Pockets of potential: fund experts find reasons for optimism in global markets

Amid the pandemic peril, our panel see salvation in a cash injection and share their forecasts for the f…

23rd July 2020 09:33

by Jim Levi from interactive investor

Amid the pandemic peril, our panel see salvation in a cash injection and share their forecasts for the future.

Wall Street is always a key barometer. Like a rising tide, it can raise all other markets; but like a falling tide, it can leave them stranded as well.

Lately, its performance has been extraordinary. The real world appears to be going to hell in the proverbial handcart – in the US the coronavirus has sent the economy into a tailspin, while two completely unsuitable candidates battle it out to be president – yet Wall Street seems to move blithely on, dragging other key global markets along the recovery road.

What do our panel make of it all? As usual, opinion is divided. No one has changed their scores on US equities since our previous review. The most sceptical is Rob Burdett at BMO, who stays underweight: “Hugely overvalued, and more and more concentrated on technology stocks,” he warns.

Certainly, Apple and Microsoft between them now constitute roughly 12% of the value of the S&P 500, while the Russell 1000 Growth index now consists of about 45% technology stocks – double what it was four years ago. Burdett also notes that Polar Capital, one of the best-known technology investment houses, ‘soft-closed’ its open-ended technology fund recently. “Apparently it was worried about the money flowing into the fund – almost like turkeys voting for Christmas,” he says.

Burdett suspects equity investing should lean more towards value rather than growth stocks from now on. He says: “We think the economy could be so bad that almost has to happen.”

Three panel members – Richard Dunbar, Monique Wong and Keith Wade – all maintain overweight positions in the US. Wong at Coutts says we should hardly be surprised by the technology-led nature of the Wall Street rally. “We all know how technology has facilitated our lockdown life,” she says.

Dunbar at Standard Life Aberdeen agrees with Burdett on “the intense debate now going on over value versus growth” among fund managers. But he scores a 7 for the US: “I think the mix of larger, high-quality US companies on offer is sensible going forward,” he says. “The US remains one of the most dynamic economies, with a big capital market, a mobile labour force and better demographics than Europe.”

The panel believes the apparent disconnect between financial markets and the real world is explained by three key factors:

• the prospect of a prolonged period of very low interest rates

• continued high levels of government spending to stimulate global recovery (the UK recently had another dollop from the chancellor, Rishi Sunak)

• a growing conviction that a vaccine and more effective treatments for the virus are closer to being realised.

Wong reminds us of a bit of history she now feels is relevant. “In the 1940s, the US Federal Reserve introduced something called yield curve control. It held interest rates low for nine years, and in that time Wall Street quintupled in value.”

Room for optimism

Is history about to repeat itself? Wong thinks it might. Governments around the world have provided a $20 trillion (£15 trillion) stimulus, either directly or via central banks, she says. “All this helps explains the recent rise in equities.”

Now Coutts has adopted a neutral position on equities. “At these levels, markets are vulnerable to consolidation, though I do not see them going back to the levels we saw in March,” she adds. “We remain cautiously optimistic, and I think markets are more likely to be up than down over the next 12 to 18 months.”

Chris Wyllie at Connor Broadley stresses the big impact the race for a vaccine has had on the recent rally. “I am sure that is why the mood has changed,” he says. “We were going into this relapse in March when the consensus was that we were at least a year away from any kind of vaccine and that we might never get one. Now we have more than 100 vaccines at various stages of development. That is what has changed. A vaccine is the real game-changer.”

There has been much use of the alphabet to describe what any post-virus economic recovery might look like: a V-shape, a U-shape, a W-shape or even a grim L-shape. Keith Wade at Schroders has his own take on what he thinks it will look like. He says: “I think a square root sign best describes what is likely to happen. We get a nice tick upwards, reflecting a good recovery in the third quarter of 2020, then things go a bit flat after that as any pent-up demand tapers off.”

He fears that a second wave of Covid-19 infection as we approach winter will sap confidence. “It is quite hard to see businesses being confident enough to go out and invest. Equally, consumers may hesitate to buy big-ticket items. Meanwhile, governments may come under pressure to rein back their fiscal support.”

Corporate bonds have emerged as the panel’s favourite investment sector, so we have a rare occasion when they are all singing from the same hymn sheet.

Corporate bonds have qualities of both equities and fixed income, effectively providing an each-way bet on recovery or the dreaded alternative of deep recession. The worldwide relapse in markets in March created a buying opportunity in the sector that all but Wade took advantage of. Now Wade has joined the pack, raising his score from 3 to 8. As well as providing attractive yields, corporate bonds offer the additional security that central banks are ‘price-insensitive’ buyers of some bonds.

Burdett is also a recent convert to corporate bonds. “We did not hold any, but in March they fell sharply along with equities – and it was a bit like throwing out the baby with the bath water, as yields shot up from 2% to as much as 6%.” As a multi-manager, he holds the Schroders Select Corporate Bond fund, which saw a near-20% uplift in the second quarter.

Equity outlook mixed

Among global fund managers, UK equities remain out of favour. The prospect of a no-deal Brexit does not please them, nor does the clear evidence of incompetence in the UK’s handling of the epidemic. The panel is divided: Wade and Aberdeen Standard Investments’ Richard Dunbar are going underweight, while Burdett and Wyllie think our domestic market looks good value.

Wyllie says: “UK equities are still at levels they fell to in 2016. If a better outlook materialises, there is still a lot to play for.”

Japanese equities had a good second quarter, so good that Burdett – the panel’s biggest Japan fan – is taking some profit and lowering his score from 8 to 7. In contrast, Wong is raising her score from 5 to 6. “The yen is a quality currency in which to hold financial assets at a time like this,” she says. Wade has decided to cut his score from 5 to 4, and move more money into Europe and emerging markets.

Indeed, European equities have moved back into favour with the panel. Burdett, Wade and Wong have all raised their scores, and none of the panellists is underweight. Wade says: “We have added to our exposure in response to the policy response to the virus we are seeing in the EU – including, effectively, a mutualisation of debt within the eurozone through the €750 million European Recovery Fund.”

Government bonds have fallen out of favour again with some panellists. Dunbar, Wade and Wyllie have all cut their scores for UK bonds after defensive moves into this sector last time. But in global bonds, a cautious Burdett keeps his score at 7. “I think we are not quite as optimistic about equity markets as some, and we are underweight overall in equities, while keeping our cash levels and bond holdings high,” he says.

The property sector now faces many challenges. Wong says: “ The virus has accelerated a trend we had before. While logistics and distribution areas have done well, there are now question marks over offices and retail.”

Dunbar prefers to stay underweight in the sector. “While there are opportunities in so-called Amazon sheds and data centres, these are often quite expensive,” he says.

Burdett has been cutting his property score by one notch every quarter since November last year, and he is now down to 2. “Almost all direct property funds are suspended and there have not been many transactions lately,” he says.

Wade concurs with his gloomy outlook. “If you do want to trade, you will not get very good prices,” he says. “Is it too late to sell? Probably. So I leave my score at 5, although the sector faces enormous challenges, made worse by the virus.”

Wyllie is the dissenting voice: “Property looks cheap. Everyone may be working from home, butI think in three months’ time that will seem like a cliché. If we get a vaccine, everyone will want to be back in the office.”

All eyes are on gold and oil in the commodities sector. Gold remains an obvious attraction in an era of low interest rates when ballooning government deficits threaten to debase paper currencies. Meanwhile, supply and demand for oil is moving into balance after a turbulent period. The result has been a dramatic recovery in the oil price.

Four of the five panellists have put extra funds into commodities, hoping that a revival in the global economy will boost other commodity prices as well. “The oil market is normalising,” says Burdett. “A combination of some global recovery led by governments’ spending means commodities ought to do well.” He has pushed his score up from 7 to 8.

Asia-Pacific promise

The US’s basketful of troubles – pandemic, race riots, trade war and Trump, to mention the most obvious – have prompted speculation that the dollar might be in for a tumble. That is one reason why interest in emerging markets has intensified. A weaker dollar helps boost their economic activity. Another support, for Asia-Pacific markets at least, has been the relative success some emerging market countries have had in dealing with the pandemic. A third is the strong rally in some Asian markets, particularly China, where the Shanghai index has made a spectacular recovery, helped by government support.

Four of the five panel members have boosted their scores for emerging markets. Burdett again shows his enthusiasm with a score of 8. He stresses that the emerging markets of Asia make up 60% of the value of this sector, and that figure may well increase. “Many of these countries are no longer emerging,” he says. “They look well-placed to benefit from any global recovery and have the benefit of having handled the pandemic well.”

For Dunbar, emerging markets along with Japan provide a cyclical element in a portfolio mix designed to be slightly overweight in equities. “Like Rob Burdett, our focus is on Asia, where countries were first into the pandemic and look like being the first out of it,” he says.

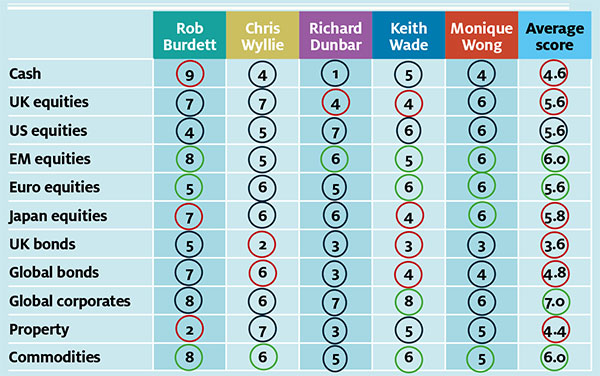

Scorecard: merit in emerging markets

Note: The scorecard is a snapshot of views for the third quarter of 2020. How the panellists’ views have changed since the second quarter of 2020: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader. BMO has £187 billion in assets under management.

Chris Wyllie is chief investment officer at Connor Broadley, a financial planning and investment management firm with £400 million under management.

Richard Dunbar is deputy head of global strategy at Aberdeen Standard Investments, which has some £610 billion in client assets under management.

Keith Wade is the chief economist and strategist at Schroders. The asset management company has around £400 billion in assets under management.

Monique Wong is a multi-asset investment manager at Coutts, the private arm subsidiary of RBS bank, which has some £17 billion of assets under management.

Time to extend warm thanks to our perspicacious panellists

it seems appropriate – as this is the last asset allocation review for Money Observer – to thank our panel of five fund managers, who have reviewed the prospects for financial markets every three months for the past 10 years.

I would particularly highlight the contributions of Keith Wade at Schroders, and Richard Dunbar and his predecessor Michael Turner at Standard Life, who have been panel members since I began writing this series 10 years ago. However, the other three members – Rob Burdett at BMO, Chris Wyllie at Connor Broadley and Monique Wong and her predecessor Alan Higgins at Coutts – have all been contributing for some years as well.

Forecasting the future – even just three months ahead – is a bit of a mug’s game. But that is what wealth managers have to do. Their reputations are always on the line; and although they are well-paid for their efforts, they cannot always react swiftly to sudden changes in volatile markets.

Our panellists’ skills in forecasting have been tested to the limit during the past few months of unprecedented turbulence. Each has his or her own approach and style. As you would expect they rarely all agree on strategy. Yet I hope they have provided helpful guidance for investors trying to tailor their funds and portfolios to achieve the balance between security, growth and income that suits them best.

The good news is that this series will continue on the website of Money Observer’s parent company interactive investor.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.