In no hurry to sell Tristel shares, but should you buy?

Our companies analyst scores this exciting business that dominates its sector and is growing fast.

22nd November 2019 15:59

by Richard Beddard from interactive investor

Our companies analyst scores this exciting business that dominates its sector and is growing fast.

For an exciting business, Tristel (LSE:TSTL) does routine pretty well. In the year to June 2019 it gained 67 approvals for 34 disinfectant products in 14 countries and gobbled up its distributor in Belgium, The Netherlands, and France. It grew revenue 18% - 10% through its own endeavours and 8% due to new revenues from Ecomed, the distributor. Adjusted profit grew 16%. Continuing in the same vein, after the year-end Tristel acquired the 80% of its Italian distributor that it did not already own.

Both the product registrations and the acquisitions are part of an international expansion, born-out in another statistic: 55% of Tristel’s revenue came from abroad in 2019, compared to 51% in the year to June 2018. Tristel tends to use distributors to establish new geographical markets, and then takes over to capture the distributor’s profit margin and intensify the sales effort.

Magic formula

Tristel manufacturers a proprietary formulation of high-level disinfectant in various forms, foams, wipes, and sprays, that are easy and safe to apply manually to simple medical devices. The words in the preceding sentence may not seem remarkable but together they appear to give Tristel a competitive advantage.

High-level disinfectants like peracetic acid can be unpleasant or harmful to human health when used manually, but Tristel is unique in using chlorine dioxide, which is efficacious and safer. The disinfectants are also attractive to hospital finance departments because they replace expensive instrument washers with consumables that are reordered routinely, a steady and highly profitable business.

With 277 patents on delivery methods and audit processes, more than two decades of documented safe use and certifications for 1,845 medical devices produced by 55 manufacturers, it has a hell of a head start over would-be imitators, which is reflected in Tristel’s domination of certain UK hospital outpatient departments.

Tristel regards ENT, ultrasound, and ophthalmology, all of which use simple easily cleaned devices, as strongholds in which it commands a “truly significant” market share, for example 80%-odd in ENT according to my aging notes from 2015.

Infection control without frontiers

Near saturation of Tristel’s UK market strongholds means the bulk of future growth is likely to come from abroad where the company is less established, sometimes in much larger markets.

As in the UK, it is pushing into almost uncontested territory. Tristel is five years into a project to enter the US market, where it currently makes no sales. There, it has agreed a manufacturing and distribution partnership with Parker Laboratories that will fire-up once the company has secured approval, initially for its foam Duo product, from the US Food and Drug Administration.

Tristel’s ambitions are not restricted to hospital outpatient departments. In many parts of the world, including rural USA and less developed countries, medical services are delivered in the community by nurses. Over the last two years, Tristel has formed a partnership with Mobile OTD, an Israeli start-up that has developed a smart mobile colposcope, a device that illuminates and photographs a woman’s cervix and transmits a picture to a consultant to help in the diagnosis of cervical cancer.

Tristel’s interest is financial (it owns a 2% stake in MOTD), but it has also developed a version of Duo recommended for disinfecting the device, and it distributes the colposcope in the UK, Australia and New Zealand. Community clinics do not have access to cleaning machines and Tristel says its foams, wipes and sprays are the only way to disinfect “frontier devices” like these.

Beyond human medicine, Tristel has what it describes as “bridgehead” products for hospital surfaces, veterinary practices (branded Anistel) and contamination control in laboratories (branded Crystel).

While we cannot discount the possibility that other groundbreaking disinfectant technologies will come along, or US approval will be hard to come by, Tristel seems to have a unique product that satisfies a genuine need, ample defences against imitators, and an abundance of opportunities to sell more.

It is a prime candidate for long-term investment but for two considerations that may take the shine off for some investors: A lofty share price means we are paying for growth the company has yet to achieve, and the remuneration policy may result in the executives being rewarded for that growth in advance.

This is how I score the shares:

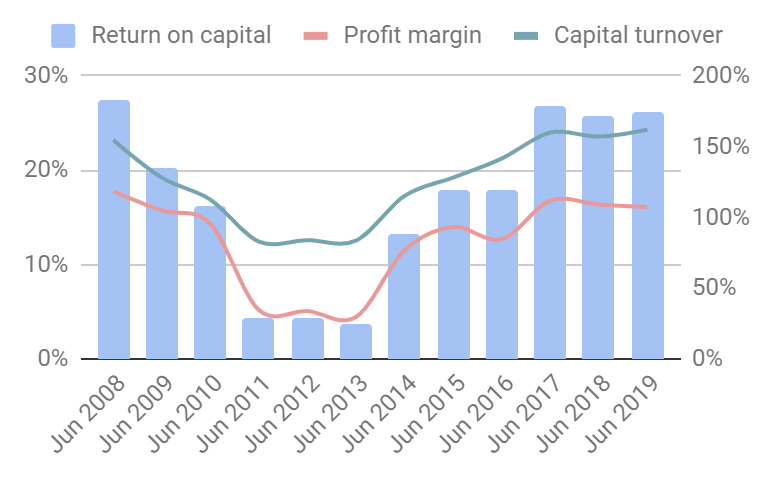

Does Tristel make good money?

Yes. Although the chart shows a dramatic decline in profitability at the beginning of the decade, it was during this period that Tristel’s business model shifted from predominantly supplying disinfectant for washing machines, to its own foams, wipes and sprays. Heavy investment during that period meant cash flow was weak too, but over the last five years cash conversion has averaged nearly 100%.

Score: 2

What could prevent it from growing profitably?

In the short term, Brexit is a threat, principally because Tristel imports chemicals, but also because it exports to Europe. Tristel stockpiles to the rhythm of Brexit deadlines and has moved its Notified Body to Brussels to ensure its products are still CE mark compliant with European health, safety and environmental standards.

One thing to keep an eye on is patent expiries, reportedly from the middle of the next decade.

Score: 2

How will it overcome these challenges?

Trifast describes itself as one of very few companies exclusively focused on infection control, an important but somewhat neglected field. It seems to be doing all the right things to protect its unique position as a supplier of chlorine dioxide-based disinfectants, and its success in introducing them into new markets suggests current investment, for example, in the US, is worthwhile.

Patents are only one element of Tristel’s strategy, and one that it is still actively pursuing. The strategy also incorporates studies validating the products, certifications for use with medical instruments, and regulatory approvals, all of which would be take time and resources for a rival to build up.

Score: 2

Will we all benefit?

This article almost wrote itself because Tristel explains the business so well. It awards share options to all staff, but I cannot reconcile myself to the much more generous share options awarded to the directors under Tristel’s so-called long-term incentive plan and described in more detail last year.

In brief, the sums involved are high, at least shares worth £2.5 million for the chief executive if the company sustains a share price above 500p for three months before June 2021 and lesser awards for lesser performance, there is no requirement to hold the shares beyond June 2021, and the target is inappropriate.

The share price does not just reflect the performance of the company, it also is a measure of our expectations, which the company helps to set, and may not come to pass.

Tristel is reviewing long-term incentives, “in the light of developments in both best and market practice”. I am not a big fan of best practice when it comes to incentive plans, let alone market practice, but we may see an improvement.

One small step forward: The company had previously awarded share options to non-executives responsible for approving the company’s remuneration, creating a potential conflict of interest. This will not happen in future. A second potential conflict of interest, that Tristel buys packaging from a firm run by the chair of the remuneration committee, has yet to be addressed.

Score: 1

Are the shares cheap?

Sadly not. A share price of 325p values the enterprise at 34 times adjusted profit. The earnings yield is just 3%.

Score: -1.6

Tristel scores 5.4 out of 10. To put that in perspective, I generally consider shares scoring seven or more to be attractive for long-term investment at the current price and shares scoring five or less to be unattractive. Companies like Tristel trapped in-between are in a buffer zone. As a shareholder, I am in no hurry to sell. Were I not a shareholder, I would be in no hurry to buy.

Richard owns shares in Tristel.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.