Popular technology trust explains sell-off and opportunities

Frequently among the most-bought investment trusts on the ii platform, this portfolio manager shares his insight on the past few months. There’s also a history lesson here.

8th August 2024 15:57

by Graeme Evans from interactive investor

Benchmark-beating results today allowed Allianz Technology Trust Ord (LSE:ATT) to put the volatile week for the sector and key holdings such as NVIDIA Corp (NASDAQ:NVDA) under a longer-term gaze.

Alongside a 28% half-year rise in net asset value (NAV), lead portfolio manager Mike Seidenberg reminded clients that technology remains a key enabler across almost every industry.

He said: “Despite short-term periods of higher volatility among technology stocks, earnings growth ultimately drives stock prices over the long term, and in our view, we are still early in the spending trend supporting this dynamic segment.”

- Invest with ii: Buy Investment Trusts | Top UK Shares | What is a Managed ISA?

Seidenberg believes that the technology sector continues to provide some of the best absolute and relative return opportunities in equity markets – “particularly for bottom-up stock pickers with proven long-term selection capabilities”.

On recent earnings, he said most have been constructive but that several “cross-currents” have arisen due to concerns about the timing of benefits from some of the emerging technologies.

He said: “Areas like semiconductors and hardware deemed as more direct plays on the AI trade were among the recent outperformers, but there have been growing questions whether enthusiasm may have eclipsed near-term fundamentals.

“Meanwhile, software and IT services lagged due to their muted guidance and interest-rate sensitivity, as expectations for Federal Reserve rate cuts in 2024 have been lowered notably throughout the year.”

- Top tech investor: ‘Big Five’ stock concentration risk is justified

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Allianz Tech Trust video: how I find tech winners and a UK share bought ahead of takeover offer

Seidenberg pointed out that the recent reporting quarter is seasonally slow for software and IT services due to technology spending cycles which favour the back half of the year.

“We saw a similar pattern of a slow relative start compared to broader technology peers in early 2023, which reversed course in the second half of the year.”

The biggest contributors to the trust’s first-half outperformance, compared with the 27% growth of the Dow Jones World Technology Index, came from above-benchmark exposure to semiconductors and being underweight to technology hardware.

Successful investments included Micron Technology Inc (NASDAQ:MU) after the provider of memory and related chips posted forecast-beating results and a strong sales forecast.

An active underweight allocation to iPhone and personal computer maker Apple Inc (NASDAQ:AAPL) contributed to the relative result after the shares underperformed technology peers.

And February’s decision to end exposure to chip maker Intel Corp (NASDAQ:INTC) also looks well timed after last week’s dividend suspension and downgraded second-half guidance. The largest of its new investments was February’s building of a stake in Dutch semiconductor supplier ASML Holding NV (EURONEXT:ASML).

- Nvidia share crash: second bite of the cherry or red flag?

- Allianz Technology Trust video: why we’re underweight biggest tech stocks

Nvidia, which accounted for 12.1% of the trust’s portfolio at the end of June, has lost more than a fifth of its value since shares traded at $135 a month ago as sentiment towards crowded long tech trades became increasingly shaky.

The chipmaker’s surge from a $2 trillion valuation to June’s $3 trillion took place in just 30 trading days, fuelling concerns about Wall Street’s over-reliance on just a handful of stocks.

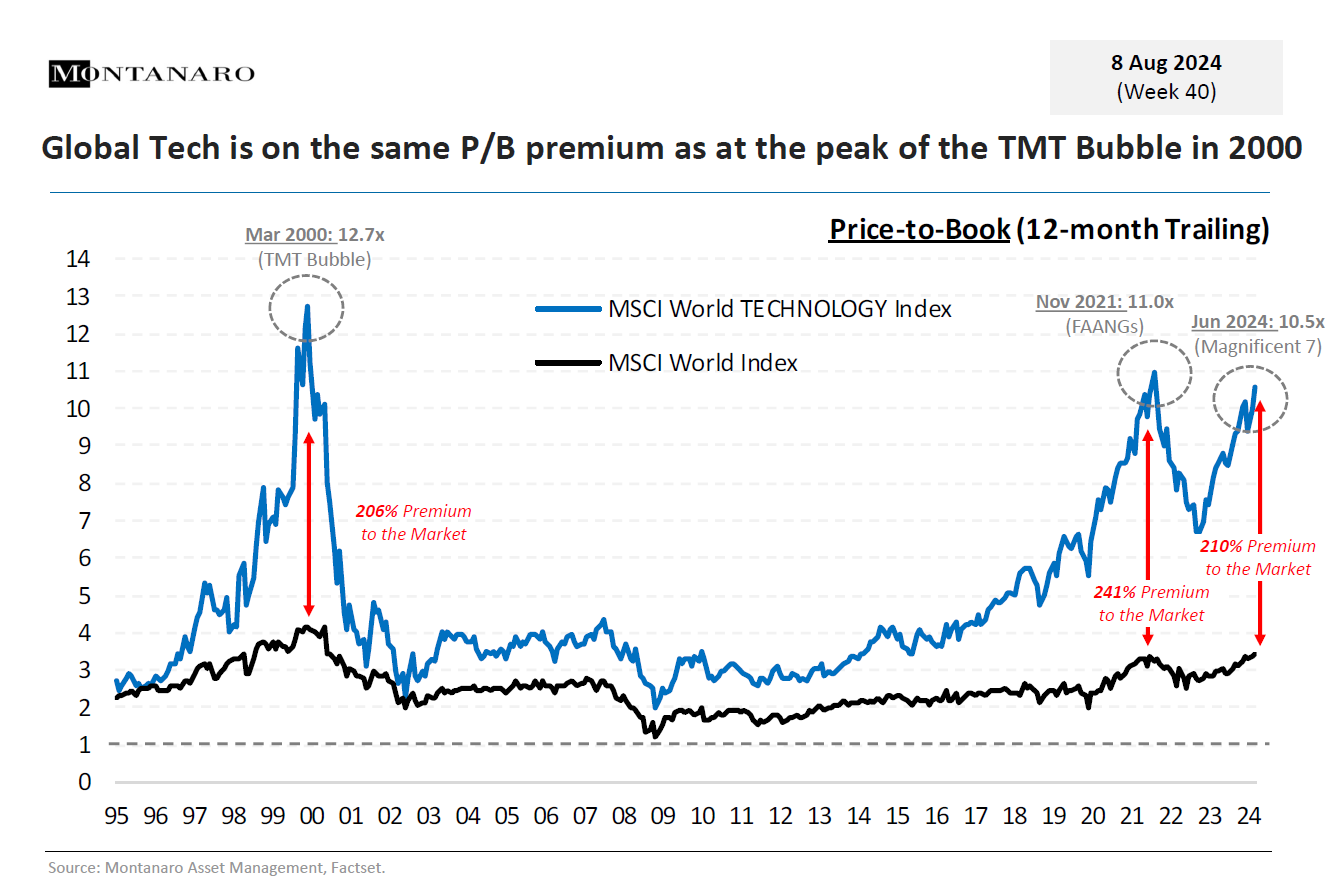

The bubble fears were highlighted today in a chart published by fund manager Montanaro, which showed the MSCI World Technology Index on a similar trailing price-to-book ratio as in the dotcom boom in 2000.

UBS Global Wealth Management believes that technical factors were part of this week’s story, with the rapid unwinding of crowded global consensus trades exacerbated by illiquid August market conditions.

It said the new market set-up is reminiscent of past periods of tech outperformance. “Looking back through 2015, bouts of Nasdaq index volatility that resulted in 10% mid-cycle corrections were historically followed by big gains in the six months following the trough.”

UBS sees parallels with the near 15% correction for tech in the third quarter of 2011.

It said: “Back then, US macroeconomic and debt concerns were flaring up, second-quarter earnings were mixed, and USD-JPY was strengthening. This correction gave way to a 10-year run of structural outperformance for tech that really only ended in the fourth quarter of 2021.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.