These tech trades offer lesson in market timing

After piling into these top tech funds, the Saltydog analyst made a big profit quickly. Here's how.

1st April 2019 12:26

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After piling into these top tech funds, the Saltydog analyst made a big profit quickly. Here's how.

Back on track?

Despite all of the political upheaval – Brexit, EU financial instability, Trump investigations, US-China Trade Wars, etc … it's been an encouraging start to the year for investors.

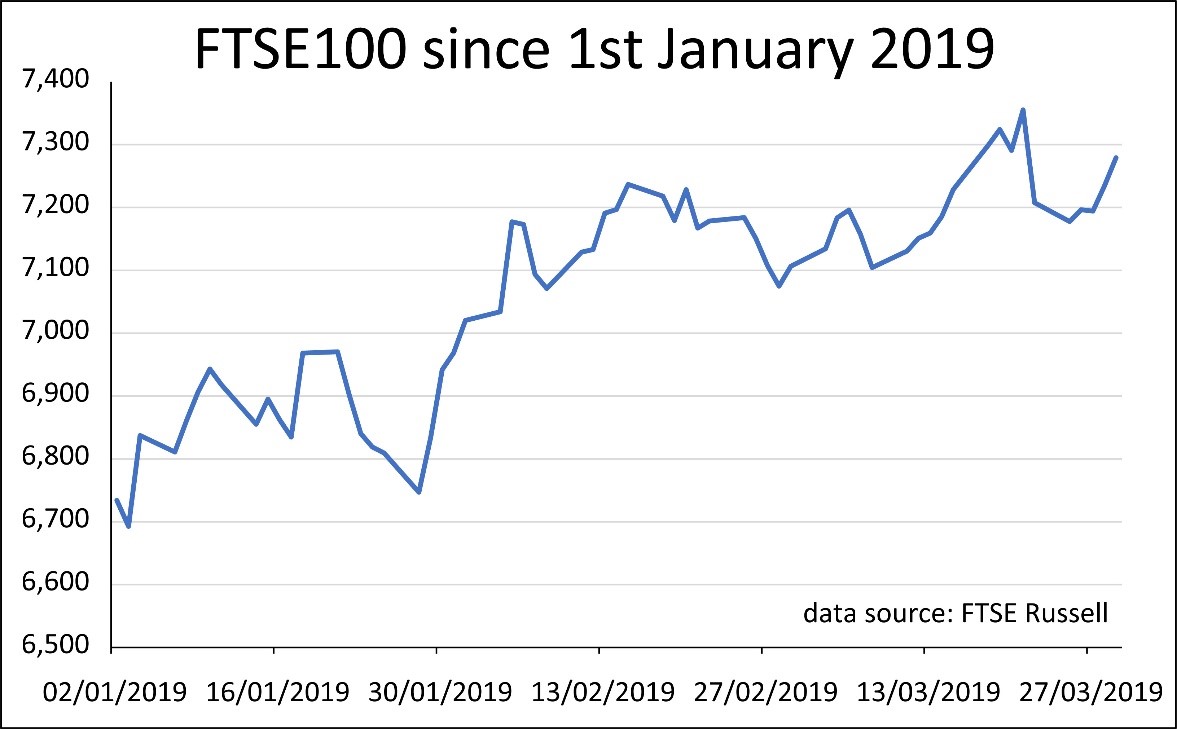

In the UK, the FTSE 100 index is up 8.2% since the beginning of January.

Other indices have done even better…

• Brazilian Ibovespa 8.6%

• Frankfurt DAX 9.2%

• Dow Jones Industrial Average 11.2%

• Russia Trading System Index 12.1%

• Paris CAC40 13.1%

• Shanghai Composite 23.9%

There are also a handful of Investment Association sectors that have made double-digit growth since the beginning of the year.

Looking at the indices above, it's not surprising that China & Greater China is one of them. One which might not be so obvious is the Technology and Telecommunications sector.

This sector is dominated by the large US internet and communication giants like Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Google parent Alphabet (NASDAQ:GOOGL). In the final quarter of last year, many of these stocks plummeted on the back of fears about increased regulation, reduced growth, and pressure to pay what most people would consider a reasonable amount of tax.

During 2018, Apple became the first publicly traded US company to pass the historic $1 trillion market cap. However, the company struggled with disappointing sales figures and smartphone market saturation. It ended the year down almost 7%, the worst year of trading since the 2008 financial crisis.

Amazon was the next company to break through the $1 trillion barrier and had a better year than most, but still lost 25% of its value in the last three months of the year.

Facebook was in the news for much of 2018, and usually for the wrong reasons. The UN blamed it for spreading hate in Myanmar; Cambridge Analytica (who worked with Donald Trump's election team) harvested 50 million people's profiles in a record data breach; several top executives quit; and the growth of new users slowed.

Alphabet had its own privacy and content moderation issues, but not on the same scale as Facebook. It's share price was only slightly down over the year, but it still lost over 15% in the last quarter.

After several years of strong growth, was this just a natural correction, or was the bubble about to burst?

Well, so far it looks as though these companies have ridden the storm and they're starting to forge ahead again.

The recovery started just after Christmas and, since then, some of the 'tech' funds have done remarkably well.

From the Technology and Telecommunications sector …

• AXA Framlington Global Technology 22.9%

• Polar Capital Global Technology 22.8%

• Fidelity Global Technology 20.3%

• GAM Star Technology 19.2%

• L&G Global Technology 19.0%

And from the Specialist sector …

• Smith & Williamson Artificial Intelligence 25.6%

• AXA Framlington Biotech 20.7%

• AXA Framlington Robotech 19.1%

Our portfolios invested in a couple of these funds in January and then added to them in February.

We know from our analysis that these are some of the most volatile funds that are available, but when they do well they can do really well.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.