A profit machine to buy and a tempting recovery play

3rd August 2022 07:50

by Rodney Hobson from interactive investor

These four companies made a total profit of $25 billion between them in just one three-month period this year. Our overseas investing expert tells us which ones he’d buy now.

Crude oil prices have quadrupled since fears over the pandemic and its possible effect on the global economy sent them plunging to a low point in April 2020, good news for oil and gas producers but bad for carmakers whose customers are feeling the squeeze.

That surge has levelled off in the first half of this year, but prices are persisting around or just below $100 a barrel as production remains constrained and demand has held up better than expected.

Because so many costs in the oil and gas sector, from exploration to processing to the forecourts, are fixed, almost every dollar on the price of crude runs through to the bottom line. However, this is not a sector for those averse to risk, as any fall in crude prices correspondingly knocks a massive hole in profits.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Although key oil price indices have continued to hold up so far in the third quarter, it is extremely difficult to make forecasts given that prices tend to swing widely once they start to move. The best guess is that they will remain reasonably steady for the rest of the quarter but the best or worst (depending on your point of view) of the latest upward surge is over for now.

Higher oil prices have certainly worked wonders for Chevron Corp (NYSE:CVX), with the oil major enjoying a bumper second quarter. Revenue for the three months to 30 June leaped a remarkable 83% to $68.76 billion, but it was the bottom line that really caught the eye, with net income of $11.72 billion nearly four times the same quarter last year.

Unsurprisingly, the upstream operations (exploration and production) among the oil and gas wells felt the benefit, as the average sales price of crude oil and liquid natural gas rose from $54 a barrel a year ago to $89 for the US arm, and from $62 to $102 in the international arm.

Yet a doubling of upsteam profits was easily beaten by the stellar performance downstream (refining, processing, marketing and distribution) as higher margins on sales of refined products sent earnings from this side of the business soaring from $839 million to $3.52 billion despite higher operating costs.

Chevron was thus able to strengthen its balance sheet by reducing debt, while at the same time announcing plans to step up the level of share buybacks.

- Scottish Mortgage stars in best July for Wall Street since Great Depression

- Growth stocks fight back: is it time to buy?

Chevron shares surged when crude prices started to move upwards in the second half of last year, but they are off the May high of $178. At $159, the price/earnings (PE) ratio is undemanding at 10.9 while the yield of 3.37% is attractive

Source: interactive investor. Past performance is not a guide to future performance.

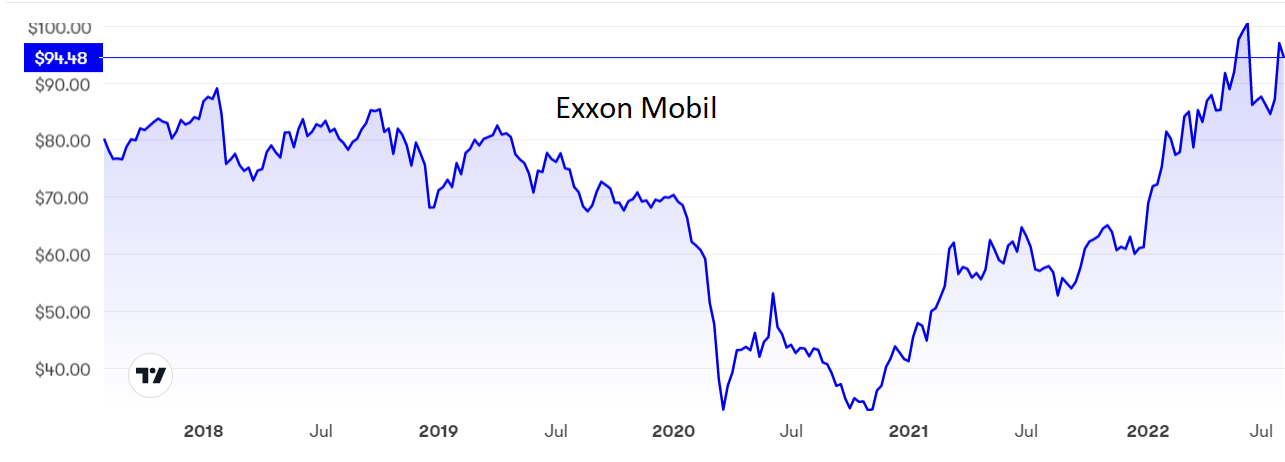

Exxon Mobil Corp (NYSE:XOM) followed a similar pattern, with revenue almost doubling to $115.68 billion and net income nearly four times as high at $17.85 billion. Exxon did, however, do much better upstream than Chevron, with earnings in this area more than tripling to $11.37 billion, even though production edged up only 4.2%.

The shares have doubled over the past two years but at $94 they are still not much above their level at the start of 2018. The PE is more demanding than Chevron’s at 16.06 and the yield is similar at 3.62%.

Source: interactive investor. Past performance is not a guide to future performance.

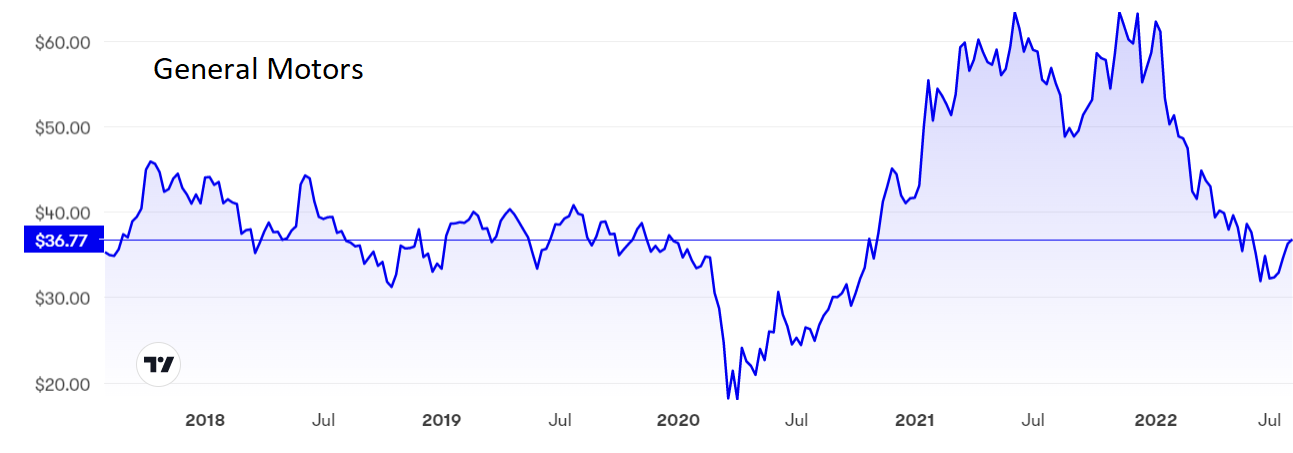

We cannot say we had no warning that General Motors Co (NYSE:GM) was struggling in the second quarter. The vehicle maker told us a month ago that US car sales were down 15% as disruptions to supply chains, particularly for computer chips, were still playing havoc. Sales in China, affected by political issues, had slumped 36%.

Now we learn that while revenue for the three months to 30 June rose slightly, net income was 40% adrift at $1.69 billion.

However, GM is confident that the worst is over and that production and deliveries to forecourts will bounce back in the second half. There is no guarantee that another unexpected setback will be avoided, but this confidence does look to be fully merited and ground lost in the first half will probably be fully made up by year end. There are nearly 100,000 partly-built vehicles waiting for components that should turn up soon, and there is plenty of pent-up demand among drivers.

The shares are currently down around $36 after baulking at $63 on three separate occasions last year. Investors looking for income should remember there is no dividend and, after the traumas of the past couple of years, there is unlikely to be one any time soon.

Source: interactive investor. Past performance is not a guide to future performance.

Like GM, Ford Motor Co (NYSE:F) also affirmed its full-year guidance, but its figures were received far better in the stock market as revenue topped analysts’ forecasts, leaping 50% to $40.19 billion. Pre-tax profits were up 7.6% to $791 million despite a hefty loss on Ford’s investment in electric vehicle firm Rivian.

Ford had already alerted the market to a 2% rise in the number of vehicles sold, in contrast with struggling rivals, despite being equally subject to supply constraints. It has also cashed in on strong demand by raising prices and pushing sales of larger vehicles. All the sales growth came in June and could well carry over into the third quarter.

Ford shares slumped from $25 to $11 in the first half of this year but are picking up again at $15, where the PE is only 5.3. At least there is a dividend, even if the yield is quite low at 1.96%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Chevron looks to be a ‘buy’, certainly as long as oil prices hold up, although it is not for the nervous investor. Existing shareholders should hold on and await developments. Exxon shares were $88 when I rated the sector a buy at the beginning of May and, while they look less attractive at this stage than Chevron’s, they are still worth a ‘hold’ rating.

I rated GM a sell at $55.50 last November and the shares have slumped since then to stand at $36, back below pre-pandemic levels and giving a PE of only 7. Enough bad news is now in the share price and at current levels this is a ‘buy’ for those willing to take a risk.

I suggested taking profits in Ford at $18 in November and, although there was a chance to sell at a higher level, that advice has on balance subsequently proved correct. The best chance to buy back in has now gone but it is not too late to make a purchase.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.