses. The index is now flat so far this year, underpinned by an average dividend yield of 3.8%, although a step change in fortunes for the UK market as a whole remains invisible.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.