NatWest shares: buy, hold or sell?

19th July 2021 07:54

by Alistair Strang from Trends and Targets

With his theory confirmed, this technical analyst maps out the future for NatWest's share price.

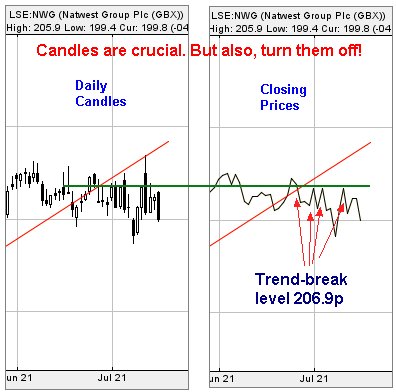

It’s always quite pleasing when the market chooses to confirm a theory. We often bang on about the importance of a share price closing above (or below) specific levels as a method of confirming whether a trend line is bogus. One such scenario involves up-trends, along with the point of a trend break. NatWest Group (LSE:NWG), in recent weeks, demonstrate exactly what we’re talking about.

The two chart extracts below highlight an interesting stance by the market. The red uptrend since September 2020 looks pretty important, and it appears the market shares this viewpoints.

In the period since the market broke this uptrend at the end of last month, considerable care has been taken to ensure NatWest’s share price has failed to close a session above the point of trend break. To us, this is a pretty big deal, confirming this historical uptrend was indeed valid and, worse, suggesting the break of the trend should be viewed as a precursor to some coming reversals.

Source: Trends and Targets. Past performance is not a guide to future performance

For three quite different reasons, this is a bit of a surprise, thanks to us taking time to read the financial press.

Firstly, the constraints on dividend payments came off last week, the UK big three expected to introduce 5%-plus payments within a year or so.

Second, we’re approaching another earnings season for the banks and it appears we should anticipate them doing better than expected. Apparently, losses due to the pandemic were nothing like expected.

Third is a bit left field. The ex-CEO of Barclays has called for an end to the requirement for banks to ring fence capital, joining a growing clamour to enable the institutions to explore more exotic ways of earning money. It must be admitted that there’s a strong chance the level of regulation inflicted on the industry has become over-regulation to the point of actually causing harm.

Collectively, the three arguments above should produce a picture of a share price desperate to go up but, instead, we’re now a little flummoxed, starting to suspect some reversal may be on the cards.

Near term, below just 199p for NatWest, suggests imminent weakness to an initial 188p with secondary, if broken, at 178p. In the event the 178p level breaks, all that’s left is a real hope for a rebound before a third level calculation of 164p.

Our alternate scenario demands the share price trade above 210p to introduce the potential of a gain to 215p. At this level, it all becomes a story of whether the share closes a session above the blue downtrend, due to some spectacular movement becoming possible. Closure above blue shall allow us to confidently mention 253p and beyond as ambitions for the future.

For now, our suspicion is the share price risks being a little bit stuffed, but we’d suspect if 164p (ish) makes a guest appearance, a future bounce is liable to prove interesting.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.