ii Winter Portfolios 2019: Half-time update

Three months into this six-month strategy, and both portfolios are thrashing the wider market.

6th February 2020 13:56

by Lee Wild from interactive investor

Three months into this six-month strategy, and both portfolios are thrashing the wider market.

January was meant to be a time for the bulls. The UK had just emerged from a general election with a result the City had wanted, a decision on Brexit had been confirmed, and UK stocks looked cheap. But, while the first half of the month went to plan, a Black Swan event quickly unwound all the post-election gains.

The interactive investor Consistent and Aggressive Winter Portfolios were not immune to the coronavirus, which has spread rapidly from the Chinese city of Wuhan. Concern about how far the infection may spread and whether it was possible to find a cure quickly, caused panic on global stock markets.

Our own FTSE 100 fell 5% in the second half of January, the Dow Jones almost 4%, and most other major indices between 3% and 4%, including the UK domestic-heavy FTSE 250 index.

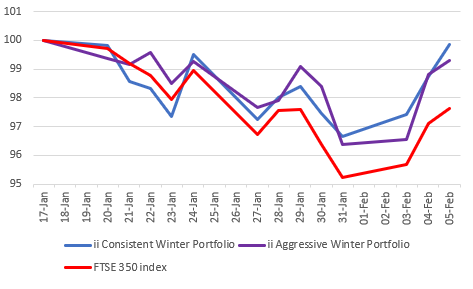

Markets peaked on 17th January before heading lower. It was the same for our seasonal baskets of shares for 2019-2020, although both outperformed the FTSE 350 benchmark index – down 4.8% - for those two weeks and the entire month.

The interactive investor Consistent Winter Portfolio, made up of five FTSE 350 stocks with the most reliable returns over the past 10 years, fell 3.3% from its January high. Meanwhile, the interactive investor Aggressive Winter Portfolio, which relaxes the entry criteria only very slightly in return for much higher potential returns, lost 3.7%.

- Discover how we do it by clicking here

- Find out more about interactive investor’s winter portfolios on our dedicated hub page

For the month, the FTSE 350 fell 3.4%, more than our consistent portfolio, down 2.8%, and our higher-risk aggressive bask of shares, down 3%. That leaves our portfolios up 8.8% and 13.5% respectively, versus less than 1.4% for FTSE 350, further validating the theory behind our six-month winter investing strategy.

What’s more, equity markets have staged a remarkable turnaround in the past few days, as the lure of cheap stocks outweighs the risk of further spread of the coronavirus. And that has had an inevitable impact on our portfolios.

Coronavirus impact on the ii Winter Portfolios

Source: interactive investor, Morningstar data Past performance is not a guide to future performance

You can see from the chart above, not only did our portfolios decline less in a falling market, they rose faster when buyers returned. This means that, just a few days into February, our consistent portfolio is now up 12.5% since launch on 31 October and the aggressive portfolio up 16.9%. The FTSE 350 is up 3.9%.

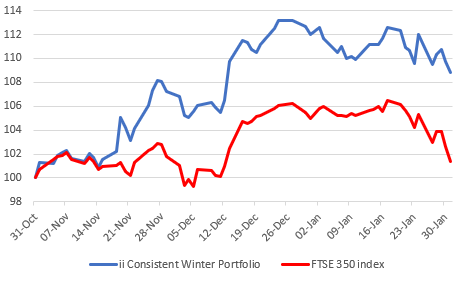

interactive investor Consistent Winter Portfolio 2019-2020

Source: interactive investor, Morningstar data Past performance is not a guide to future performance

As one might expect, the consistent portfolio enjoyed a smoother ride through the coronavirus sell-off. Most constituents avoided the worst of it, but the threat to global travel and hotel bookings had investors rushing to check out of InterContinental Hotels Group (LSE:IHG).

Shares in the Holiday Inn and Crowne Plaza owner, which started the month up 12% since this year’s winter portfolio was launched on 31 October, fell 10% in January. Thankfully, it is participating in the market rebound, and has recovered more than half its recent losses.

FTSE 100 speciality chemicals firm Croda (LSE:CRDA) and mid-cap motorway barriers company Hill & Smith (LSE:HILS) fell slightly less than the market, down 2.7% and 3.5% last month. But it was kitchen supplier Howden Joinery (LSE:HWDN), up 2.3% in January, and portfolio debutant, technology conglomerate Halma (LSE:HLMA), down just 0.4%, that stole the show.

Three months into this six-month strategy, Howden is the consistent portfolio’s best performer, with a 19.3% share price gain. We know the company is expanding fast, and further progress is expected when the company reports full-year results on 27 February.

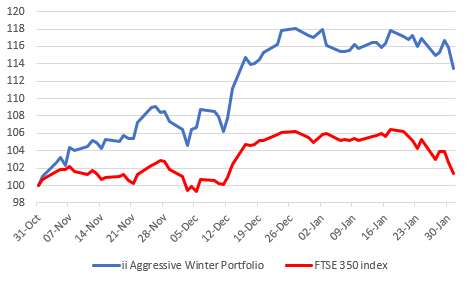

interactive investor Aggressive Winter Portfolio 2019-2020

Source: interactive investor, Morningstar data Past performance is not a guide to future performance

As with the consistent portfolio, our aggressive portfolio had a single significant loser in January. This time it was heat treatment engineer Bodycote (LSE:BOY).

There was no more a threat to Bodycote’s business from coronavirus than anyone else’s and, to be fair, it was a desire to protect already substantial profits that likely exacerbated the fall. The shares had already returned as much as 34% for our winter portfolio, making it more vulnerable to profit takers.

Another high-flyer Synthomer (LSE:SYNT) was down 4.5% for the month, but the chemicals company is still up over 21% since October. JD Sports (LSE:JD.), the unstoppable tracksuits-to-trainers retail chain, suffered just a 1.9% monthly decline and is returning 7% for the portfolio so far.

Bucking the downward trend last month were equipment rentals giant Ashtead (LSE:AHT), up 1.7%, and We-Work rival IWG (LSE:IWG), formerly known as Regus, up 1.4%.

Ashtead was slow out of the blocks this portfolio, falling as much as 5% by mid-December. But it has a growing fan club, some of whom think the company should do well from construction of massive data centres in the US, among other things. Morgan Stanley thinks the shares might one day be worth 3,000p. We hope so!

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.