Please remember, investment value can go up or down and you could get back less than you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling.

Get £100 of free trades

Enjoy £100 towards your trading fees when you open an ii Trading Account. That’s up to 25 free trades to kick-start your year.

Offer ends 28 February 2026. New customers only. Terms and fees apply.

What is a general investment account?

A general investment account (GIA) is a flexible way of investing as they can provide uncapped investment options. You can trade UK and international shares, funds, investment trusts, ETFs, bonds and more.

There are no limits on how much you can invest in a general investment account, so they may be suitable for people who have used up their ISA annual allowance.

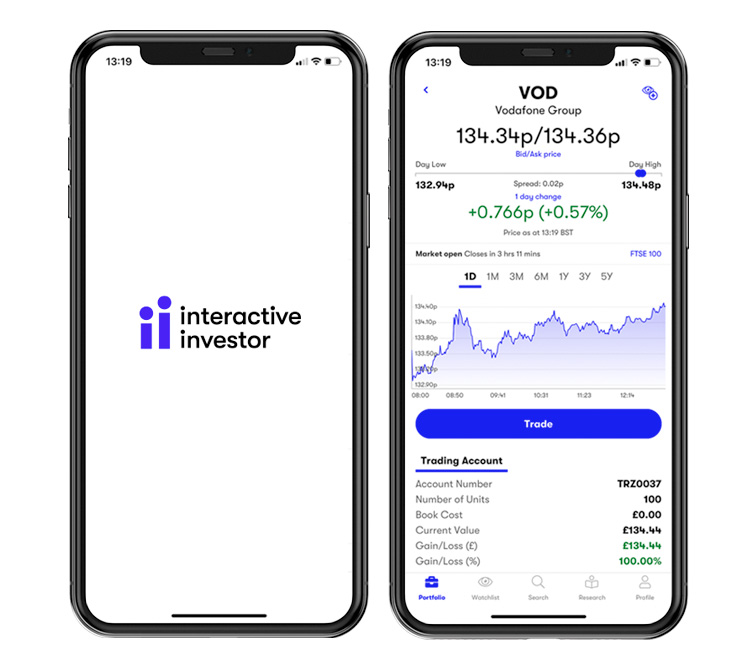

The ii Trading Account could be ideal for you if you are looking to open a general investment account. You’ll have access to one of the widest range of investment options in the market for a low, flat monthly fee.

Why choose an ii Trading Account?

- Low, flat fees - could save you money and help you achieve your goals sooner.

- More opportunities - choose from one of the widest range of investments on the market.

- You're in control - check on your investments any time, anywhere with our secure mobile app.

- We've got your back - our UK-based team is rated 'excellent' on Trustpilot.

- Learn from the best - impartial information from our analysts, including selected funds, ready-made portfolios and our award-winning newsletters.

*We've crunched the numbers: If you invested in both our Trading Account (General Investment Account) and ISA, after 30 years you could be better off by £45k. That's more than £1,000 difference a year, just for using us over another platform. Lots of things can affect your final figure. But the lower the fees, the more money you'll keep for yourself. This is just for illustration if all other factors were the same. Don't just take our word for it: check our working out here.

Can I transfer an existing general investment account to ii?

You can transfer an existing general investment account to an ii Trading Account. You will need to have opened a Trading Account before you can start your transfer.

Also, if you want to benefit from having a Stocks and Shares ISA and a Junior ISA included for no extra monthly cost.

You can either choose to transfer your existing investments (“in-specie” transfer) or to transfer in cash.

How much can I invest in a general investment account?

A general investment account is especially useful if you have used up your ISA and pensions allowances as there is no limit to the amount you can invest.

In contrast, the annual allowance for ISA contributions is £20,000. There is also an annual allowance for pension contributions which is dependent on your income.

Do I pay tax on dividends or gains in my general investment account?

Yes, dividends and investment gains are liable for tax in a trading account or a general investment account.

You have tax-free annual allowances for income earned from dividends and investment gains. The dividends and investment gains you earn from general investing count towards these allowances. Any money over the allowance is taxed.

In contrast, money you earn from dividends and investment gains in an ISA or a pension is tax-free and does not count towards the allowance.

Currently, you can earn £500 in tax-free dividend income in a tax year. Any dividend income over £500 is taxed depending on your tax-rate. Basic rate taxpayers pay 8.75%, higher rate taxpayers pay 33.75% and additional rate taxpayers pay 39.35%.

Investment gains in general investment accounts are subject to Capital Gains Tax. Each year, you can make £3,000 of profit on your investments without paying tax. For any gains you make over £3,000 in a tax year, you will pay 10% tax if you are a basic rate taxpayer and 20% tax if you are a higher rate taxpayer.

General investment account vs Stocks and Shares ISA

You can invest in a wide range of investment options in both general investment accounts and Stocks and Shares ISAs. The main difference between the two is that ISAs are tax-efficient, but general investment accounts don’t have limits on how much you can invest.

Stocks and Shares ISA benefits:

- Invest up to £20,000 per tax year

- Pay no tax on investment profit, interest and dividend income

- Does not have to be declared on your tax return

General investing benefits:

- No limits on how much you can invest

- You may have to pay tax on investment profit, interest and dividend income

For a deeper dive into the differences, read GIA vs ISA: How should you invest?

Can I open a joint general investment account?

You can open an ii Joint Trading Account if you are looking to open a joint general investment account. Our Joint Trading Account allows you to trade our full range of investment options, including shares, funds, investment trusts and ETFs.

Please note: a joint trading account is only available on our Plus plan.

General investing FAQs

Get started with your Trading Account

We provide one of the widest choice of investments in the market – as well as some ready-made options to get you started.