Richard Beddard: big is beautiful for blob-like blue-chip

11th March 2022 15:01

by Richard Beddard from interactive investor

Acquisitions underpin this distributor’s impressive business model: despite a relatively high share price, our columnist likes what he sees.

First impressions count. In a more than three-hour presentation to analysts and investors last October, Frank Van Zanten, Bunzl (LSE:BNZL)’s chief executive, kicked off by promising that a roster of executives would answer the big questions.

High on the list were questions also on my mind: can a distributor that already sells £10 billion worth of everyday essentials to large businesses and organisations keep growing reliably like it has for the last two decades? Is the introduction of taxes on plastic a threat to its packaging business?

It was a long but impressive presentation.

The Blob

Van Zanten likens Bunzl’s growth to a snowball rolling down a mountain, picking up more snow. To my mind, it is expanding around the world like a benign version of the B-movie science fiction monster The Blob, absorbing other businesses and growing ever larger.

It supplies essential low-cost products such as coffee cups to Starbucks and protective gloves to car manufacturers, protective equipment to mining and construction companies, packaging to supermarkets and consumables to hospitals. It has been a major supplier of masks, sanitiser and gloves during the pandemic.

These products are required in vast quantities, so Bunzl’s skill set lies in sourcing, warehousing and supplying them just in time to customers. Its main advantage is its size. Bunzl says its 6,000 strong sales force operating from 150 locations makes it the world’s biggest distributor in its markets.

As the largest customer of its largest suppliers, it has their full attention and considerable buying power. Bunzl’s network of warehouses can supply multinational companies across Europe and North America. The breadth of its range means it can often fill a truck with goods bound for one company, reducing transport costs in terms of money and emissions.

- Bunzl shares boom following results upgrade

- Ian Cowie: battery trust play for shift away from Russian energy

- How to invest £100,000

To deepen its competitive advantage, Bunzl needs to grow by acquiring smaller rivals, integrating them into its sourcing network, improving their webshops (two-thirds of orders are placed online) and tools to help customers choose products, and reducing costs by consolidating warehouses.

The acquisitions bring Bunzl new territories, new products and new suppliers. It targets businesses with a strong competitive position: typically, they already have diverse suppliers, they are not dependent on a few customers and they have their own brands.

It prefers the owners of these successful businesses to stay on and flourish within its decentralised set-up. They know the local market best, collaborate with Bunzl’s other ex-owner managers, and recruit other owner-managers who see the benefit of belonging to something bigger.

Indeed, Van Zanten himself (pictured below) was one of those managers: he joined Bunzl in 1994 when it acquired the family business he managed.

The acquisition trail goes on. In 2021, Bunzl spent £500 million on 14 acquisitions, the company’s second-biggest haul ever, and it has announced six more since January. Bunzl’s risk report states its acquisition database is still growing.

In the movie, The Blob is ultimately frozen by a local militia armed with fire extinguishers and then dumped in the Arctic by the US Air Force. I do not think the end of Bunzl’s growth is close, and neither will it be as dramatic.

The company says it has plenty of room to grow, although the example it gives is cherry-picked so I do not know how representative it is.

Bunzl has been investing in Spain for a decade, it says, and using the UK as a benchmark it could triple Spanish revenue to reach the same level. The UK is third after the Netherlands and Denmark in terms of the company’s market share, so it is not as challenging a benchmark as it might be.

When a 3% fall in profit is good news...

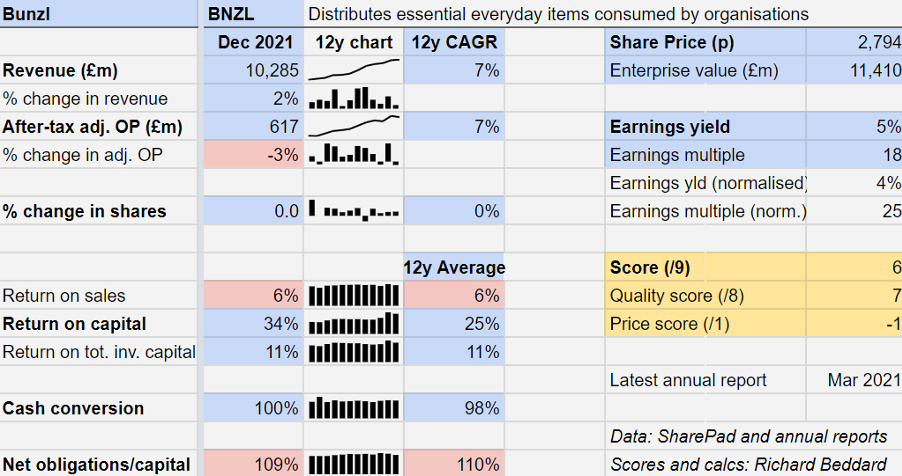

Revenue only grew 2% in the year to December 2021 and adjusted profit fell 3%, but I do not think we need to be concerned. For one thing, revenue was higher and profit grew modestly at constant exchange rates.

For another, the last two years have hardly been normal. Profit increased 18% in the first year of the pandemic as increased sales of masks and sanitiser outweighed declines in categories such as retail and food services during the early stages of the pandemic.

Profit growth got a bit ahead of itself that year – a performance that could not be repeated as the business started to return to a more normal pattern. The overall growth trend appears to be intact, though.

The only other red flags on my scorecard are familiar ones. Bunzl’s profit margins are modest, but no more so than usual, and its debt levels are high relative to the capital required to operate the business, but also no more than usual.

These are risks we can live with, because the business is so stable, reliably generating more than enough cash to pay rent and interest and for acquisitions without increasing the level of debt relative to the size of the business.

Bunzl expects the normalisation to continue in 2022, with sales of Covid-related products to fall further towards 2019 levels and volumes of non-Covid products to improve. The net result should be modest organic growth, augmented of course by acquisitions.

Scoring Bunzl

I believe Bunzl is an outwardly simple but inwardly impressive business that can do things smaller rivals might not be able to.

For example, it sees the increasing focus on sustainability as an opportunity in packaging. It has its own brands of recyclable, reusable, compostable products, and has developed tools to manage customer data and show them how changing products can help them meet regulations and sustainability targets.

It says customers are putting more emphasis on sustainability and less on pricing than they used to, which is an opportunity because sustainability is complicated; as in other areas such as health and safety, Bunzl is a trusted adviser.

Higher-priced, higher-margin products compensate for sometimes lower volumes. The growth of e-commerce is also increasing the demands on packaging, which must be more protective and repurposable for returns.

The company’s regional competitors, with smaller networks of suppliers and fewer internal resources, may not be able to match Bunzl; if they can’t beat it, perhaps they should join it.

Given deteriorating international relations I do wonder about its operation headquartered in Shanghai, which sources products from across the Far East, and how dependent the business is on China. However, the company’s risk report says it is not overly exposed to any particular country changing tariffs.

Does the business make good money? [2]

+ High and reliable return on capital

+ 100% cash conversion

+ Modest but very stable profit margins

What could stop it growing profitably? [1]

? Considerable financial obligations

+ Size makes it a formidable competitor

? China dependency

How does its strategy address the risks? [2]

+ Financial discipline

+ Acquisitions deepen competitive advantage

+ Risk report says not dependent on one country

Will we all benefit? [2]

+ Decentralised, high levels of employee satisfaction

+ Turning sustainability into a conservative advantage

+ Very experienced board, high disparity between CEO and median UK pay though

Is the share price low relative to profit? [-2]

+ Yes/No. A share price of about £28.00 values the enterprise at £11.5 billion, about 25 times normalised profit.

A score of 6 out of 9 indicates Bunzl is probably a good long-term investment. Its relatively high share price means it is ranked 23 out 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.