Record inheritance tax grab: how to minimise your bill

25th August 2021 08:49

by Katie Binns from interactive investor

As the amount of ‘death tax’ paid reaches a new record high, we explain how it works and outline ways to cut your estate’s obligation.

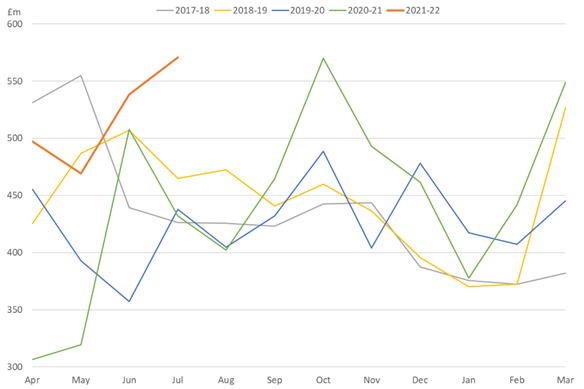

Britons paid an astounding £571 million in inheritance tax (IHT) in July, the most ever paid in a single month, the Office for National Statistics has revealed.

Between April and July this year, a weighty £2.1 billion in IHT was handed over by the estates of the deceased.

Experts believe this is a result of the rise in deaths owing to Covid, plus the government’s decision to freeze the level at which we start paying tax that has consequently drawn more estates into its tax net as property and share prices have soared.

Monthly inheritance tax receipts since the 2017-18 financial year

Source: Office for National Statistics

It is out of your estate - your property, savings, investments, other assets and gifts you give away in the seven years leading up to your death - that inheritance tax is paid, after any debts have been cleared.

- Mind & Money: we need to talk about inheritance

- AIM ISAs explained

- AIM stocks for an inheritance tax ISA in 2021

The government gives everyone a tax-free limit, known as the nil-rate band, which is currently £325,000, with the bonus of no tax being charged on assets left to spouses or civil partners. If your estate is above this amount, the taxman can potentially take 40% as IHT.

The government also gives you another allowance of £175,000 if you leave your home to your children or grandchildren, known as the residence nil-rate band.

This means a person can pass on £500,000 inheritance tax-free. All or part of an unused nil-rate band can be inherited by a spouse or civil partner, so it is doubled to £1 million for couples.

If your estate is worth more than £2 million, the property limit gets chipped away by £1 for every £2 above £2 million. For example, if you leave an estate worth £2.2 million and your £450,000 house to your child, the estate is £200,000 above the £2 million limit.

Under the rules, the residential nil-rate band limit is half of £200,000 (£100,000). So your allowance reduces from £175,000 to £75,000, giving a combined IHT threshold of £400,000 (£325,000 + £75,000). Subtract £400,000 from the £2.2 million estate and £1.8 million could be subject to 40% tax.

Minimising your IHT charge

The proportion of estates paying IHT is under 5%, yet buoyant property prices and the nil-rate band freeze until 2026 mean that figure is rising.

Inheritance planning involves thinking about what you can afford to give away now - and what to leave behind.

- Stocks that fund managers own in their AIM ISA IHT portfolios

- Are you saving enough for retirement? Our calculator can help you find out

To reduce your estate while alive, you could give away up to £3,000 each tax year, bestow wedding gifts (£5,000 to children, £2,500 to a grandchild, £1,000 to others), donate to charities, museums and political parties or pay into a pension (these aren’t subject to IHT). You may need to take advice for a high-worth estate.

Once obligations have been minimised, the crucial thing to consider is what the recipients will do with the money. Planning ahead in this regard is a great idea.

Leaving an inheritance sitting in cash will see its real value steadily erode over time due to inflation. It is therefore paramount that any money not quickly spent is invested to protect and grow it.

A diverse selection of funds and trusts is likely to be the best option, but individual circumstances vary, and you may wish to consult a financial adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.