Revealed: 10 best funds in record US bull market

It's the most 'unloved' bull market ever, but these star funds have delivered mouth-watering returns.

15th March 2019 11:24

by Tom Bailey from interactive investor

It's the most 'unloved' bull market in history, but these star funds have delivered mouth-watering returns.

The bull market in US equities is now 10 years old. On 9 March 2009, following the dramatic declines as a result of the global financial crisis, US stocks finally started to climb up again. For the past decade, despite some nasty brief corrections, prices have continued to rise ever higher.

The current bull market is the longest on record, with the average bull market since 1928 being roughly 60 months long. However, despite being the longest, the current bull market is often also seen as the most "unloved" in history.

Over the past decade, the S&P 500 index has seen price growth of 313%. In comparison, the dotcom boom of the 1990s saw the S&P 500 surge by 417%. Average share price growth during the average 60-month bull market since 1928 has been 172%.

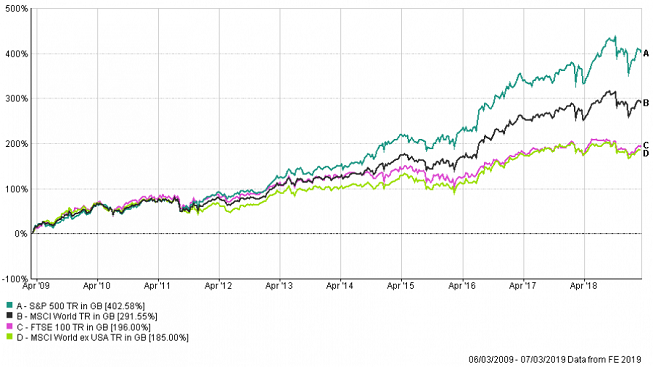

Even so, the US market has undoubtedly been the best place to be for investors over the past decade. As the graph below shows, the total return from the S&P 500 between the start of March 2009 and March 2019 has been 403%. Investors in the UK's FTSE 100 index would have received 196%, less than half of the S&P 500's total return, over the same time period.

Comparing the MSCI World Index with and without the US also shows the importance of US stocks over the past decade. The MSCI World index saw a total return of 292%. If you strip out American stocks (the MSCI World index ex USA), that total return falls to 185%.

Which funds and trusts did best?

Over the past decade a number of active funds have provided returns much higher than the S&P 500's total return. The top-performing fund in the Investment Association's North America sector over the past decade has been Vanguard US Opportunities, with a 10-year total return of 700%.

| Fund | 10-year total return GBP |

|---|---|

| Vanguard US Opportunities | 700.11 |

| Morgan Stanley US Growth | 653.95 |

| T. Rowe Price US Large Cap Growth | 567.23 |

| Baillie Gifford American | 554.05 |

| Morgan Stanley US Advantage | 549.94 |

| Source: FE Analytics |

That is followed by Morgan Stanley US Growth with a total return of 654% and T. Rowe Price US Large Cap Growth with 567%.

When it comes to investment trusts in the AIC's North America and North America smaller companies sectors, results are less impressive. Of the top five, only four have provided total return higher than the S&P 500's 403%, with JPMorgan American (LSE:JAM) returning 381%. At the same time, Middlefield International, Middlefield Canadian Income (LSE:MCT) and Jupiter US Smaller Companies (LSE:JUS) saw returns only marginally higher than S&P 500's.

The performance is even more unremarkable for Jupiter US Smaller Companies when compared to its benchmark, the Russell 2000. An index of US smaller companies, the Russell 2000 provided a total return of 418.9% compared to the trust's 419.9%.

| Investment trust | 10-year total return GBP |

|---|---|

| Harwood Capital North Atlantic Smaller Companies | 638.54 |

| JPM JP Morgan US Smaller Companies | 601.51 |

| Middlefield International Middlefield Canadian Income | 437.11 |

| Jupiter US Smaller Companies | 419.89 |

| JPMorgan American IT | 381.14 |

| Source: FE Analytics |

It should also be noted that many trusts and funds that investors often use to gain exposure to the US are not included, including Scottish Mortgage (LSE:SMT) and Allianz Technology Trust (LSE:ATT). Despite their heavily overweight US portfolios, these trusts and other similar ones are part of either the global or technology sectors.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.