Richard Beddard: this AIM share appears to be unstoppable

This company makes essential consumables that customers buy regularly, but are the shares a ‘buy’?

4th December 2020 15:17

by Richard Beddard from interactive investor

This company makes essential consumables that customers buy regularly, but are the shares a ‘buy’?

The Covid-19 pandemic has accelerated the adoption of Tristel (LSE:TSTL) new surface disinfectant range by hospitals, but the company was already on the path to long-term success well before a novel virus put infection control on everyone’s agendas.

One of a kind

Tristel is the only company that makes high-level disinfectants using chlorine dioxide, which is safer to use manually than alternative formulations.

The disinfectants it makes are used mainly in hospitals to clean small instruments that might previously have been disinfected in expensive instrument washers.

The chemistry is not patented, but its delivery in foams, wipes and sprays is, and so too is the audit trail. Tristel owns hundreds of patents. Reportedly the earliest will start expiring from the mid 2020’s but Tristel is still adding to them today.

Additionally, Tristel products are certified for use on thousands of medical devices, and approved by regulatory bodies around the World.

In the UK, where Tristel earns 40% of revenue, it is the dominant disinfectant in outpatient departments using small medical devices like ear nose and throat, ultrasound and ophthalmology.

This dominance means the bulk of growth is coming from abroad. The market with the most potential is the USA, but Tristel is taking much longer than expected to gain regulatory approval there, a process that has been delayed further by the pandemic.

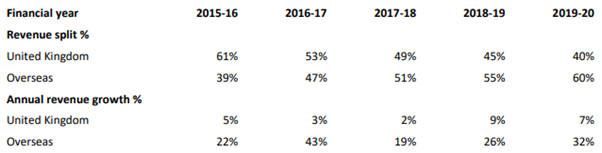

Even without the USA, the share of overseas revenue has grown steadily as a proportion of total revenue, which has itself been growing rapidly.

Over the past five years, Tristel has reversed its historic dependence on the UK by growing much more strongly overseas. Source: Tristel annual report 2020.

Further in the future Tristel hopes to take disinfectants into rural communities and less developed countries where medical services are delivered by nurses. A partnership with Mobile OTD, may show the way, although the company did not update shareholders in the annual report.

Mobile OTD makes a mobile colposcope, which illuminates and photographs a woman’s cervix and sends it to a consultant so she can diagnose cervical cancer.

Tristel has developed a version of Tristel Duo to disinfect the device, and is also the colposcope’s UK distributor.

Every year is a good year for killing pathogens

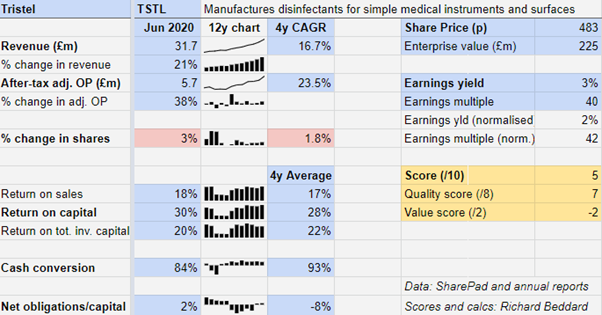

Although Tristel lifted revenue 21% and adjusted profit 38% in the year ended 30 June 2020, ahead of its own impressive averages, the impact of the pandemic was not entirely positive.

While there was a surge in demand for surface contamination products, there was a decline in demand for medical device decontamination due to the cancellation of routine medical procedures.

Most revenue (74% in 2020) comes from medical device decontamination, but Tristel was ready with surface dis pandemic struck. It had spent the last three years developing a new surface decontamination range, the Cache Collection, which it had stockpiled for launch in 2021.

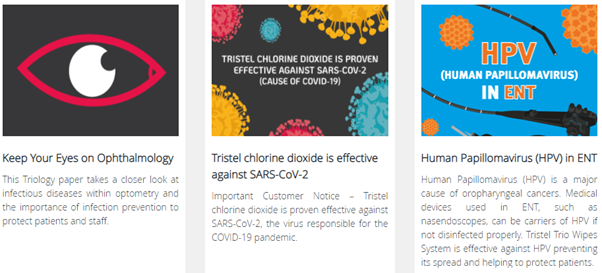

Tristel keeps customers informed about infection control. The articles give an indication of where the company’s priorities lie. Throughout the pandemic it has published evidence that Tristel chlorine dioxide is effective against Covid-19. Source: Triology

A flying start for the new range resulted in 10% of revenue from surface disinfection in 2020, but Tristel believes it has ample opportunity to grow this segment alongside device decontamination in a post-Covid-19 world in which awareness of the risk of infection is heightened.

Tristel targets 10 to 15% annual revenue growth, 25% Earnings Before Interest and Tax (EBITDA) margin, and annual Profit Before Interest and Tax (PBIT) growth excluding the impact of incentive payments to the directors.

My calculations in the table below include the cost of share-based payments because they are a significant and routine element of remuneration.

If you look closely at the charts for return on capital, you will see three years of relatively poor performance.

Before the early part of the last decade Tristel was primarily a manufacturer of disinfectant for washing machines, but the washing machine manufacturers acquired their own disinfectants.

While the machine manufacturers did not have Trifast’s chlorine dioxide chemistry, more noxious disinfectants could be used effectively in machines. When the NHS recommended the manufacturer's own disinfectants, Tristel lost substantial revenue almost overnight.

The company had already developed the current range of manual disinfection products, and in the process it created a market for itself. Until revenues from the new disinfectants eclipsed lost revenues from machine disinfectants, there was a dent in Tristel’s profitability.

Since this was a one-off, albeit drawn-out, strategic event, I calculate average profitability from more recent years.

The numbers are impressive. Tristel earns an average 28% return on operating capital. Factor in acquisitions at cost, and the return on total invested capital is 22%.

Tristel likes to acquire its distributors once they have established the products in-country, and in 2020 it acquired 80% of Tristel Italia, taking its tally of overseas subsidiaries earning revenues to 13. Four more in the USA, Japan, India and Ireland, have yet to earn any money.

Scoring Tristel

There is a risk in the short-term that demand for medical decontamination products remains subdued while hospitals continue to give priority to Covid-19 patients, which explains why Tristel has accelerated its surface decontamination plans.

Longer term, Trifast appears to be unstoppable. It manufactures unique, protected, essential consumables that hospitals buy regularly, and it is gradually securing the product authorisations to sell them around the world.

But I really do not like the incentive plan that remunerates its two executive directors.

To achieve the maximum award (worth at least £2.5 million in shares for the chief executive) the share price must stay above 500p for a period of three months any time before June next year. Since it is currently 483p a maximum award is on the cards.

The share price does not just reflect the performance of the company, it is also a measure of traders’ expectations, which the company helps to set.

This creates an incentive for a company to misrepresent its prospects, and that puts me in a bind because Tristel communicates very well with private shareholders.

I have toured the factory, attended presentations, and generally been impressed, but I also wonder whether the story I am being told is even more sanitised than at other businesses, particularly around the time the share price is likely to trigger option payments.

Does the business make good money? [2]

+ High Return on capital and profit margins

+ Good cash conversion

+ Business model changed in the early 2010’s

What could stop it growing profitably? [2]

+ Strong finances

+ Constant demand for disinfectant

? Patent expiries from mid 2020’s

How does its strategy address the risks? [2]

+ Product development/protection

+ Registrations in new geographical markets

+ Opportunities to grow in surface disinfection, communities, and animal and laboratory markets.

Will we all benefit? [1]

+ The company is still run by its founder, who has been a shrewd entrepreneur

+ Excellent communication with shareholders

- Extreme incentive plan

Is the share price low relative to profit? [-2]

˗ A share price of 483p values the enterprise at £225m, about 40 times adjusted profit in 2020

Tristel is a very good business but as an investment it is marred somewhat by a discombobulating executive incentive plan and a high share price.

It is probably a good long-term investment, but it is ranked 29 out of the 37 good long-term investments tracked by my Decision Engine.

Richard owns shares in Tristel.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.