Richard Beddard: a good company with the mother of all strategies

26th November 2021 14:45

by Richard Beddard from interactive investor

These FTSE 250 shares have raced higher but are less expensive than they were. Have they fallen enough for our stocks expert to give them a top rating?

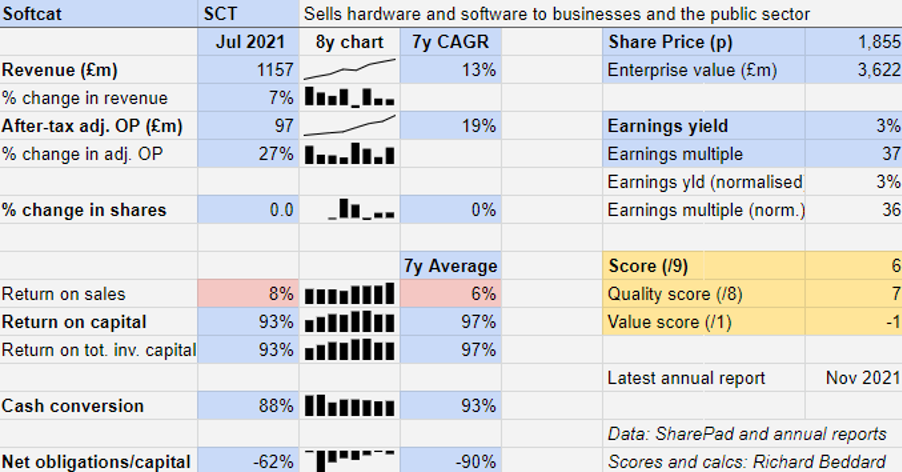

There is an irony in Softcat (LSE:SCT)’s performance for the year to July 2021. It was the company’s 16th consecutive year of profit growth, yet it was unable to do many of the things that make it so special.

The pandemic stopped the software and hardware reseller’s account managers from visiting their customers, and it emptied its offices where its legendary culture flourishes through events that motivate and train its people to sell more kit to more customers.

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

- Read more Richard Beddard articles here

It tried to engage. Top performers were still treated to lunch on the company, but they did not share it with each other, or their bosses.

Travel and events cost money and not doing as much saved Softcat £1 million a month. That saving, and a surge in demand as business and the public sector scrambled to enable their staff to work from home caused a 27% surge in profit, taking the company’s compound annual growth rate over the last seven years to nearly 20%.

Past performance is not a guide to future performance

While Softcat expects gross profit to continue growing in double figures in 2022, it anticipates operating profit will probably equal what it achieved in 2021 due to the return of travel and events, and investment, which at Softcat means recruitment and training.

The company employs 26% more people than it did two years ago, before the pandemic.

The mother of all strategies

Softcat’s purpose, stated on the front page of the annual report, is to “help customers use IT to succeed by putting our employees first.”

It is the mantra of many a formidable sales organisation, because to get customers to buy for the first time, or to return, you need to win their trust. That requires knowledgeable and motivated employees.

Softcat’s strategy is to sell more IT to existing customers and recruit more customers.

The company says that in 2017 it increased investment in recruiting and training specialist technical roles to “go deeper” into its customers’ IT budgets. Training in new technologies does not just increase the company’s relevance now, it convinces customers Softcat is a partner for the long haul.

- Bill Ackman: an industry as certain as food and oxygen

- The Chart Show: Zoom, AO World, IAG

- Read more of our content on UK shares here

It is also seeking to grow internationally, primarily by servicing UK customers internationally through a number of overseas offices. It is beginning to serve overseas customers through those offices too.

Judging by the non-financial indicators published by the company, the strategy is working.

Even though lockdown restricted its opportunities to win new business, Softcat grew its customer base by more than 2%, and its share of customers’ business increased to 20%.

Since the company supplies 20% of its addressable market, its market share is about 4%.

The company’s employee engagement score was 93%, and customer satisfaction was 95%. It won recognition as usual, as an employer, reseller, and from its vendors.

In some ways, Softcat’s strategy is the mother of all strategies because motivated and trained staff should be able to respond to any challenge.

There seems little risk of complacency. The company was founded in 1993 by Peter Kelly, who wanted to create a company people would enjoy being part of.

He still owns 33% of the shares and has the unexercised right to nominate somebody to the board.

Chairman Martin Hellawell is the previous chief executive, responsible for much of the company’s extraordinary growth.

These people are probably guardians of the corporate culture, and Softcat emphasises this culture at every opportunity.

But it worries me slightly that Softcat says little about strategic challenges, the competitive environment, and the risk that the frenetic adoption of IT might one day subside, at least in its current form.

Scoring Softcat

The competitive environment is complicated. Resellers, of which Softcat is one of the biggest and fastest growing in the UK, simplify things for customers, advising them about technology and licensing options and bundling products and services that replace multiple vendor relationships with one.

But vendors sell direct too, which might be getting easier now software is increasingly sold as a service and there is no-longer a shrink-wrapped product to supply. Since Softcat’s 200 vendors are big innovative companies like Amazon Web Services and Microsoft, there may be a risk that customers get more used to buying and configuring their own services.

SAAS buying platforms are also emerging, which are introducing an element of automation into procurement and perhaps signalling that in future there will not always need to be as much of a personal touch buying IT.

Software houses and resellers are booming, though, as businesses move their infrastructure into the cloud, increasingly use data to derive insights into their businesses, and require higher levels of security to protect their more valuable information.

But these transitions may have a cyclical element like earlier waves of IT adoption. The internet bubble that ended in 2000 caused years of painful contraction at many IT resellers.

- Subscribe to the ii YouTube channel for interviews with popular investors

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

The worst affected were disparagingly known as “box shifters”. They did not do much more than sell hardware and software in boxes.

Softcat’s average profit margin of 6% suggests that the value added by its expertise is limited, and I wonder if the strategy works as well in an environment, unimaginable though it is now, where IT spending is more constrained.

My doubts probably say more about my ignorance of IT, and I might be wrong for longer than I have left as an investor, but I would be lying if I did not admit to them.

Does the business make good money? [2]

+ High Return on Capital

+ Strong cash flow

? Modest profit margin

What could stop it growing profitably? [1]

+ Very strong finances

? Possibility IT investment wave will subside

? Complex competitive landscape

How does its strategy address the risks? [2]

+ Investing in recruitment and training compounds people advantage

+ Staff trained and motivated to sell more IT to more customers

? Strategy seems tuned to a growing market

Will we all benefit? [2]

+ Founder Peter Kelly owns 33%, has right to nominate a board member

+ Employee first culture puts customer first

? High level variable pay earned current ceo £2.5 million in 2021

Is the share price low relative to profit? [-2]

− No. A share price of £18.55 values the enterprise at nearly 36 times normalised profit.

A score of 5 out of 9 suggests that Softcat may be a good long-term investment, but I am a little wary about the potential for change.

Apparently, others are not concerned, because the share price is high too.

Softcat is ranked 28 out of the 40 companies I score in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.