New targets for FTSE 100 and AIM market

After a strong November, our chartist plots possible upside for the small-cap and blue-chip indices.

20th November 2020 09:10

by Alistair Strang from Trends and Targets

After a strong November, our chartist plots possible upside for the small-cap and blue-chip indices in the run-up to Christmas.

FTSE 100, AIM & the DAX too

‘Santa Rally’ sounds like a town south of LA and we’re at the time when ‘Santa’ speculation starts to rear its head on the stock markets.

There’s little doubt people are embracing the Christmas spirit early, with exterior lights and even the odd tree appearing, doubtless due to many folk wanting to be cheered up as this awful year approaches an end. We’re starting to suspect this need for optimism may spread to the stock markets and thankfully, there are some fairly easy signs to watch for.

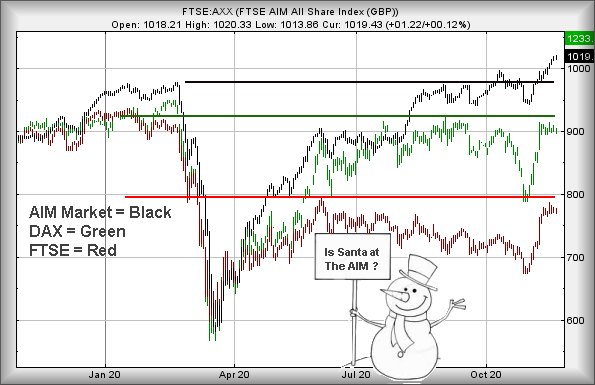

The UK’s AIM market, home of the eternal optimist, has already started the party with the FTSE AIM All-Share index (FTSE:AXX) hitting higher levels than achieved before the March Covid-19 drop. This is pretty unusual, a feat currently beyond the FTSE, the DAX, and France’s CAC 40.

Across the Atlantic, the Dow Jones is carefully attempting higher levels, while the S&P 500 has recoiled in shock following a couple of upward attempts. Visually, we suspect the concept of a ‘Santa Rally’ shall prove real this year, thanks to markets appearing to surge at the starting line.

The question is as always; where’s the starting line anyway?

We’ve written previously about ‘Glass Ceilings’ and our preferred idiom, the Horizontal Trend. There’s absolutely no rule dictating a trend line should head up or down. Sometimes, the most important trend line, when identifying a trend break, is the horizontal one. Our preferred demand is for a market (or price) to actually close above the level of the Horizontal Trend to provide proof an instrument is actually about to move properly.

In the case of the FTSE, this implies that closing a session above 6,509 points shall justify a party popper. For Germany and the DAX, the index needs to close a session above 13,268 points.

For the AIM, however, the Christmas tree is up, illuminated, and there are lights decorating the outside of the house. People may even be smiling!

Presently, the AIM is trading around 1,019 points, only requiring to exceed 1,025 points to suggest a cycle is commencing toward 1,233 points. A 20% rise on the junior market cannot be sneezed at, despite it being winter.

Source: Trends and Targets Past performance is not a guide to future performance

Given the rate of acceleration during the last month, if this pace continues, our target level should appear around Christmas time. This has fairly significant implications for members of the AIM, when this sort of acceleration occurs, bounces and surges tend be quite flamboyant, exceeding expectations.

Importantly, should the FTSE itself manage above our 6,509 trigger level, our thoughts against the AIM shall improve to “Print This Out, compare with what actually happens!”

FTSE for FRIDAY (FTSE:UKX)

We remain quite proud of how widely read our Friday FTSE article is, quite literally worldwide. Apparently, we’re a thing in UAE currently as the Emirates is third of the list of international visitors to the Trends & Targets website. Good old Reunion Island remains in the Top 10, clinging on at number 9.

The FTSE closed the session on Thursday at 6,333 points, now requiring above 6,378 to signal the potential of some proper recovery. Such a movement calculates with an initial ambition of 6,428 points with secondary, if exceeded, a rather more impressive 6,476 points.

Source: Trends and Targets Past performance is not a guide to future performance

Visually, this should position the UK market for further upward nudges next week. If this scenario triggers, the tightest “safe” stop loss level looks wide at 6,313 points.

Alternately, below 6,283 becomes problematic, allowing weakness to establish to an initial 6,233 with secondary, if broken, at 6,156 points.

What does Friday hold? Very difficult to say, thanks to the UK market spending the last four days effectively doing nothing except pretend to breathe.

Have a good weekend.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.