Renishaw crash puts shares in the 'buy' zone

This highly-rated ambassador for British technology just got cheap enough to get investors interested.

15th October 2019 12:35

by Graeme Evans from interactive investor

This highly-rated ambassador for British technology just got cheap enough to get investors interested.

High-quality stocks rarely come cheap, which is why the slide in valuation at Renishaw (LSE:RSW) after a run of profit warnings is a potentially interesting development for longer-term investors.

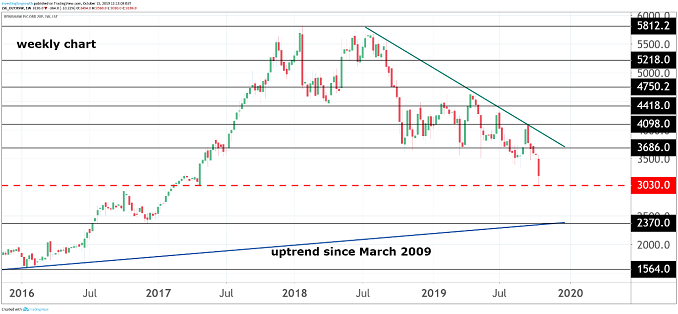

The FTSE 250 stock peaked at 5,820p at the start of 2018 and was still trading on a lofty 34 times adjusted earnings at the end of last month when shares were just under 3,500p.

Its valuation is now closer to 26 times, with the company's shares back to as low as 3,030p and their worst point since April 2017 after falling 15% today in the wake of its fourth profits warning this year. Renishaw continues to feel pressure from toughening Asia Pacific markets, with large orders from consumer electronic product manufacturers not repeated this year.

Source: TradingView Past performance is not a guide to future performance

The company's metrology business, which designs and manufactures the sensors, probes, gauges and software used to automate and calibrate machine tools, control industrial robots, and inspect the components they make, saw sales fall 19% to £119.7 million in the first quarter.

Adjusted profit across the group was £4.3 million compared with £32.6 million last year, which Morgan Stanley said showed margins had fallen from 20% to about 3.3% this year, a decline the bank believes is not being reflected in the current valuation.

Renishaw's high fixed costs mean it is prone to big swings in profitability depending on global economic conditions. But this company is no flash in the pan, having been in the same business for nearly 50 years. It is a world leader in what it does, with a strong commitment to R&D as 17% of its revenues were invested in research and engineering in the last financial year.

Our companies analyst Richard Beddard recently highlighted Renishaw's longer-term qualities in his latest look at the Gloucestershire-based company after the publication of its annual report, in which profits fell 28% to £103.9 million.

Beddard, who owns shares in Renishaw, suggested that a fall in the share price towards £30 would put the stock "back into the buy-zone".

He said:

"A normalised enterprise multiple based on how much profit the company would have earned had it achieved its 13-year average return on capital of 18% is 23 times adjusted profit, which is more reasonable but still not obviously cheap."

Beddard highlighted the value of its intellectual property, and the year end £107 million of cash on the balance sheet - more than a good year's profit - and only £10 million of borrowings.

The question for investors is whether the stock still has further to fall, given that demand is being skewed by multiple factors such as trade frictions, Brexit, and a glut of smartphones.

In today's update, Renishaw said trading conditions were expected to remain challenging throughout this financial year, although it added that "structural demand drivers" in its end-markets were intact.

It added:

"The group is in a strong financial position and remains committed to our long-term strategy of delivering growth through the development and introduction of innovative and patented products."

Renishaw said it will continue to focus on improving productivity and undertaking further initiatives to reduce the group's cost base.

The majority of its 5,000 staff are employed within the UK, where the company carries out most of its research and development. About 94% of sales are generated overseas, however.

It is a world leader in the field of additive manufacturing (also referred to as metal 3D printing), where it is the only UK business that designs and makes industrial machines which 'print' parts from metal powder.

Its roots are in aerospace after Rolls-Royce (LSE:RR.) was unable to find a measuring device with the accuracy it needed for Concorde's instrumentation pipes. The newish chief executive, Will Lee joined as a graduate trainee in 1996, and the company's founders remain on the company's board as executive chairman and deputy chairman.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.