Navigating a volatile macro and market regime

How should investors navigate tariffs, rate cuts and fading US exceptionalism? Explore the latest Aberdeen House View for new insights on equities, bonds, private markets and the global trends shaping the next 12 to 18 months.

17th June 2025 13:46

by Peter Branner from Aberdeen

The Aberdeen House View is designed to provide a structure around the macro and market outlook to help our investment teams, and our clients, make more informed decisions.

This is even more important in today's complex investment environment, as higher tariffs threaten to hinder growth and fuel inflation, and amid investor concerns over US government borrowing plans. Clarity is vital for investing with conviction.

Here are some key insights from the latest House View which we presented to clients attending Aberdeen Gather – Global Investment Forum 2025 earlier this month.

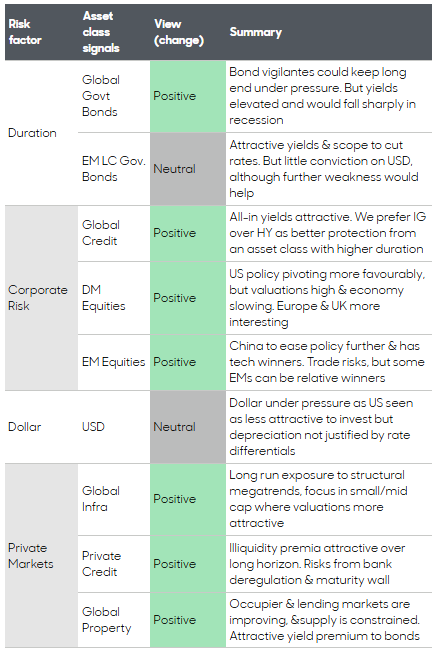

Our analysis focuses on four areas: bonds, corporate risk, the US dollar and private markets. The views cover the next 12 to 18 months.

Bonds are back (but with a twist)

After years of being out of favour, bonds are back on investors’ radar. We’re modestly positive on government and corporate bonds due to the attractive yields and diversification benefits as we head into a possible economic slowdown.

Central banks remain in easing mode, with the US Federal Reserve, European Central Bank and the Bank of England likely to cut interest rates further. This will provide support for bond prices, which rise when interest rates fall.

However, bond term premia — the extra compensation investors demand for holding longer-term debt instead of short-term duration – may continue to increase. This will be driven by geopolitical risk, inflation uncertainty and ballooning government budget deficits.

So that’s why investors need to be more selective. We like high-quality corporate credit, the shorter end of bond yield curves, and sovereign debt where central banks are likely to deliver the most rate cuts, such as UK gilts.

Corporate risk: looking beyond the US

We expect global economic growth to slow but not collapse. For example, we’ve downgraded our US growth forecast to around 1.8% this year, from 2.8% last year, largely due to the impact of trade tariffs.

That said, policy tailwinds are strengthening in Europe and China, creating opportunities. We’re gradually pivoting away from the US because other developed market and emerging market equities are starting to look more attractive.

For example, European fiscal policy has become more supportive, with European Union (EU) defence spending to rise by €800 billion, or some 5% of gross domestic product (GDP), reflecting a shift in thinking about security.

Meanwhile, US equity valuations are still high following the big market rebound in April and May, and we think European and Chinese valuations offer better value.

The dollar debate and fading ‘exceptionalism’

The dollar is a hot topic as the shine comes off the world’s reserve currency. We’re neutral on the US currency in the short term but believe that it could weaken in the years ahead.

US exceptionalism – the idea that the US enjoys unique structural advantages that consistently make it a more attractive place to invest – is fading.

For example, other developed markets will challenge the superior growth the US has experienced in recent years, while the industry lead enjoyed by some of the US tech giants is also looking shaky. The dollar may still enjoy deep liquidity and institutional backing, but its long-term outlook looks dimmer.

In fact, the dollar has come under sustained pressure in recent months as international investors reached the conclusion that the US has become a less attractive place to deploy capital.

Private markets: a structural opportunity

Private markets are in a sweet spot with interest rates falling, economic growth slowing but not contracting, and a legacy of undersupply of good assets in areas such as real estate, infrastructure and private credit.

For example, global direct real estate is looking attractive, with occupier and lending markets improving but with supply constrained.

Portfolio diversification is important in an unpredictable world. With more frequent signs of positive correlation between stocks and bonds – with both moving up and down in tandem – standard bond-equity portfolios won’t provide enough diversification.

For investors who can tolerate less liquidity, private markets may offer diversification benefits while delivering attractive returns. However, due diligence is key because valuations can be less dependable, and risks may be underestimated.

Here’s a more detailed look at how we view the major asset classes:

Chart 1: Aberdeen House View

Source: Aberdeen, May 2025. The views expressed should not be construed as advice or an investment recommendation on how to construct a portfolio or whether to buy, retain or sell a particular investment.

Final thoughts

Clarity matters. We don’t pretend to know exactly what’s coming but we do build scenarios and prepare for a range of outcomes.

Tariffs, elections and geopolitics — these are all wildcards. By combining economic insights with investment flexibility and careful selection, we can try to stay ahead of the curve.

Peter Branner is chief investment officer at Aberdeen.

Paul Diggle is chief economist at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.