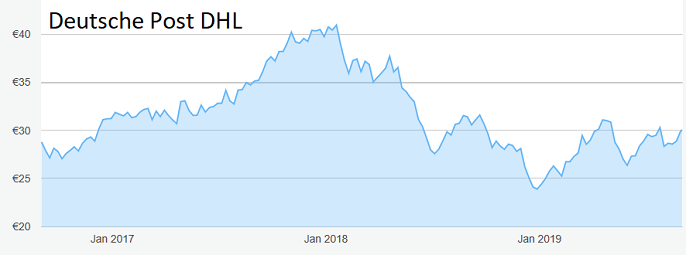

Progress not reflected in this postie's share price

This industry giant is making big money, overcoming weaknesses and expects to make even more in 2020.

4th September 2019 10:22

by Rodney Hobson from interactive investor

This industry giant is making big money, overcoming weaknesses and expects to make even more in 2020.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

One of the world's leading mail and logistics company is growing profits. Investing for the future and reorganising the less profitable part of the business. This progress is not reflected in the share price.

With all divisions and all regions contributing to growth, Deutsche Post DHL (XETRA:DPW) reported group revenue up 3% to €15.5 billion in the second quarter of 2019, with operating profit 2.9% ahead at €769 million.

Chief executive Frank Appel edged up forecasts for the full year and added:

"We expect earnings to further improve in the second half of the year - despite the challenging macroeconomic environment."

There are five divisions but essentially the business splits into the two parts reflected in the name of the group: the post and parcels operations in Germany and the international DHL logistics side. All parts and all regions made a positive contribution in the second quarter.

Crucially, delivery of post and parcels in Germany turned positive again after five consecutive disappointing quarters. On the downside, profits were held back by restructuring expenses in the Supply Chain and eCommerce Solutions divisions.

Earnings in the first half fell just short of half the total target for the full year. That is better than it sounds, for like all postal services Deutsch Post does best in the final quarter when Christmas boosts letter and parcel volumes. Parcels and goods sent via DHL also boom in the festive season.

Source: interactive investor Past performance is not guide to future performance

Appel says the business developed as planned in the second quarter and he believes that measures initiated to improve productivity at Post & Parcels, plus a postage rate increase introduced on July 1, will provide further momentum in the second half. This division saw second quarter revenue rise 1.5% compared with the same period last year, thanks to rising volumes and an increase in average revenue per parcel. This is crucial: like postal services around the world, Deutsche Post needs to boost parcel revenue as letters continue to spiral downwards, replaced by telephony, faxes and emails.

For the current financial year, he expects group operating profit to be between €4 and €4.3 billion, which marks an increase at the bottom end from the previous guidance of €3.9-4-3 billion. That is admittedly a modest upgrade but at least it is a move in the right direction. It reflects the better scenario in post and parcels. Appel has also confirmed that the forecast for €5 billion next year still stands, with most of the improvement coming in Post & Parcels.

Deutsche Post DHL continues to make heavy but necessary targeted investments in its core businesses to strengthen the foundations for long-term profitable growth. The company invested a total of €1.3 billion across all divisions from April to June, more than double the figure in the previous second quarter. This strong increase resulted particularly from renewing DHL's fleet of aircraft. So far, the first two of 14 new Boeing 777 freight aircraft have been commissioned and two more follow before the year is out.

This significantly increased capital expenditure is naturally affecting free cash flow, which was negative in the second quarter and probably will be for the full year, but it is money that will bring rewards in future years.

The shares have pretty much moved sideways over the past five years to stand at just over €30, where the yield is 3.85%, although they have been as low as €20 in early 2016 and they topped €40 briefly at the start of 2018. So far this year they have moved erratically between €24 and €31. If they can break through the ceiling around the €31 level they could zoom back up to €40.

Hobson's Choice: Buy at up to €32.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.