NMC Health: Should you consider catching this falling knife?

The slump in these shares looks increasingly like market psychosis rather than underlying trouble.

7th February 2020 10:59

by Edmond Jackson from interactive investor

The slump in these volatile and high-risk shares looks increasingly like market psychosis rather than underlying trouble.

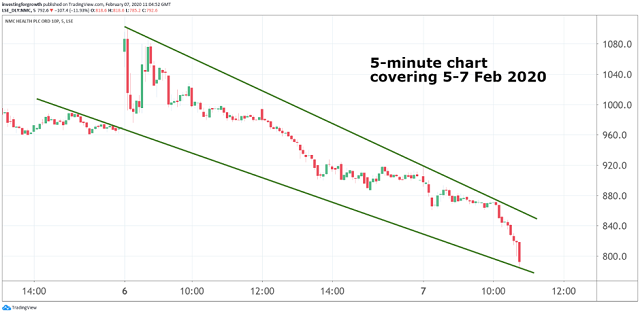

Down to 780p in early trading today, shares in Middle East hospitals operator NMC Health (LSE:NMC) have plunged over 65% since the Muddy Waters hedge fund published an assault on its asset values last December. In 2018, they were worth around £40.

By the time you read this, the shares could be 600p, 1000p, who knows where NMC, the jack-rabbit stock, might twitch next with electrifying volatility. This, for a healthcare group in a wealthy part of the world, the kind of situation you would think should have resilience, dependable financials and hence a decent rating.

Source: TradingView Past performance is not a guide to future performance

Key development in founder taking back control

The financial commentariat has a rush of adages, about how you should avoid stocks targeted by short-sellers, especially those operated overseas but listed in London and showing complex accounts. A bout of negative sentiment has festered into collective neurosis and now psychosis.

Meanwhile, Bavaguthu Shetty, NMC’s Indian-born founder who still owns 15% of the equity, appears reliably reported as limbering up to take back control (having stepped down as CEO in 2017), which counters the sense of a business based on financial quicksand, liable to fold at anytime.

He ought to know whether NMC’s foundations are reliant or dodgy, and my sense, having followed situations quite like this, is that a founder CEO would keep his head down if trouble is in the offing. A founder seeking to take back control doesn’t guarantee the business does not have any issues, but is it really odds-on that a 77 year-old (here) wants to open a can of worms?

It would appear his advisers have placed on at least one respected media platform, the story about how he is conducting an operational review ahead of formal talks to explore options with shareholders and regulators.

So, despite high debts that mean a market cap of around £2 billion more than doubles to a £4 billion enterprise value, a hefty $1.6 billion (£1.2 billion) balance sheet intangibles, and after my last review of the shares suggesting “Avoid” at 1,370p on 20 December, my interest is now piqued by the sell-off. Could the stock be oversold?

- NMC Health shares: Bargain or no-go area?

- Stockwatch: Should you buy NMC Health after 50% slump?

- 10 stock ideas from a market master

Bank margin calls on director debt is the catalyst

The latest de-rating from around 1,400p in early January was caused by a 1,200p placing worth £375 million - 15% of NMC’s issued equity – as a result of Deutsche Bank and Credit Suisse calling in loans on two Emirati investors/directors of NMC - Saeed al-Qebaisi and his relative Khalifa al-Muhairi.

Another 1% was sold at 1,250p on 23 January and it appears the founder’s objective is to find fresh investors to replace these unstable shareholdings. It would appear the bank’s motivation was based on a straightforward reading of NMC’s fallen market value, by way of these men’s net worth hence financial risk, rather than examples where banks pull facilities on a company because it is judged inherently weak.

The story around B Shetty is his looking to buy out existing Emirati investors under creditor pressure and bring in new investors. Eliminating such an overhang would indeed be a positive development.

Source: TradingView Past performance is not a guide to future performance

Elsewhere in “market technical” news, as opposed to company fundamentals, fund manager Capital Group raised its exposure from 11.5% over 12% in late January and disclosed that short selling (i.e. over 5% of the issued share capital) has reduced below 2.3% from 6.0% last August. The only two (disclosed) hedge funds involved bought back stock to trim their shorts on 31 January and 4 February respectively. At least there is no writing on the wall by way of market professionals’ action, to suggest NMC’s risk/reward profile is worsening. If anything, the implication is upside.

| NMC Health - financial summary | ||||||

|---|---|---|---|---|---|---|

| year ended 31 Dec | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Turnover ($ millions) | 551 | 645 | 881 | 1,221 | 1,603 | 2,057 |

| Operating margin (%) | 15.1 | 13.7 | 12.6 | 15.1 | 17.1 | 18.7 |

| Reported earnings/share ($) | 0.37 | 0.41 | 0.44 | 0.71 | 0.90 | 1.19 |

| Normalised earnings/share ($) | 0.37 | 0.41 | 0.46 | 0.75 | 0.96 | 1.21 |

| Earnings per share growth (%) | 7.4 | 12.3 | 10.5 | 64.1 | 28.0 | 25.8 |

| Price/earnings multiple (x) | 10.5 | |||||

| Operating cash flow/share ($) | 0.46 | 0.46 | 0.45 | 0.94 | 1.35 | 1.85 |

| Capex/share ($) | 0.42 | 0.60 | 0.43 | 0.32 | 0.32 | 0.79 |

| Free cash flow/share ($) | 0.04 | -0.14 | 0.02 | 0.62 | 1.03 | 1.06 |

| Dividends/share ($) | 0.04 | 0.05 | 0.06 | 0.11 | 0.18 | 0.18 |

| Yield (%) | 1.44 | |||||

| Covered by earnings (x) | 8.34 | 7.63 | 7.12 | 6.67 | 6.95 | 6.56 |

| Net asset value/share ($) | 2.08 | 2.42 | 2.63 | 4.44 | 5.33 | 6.26 |

| Source: historic Company REFS and company accounts |

NMC continues to rebuff any sense of wrongdoing

Last Tuesday, NMC announced that, in response to Monday’s further drop from around 1,300p to near 1,000p, “it knows of no specific reason” and full-year 2019 results are due in line with management’s expectations.

If market guidance reflects those expectations, consensus is for a 27% rise in net profit to $312 million net profit for normalised earnings per share (EPS) up 24% to 150 cents and the dividend to 28 cents.

The market rating for NMC shares implies a current sterling-based price/earnings (PE) ratio of around 7.7x, although the yield is barely supportive at around 2.5%. The stock clearly says investors are now dubious of NMC’s earnings presentation, hardly backed by yield (although with a professed operating margin over 18% and a 21% return on equity, investment should be rewarded).

A dilemma for all analysts is our being substantially reliant on company accounts to derive targets; all we can do is caution where aspects give unease, but ultimately if the accounts are flimsy then so are forecasts.

Guidance is similarly for around 26% earnings growth in 2020 and dividend growth of 20%, which does superficially feel rather too good to be true for a multi-billion company, whether dollars or sterling. Investor thinking would typically be divided, reasoning either that the stock now (over) discounts even a financial clean sweep, or much sense of a rose-tinted view means it should be given a wide berth. Hence, the stock’s jack-rabbit behaviour, I concede chart-wise remains in downward trend.

Outcome of an “independent” review seems predictable

From my own experience, having done an episode of sponsored research well over a decade ago, I would say only the toughest terrier of an analyst stands a chance of getting criticism of management signed off for publication, and being paid for this.

Forecasts, in particular, are amended by finance directors. Period. The trouble for client companies is that this leaves a sense of scepticism in the market, anywhere there’s a commercial link to published “judgment”. So, excuse my cynicism, but I expect the paid-for investigation underway by Louis Freeh, a former US federal judge and FBI director, into the Muddy Waters critique, to broadly exonerate management.

- ii Winter Portfolios 2019: Half-time update

- Six speculative UK share ideas for 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

I concede prejudice and I draw your attention to NMC’s “independent” review committee declaring on 17 January that it had hired Freeh Group on a basis to provide “a completely independent, unbiased, comprehensive and transparent report that will address all of these allegations”.

Pragmatically, I also believe that if this report comes across well – as it should - it should also improve stock sentiment. Frankly, at present, it could rise simply by easing market psychosis to measured neurosis.

Speculative but potentially interesting to average into

A chartist would most definitely say the line of least resistance here is downward; you should sit well back and avoid knife catching. Respect to that, pragmatically, but from a fundamentals’ perspective I can see potential catalysts now, where the founder’s action and the Freeh report, are interpreted net-positively in due course.

I continue with concerns about the accounts, where Freeh needs to clear the air. NMC is effectively a binary call between a debt-ridden accounting black hole and a roaring “buy”. It’s impossible to assert conviction but, on this week’s developments, I suggest that at around 780p the stock now deserves setting in the frame to Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.