OneFamily is new home for Share Centre LISA accounts

interactive investor announces transfer of administration and management of 1,500 Lifetime ISA accounts.

13th May 2021 11:31

by Jemma Jackson from interactive investor

interactive investor announces transfer of administration and management of 1,500 Lifetime ISA accounts.

interactive investor, the UK’s second largest direct-to-consumer investment platform and number one flat-fee provider, will transfer the administration and management of 1,500 Lifetime ISA (LISA) accounts previously held on The Share Centre to OneFamily, for an undisclosed sum.

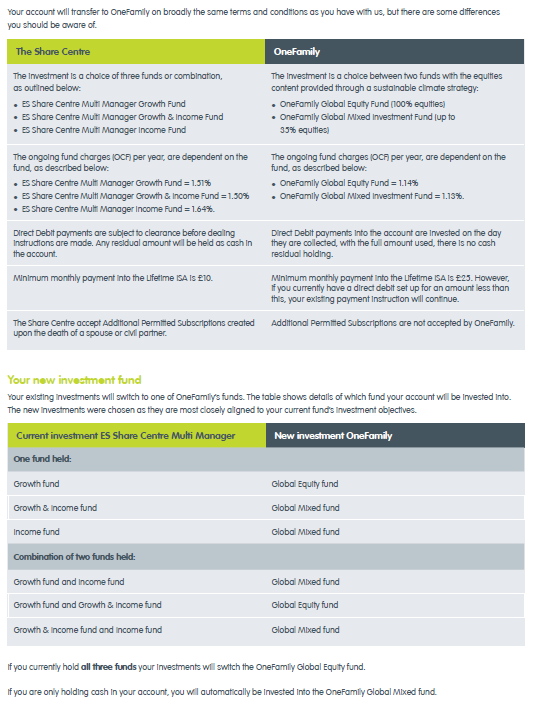

The move follows interactive investor’s acquisition of The Share Centre in July 2020. The ongoing charges in the OneFamily funds are approximately 0.4% lower than The Share Centre Lifetime ISA funds, based on current charges.

OneFamily has over 40 years’ experience in helping customers save for the future, over two million accounts and manages over £7 billion worth of customer money. Key information for customers can be viewed here.

The transfer, effective from 3 July 2021, will enable interactive investor, which does not offer LISAs, to focus on further enhancing its core offerings of trading accounts, SIPPs, ISAs and Junior ISAs (JISAs are free to existing customers), original content and impartial investment ideas, delivered through a best-in-class technology platform.

The move also follows interactive investor’s March 2021 announcement that stakeholder Child Trust Funds (CTFs) and Protected ISAs previously held on The Share Centre platform would be transferred to OneFamily.

Richard Wilson, CEO of interactive investor, says: “We believe we have found a good home for The Share Centre LISA accounts and these customers will be best served by a specialist provider. Those who want to transfer to a different provider can do so without penalty.

“The transfer will allow us to continue to focus on enhancing our core offerings. We remain concentrated on building a best-in-class customer experience, that is unrivalled in value and a trusted source of impartial information.”

Customers who would prefer to transfer to another LISA provider instead can do so and will have to arrange this through their new provider. The Share Centre will need to have received a customer’s instructions by 18 June 2021.

Paul Bridgwater, OneFamily’s Head of Investments, says: “We’re pleased to have been chosen by interactive investor as the new home for The Share Centre’s Lifetime ISAs in the industry’s first ever bulk transfer of Lifetime ISA accounts. We have a strong heritage of partnering with other organisations to support investment propositions and are always looking for opportunities to help partners in this area.

“As we welcome our new customers, we’re going to let them know that we’re here to support them as they plan for their futures – whether that’s in saving for their first home or for their retirement. The added bonus in switching to OneFamily is that as they continue to build up their savings with us, they are also going to be looking after the planet with our climate-friendly funds.”

The Share Centre’s LISA customers can visit https://www.share.com/lisa for more information on how this decision may affect them.

See notes to editors for more information on the key changes.

Notes to editors

About OneFamily

We want to empower modern families through their financial lives.

We believe that finance isn’t just personal. Every decision you make affects the people you care about most. That’s why we believe in creating products for modern families. OneFamily is a customer-owned financial services company that offers lifetime ISAs, lifetime mortgages, junior ISAs, child trust funds, bonds and over 50s life cover. We are committed to enabling families to work together to meet the financial demands of modern life.

We have 40 years’ experience of being a trusted provider of financial solutions, with 2.6 million customers and 7.4 billion in funds under management.

OneFamily Foundation

The OneFamily Foundation was set up to benefit OneFamily customers, their families and the communities in which they live and work. OneFamily is owned by its customers, rather than shareholders, which means it focuses on offering added value for customers instead of running the business to pay dividends to shareholders. The Foundation has awarded £4 million since 2015 through its personal and community-based funding initiatives.

OneFamily customers can apply for a Young Persons Education Grant of up to £500 which are awarded monthly, to help them or someone, aged 15-19, they care about. They can be used for study materials, to travel costs or a new laptop.

Alternatively, OneFamily customers can nominate a project close to their heart for a Community Grant of up to £2,500. These awards have helped communities to fund projects including the renovation of swimming pools, parks and supporting dementia charities.

www.onefamily.com/your-foundation/

More information about the changes

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.