Richard Beddard: court case clouds confidence in this star stock

8th April 2022 14:30

by Richard Beddard from interactive investor

It’s a business that ticks lots of boxes for our columnist’s Decision Engine – but what is the significance of this legal slur on its reputation and culture?

Before I examine how XP Power (LSE:XPP) makes money, how it plans to make more and what might stop it, news of an event after the year end in December is cause for concern.

Let us start with the twist in the tale.

A nasty twist in the fairy tale

In March, this manufacturer of power supplies lost a court case brought in California by rival Comet.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Reportedly, Comet says XP Power stole trade secrets when it recruited some of its personnel in 2017 and used their knowledge to develop radio frequency (RF) generators. These generators are one of three types of power product manufactured by XP Power, the other two being low voltage and high voltage power supplies.

RF generators are principally used in machines that manufacture semiconductors, one of three markets in which XP Power is a major supplier. It earned 39% of revenue from semiconductors in 2021.

XP Power must pay damages of $40 million to Comet, getting on for a year’s profit.

The significance of this verdict is not clear to me. Considering XP Power’s high level of profitability and financial strength, the loss of $40 million is not enough in itself to turn the company into a bad investment, if it is a one-off.

However, according to an analyst quoted in the press, while the verdict will not impact sales of current products, it could hamper XP Power’s roll-out of new RF products.

- Shares for the future: top-ranked company causes tricky situation

- Richard Beddard: look at the right numbers and this stock will impress

- Read more articles by Richard Beddard here

XP Power acquired its RF capability when it bought Comdel in 2017, the same year as the events leading to the court case took place, so it is tempting to believe any wrongdoing is limited to this business.

Publicly, XP has revealed very little. The annual report, published days before the court case started, said almost nothing beyond the fact that it had run up a legal bill of £10.1 million in relation to the case, which it felt had “no merit”. To say any more, it wrote, might be detrimental to its chances of winning the dispute.

Now it has lost, the company says it disagrees with the verdict and is considering its next steps, which could mean an appeal.

These developments are most unwelcome. Up until this point, XP Power had, in my estimation, all the qualities I seek in a good long-term investment.

To add to my uncertainty, chairman and founder James Peters is retiring in April 2023, following the retirement of the company’s longstanding chief executive in December 2020.

This pair guided the company over the last two decades as it successfully moved up the value chain from distributing to manufacturing low-voltage adapters, and latterly expanding the product range to RF and high-voltage products.

The latest phase in this strategy was the acquisition of two German manufacturers of high-voltage products, bringing new capabilities and serving new markets within the industrial and semiconductor markets.

Gavin Griggs, who joined as chief financial officer in 2017, is the chief executive.

Resilient performer

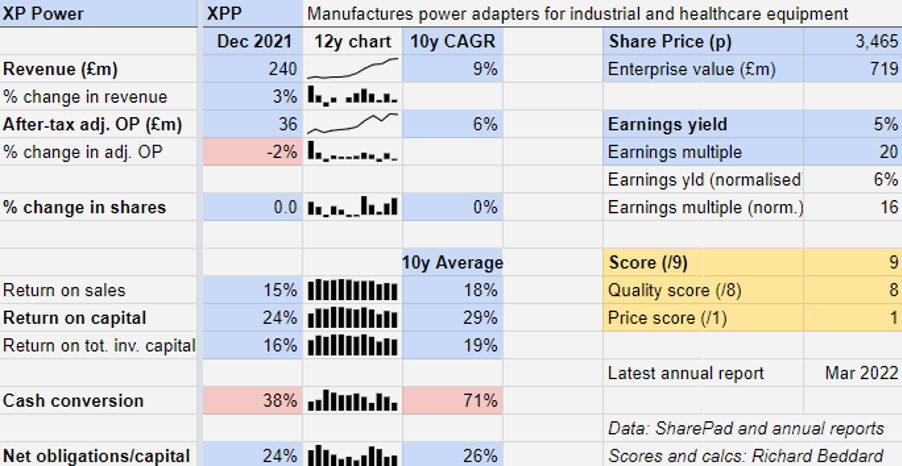

XP experienced a small but understandable fall in profit in the year to December 2021, slightly underperforming recent years in terms of return on capital.

Revenue growth, profit growth and profit margins were all constrained by higher freight costs, component shortages and price increases, and increased labour pay rates during the lockdown in Vietnam. This was compounded by adverse currency movements.

In my numbers, the profit figure ignores the cost of the legal dispute, but the cash flow figure does not, which explains the weak cash conversion.

Past performance is not a guide to future performance

As orders from industrial and semiconductor machinery manufacturers surge after the pandemic, far outweighing the declines in healthcare following exceptional demand last year, trading should improve. Shortages and cost increases still abound though.

Consistently strong returns on capital support the view that XP Power does something special.

Sure strategy

Power converters regulate the electrical voltage supplied to machines. XP designs converters for machines used in industrial, semiconductor and healthcare markets, which require reliable components because failure could lead to a halt in production or a medical procedure.

Due to the increasing sophistication of machines, and greater demands on them in terms of reliability and efficiency, there has been a proliferation both in the number of converters used by machines and in their design. This means XP Power can sell more convertors to its blue-chip customer base.

With the largest field sales force in the industry, a legacy of its days as a distributor, XP Power is attuned to changes in customers’ requirements and is developing new products that meet them.

Having built modern low-cost factories in China, Vietnam, and soon Malaysia, it has been able to control cost and quality, supplying customers with reliable products that are easy to design into their machines.

- Share Sleuth: my first trades of 2022 lead to a new holding

- Richard Beddard: could this firm be a stock market darling again?

By not relying only on China, XP Power is protecting the business from the risk that trade relations between the West and China might deteriorate, demonstrating its instinct to build resilience as well as growth into the business model.

Once designed into a product, power converters form part of the specification and are unlikely to be swapped out due to the cost of designing and certifying an alternative.

While XP Power’s customers may experience lower demand during recessions, manufacturers tend to cut back investment in machinery when they are selling less; the power supplies are unlikely to be substituted for cheaper alternatives. This too makes XP Power resilient.

Low-voltage converters are not very complex, though, and here XP Power faces competition from other low-cost manufacturers in the Far East.

This explains the company’s policy of acquiring manufacturers of high-voltage and RF products in recent years, products it can sell to its existing customers, and the development of its highly efficient Green XP Power range.

Scoring XP Power

Despite the court case, XP Power has a coherent strategy that addresses the risks it faces. I do not believe the verdict undermines the company’s past achievements. The strategy has been successful.

However, the court case raises questions about the company’s ethics and culture that I cannot answer with confidence.

That makes me uncomfortable, and compels me to award XP Power a fairness score of zero until it has successfully challenged the verdict, accepted it and reassured shareholders the damage is limited, or sufficient time has gone by for us to write the case off as a one-off.

Does the business make good money? [2]

+ High return on capital

+ Good profit margins

? Reasonable cash conversion

What could stop it growing profitably? [2]

+ Resilient in market downturns

? Commoditisation of low-end products

? Potential deterioration of trade relations with China

How does its strategy address the risks? [2]

+ Selling more to largest customers

+ Moving up value chain

+ Further diversification of manufacturing

Will we all benefit? [0]

+ Communicates well with shareholders

+ Green XP Power products make machines more efficient

− Stole trade secrets according to court verdict

Is the share price low relative to profit? [1]

+ Yes. A share price of £34.65 values the enterprise at about £710 million, about 16 times normalised profit.

A score of 7 out of 9 suggests XP Power is a good long-term investment, although the court case is confounding, and means that I have a lower level of confidence than usual in my score.

XP Power is ranked 15 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in XP Power

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.