Richard Beddard: investors could win big with this small-cap

17th February 2023 14:32

by Richard Beddard from interactive investor

Consistent but complex, a growth share, but unflashy. Our companies analyst examines ‘one of the best businesses’ he follows.

The big news from transport technology company Tracsis (LSE:TRCS) in the year to July 2022 was a small acquisition, its second of the financial year. Since the annual report was published in December there has been none*.

Last May, Tracsis acquired RailComm, a US company that earned $6 million revenue in 2021. Its two main products are software that automates rail yards and train dispatching. Tracsis intends to market its highly profitable products and services to RailComm’s customers.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Unflashy growth

Tracsis is one of the most consistent and, to my mind, least flashy, growth shares listed in London. Its rail business, which does not depend much on passenger numbers, barely faltered during the pandemic, but 2022 was a year of recovery for the rest of the business, much of it focused on traffic management.

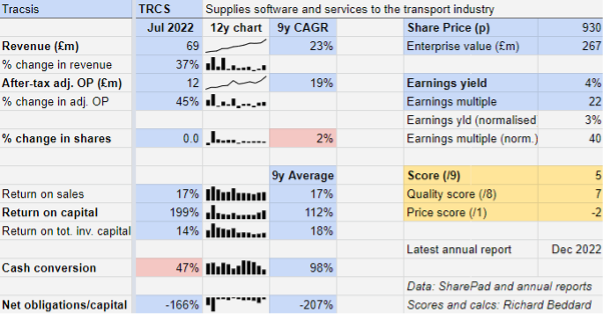

In terms of performance, Tracsis looks like one of the best businesses I follow. Rapid growth in revenue and profit, high levels of profitability and in almost every year bar 2022, excellent cash conversion.

Cash flow was relatively modest compared to profit in 2022 because of a large rise in receivables, an increase in the money owed by events organisers and highway authorities as road travel and events recovered after the pandemic.

Rail and the rest

The company primarily supplies software, hardware and consultancy services for rail and road companies, infrastructure providers such as National Rail, and local and highway authorities.

The strategic focus of the rail businesses is on four technology platforms: a software suite for rail operators, trackside remote condition monitoring systems and a risk management and health and safety application for infrastructure providers such as Network Rail, and smart account-based ticketing solutions used by 20% of the rail network.

- Five AIM income stocks for your ISA in 2023

- The AIM stocks the pros are buying as they bet on a recovery

Tracsis has started its North American conquest with the remote condition monitoring product it was already selling there through a reseller, probably because it is relatively easy to adapt to different geographical markets. The sensors and hardware that communicates the data just require a different power supply.

The rest of the business is bundled together in a division with a name too long and discombobulating to repeat. It encompasses businesses that do traffic surveys for highway authorities, manage traffic and parking at large events, and a data and analytics unit that helps road, rail and utility customers know where their assets are and how they are performing.

The data and analytics business has been augmented by Icon GEO, acquired in November 2021.

Complexity risk

Tracsis’ rail software businesses provided £21 million of reliable and scalable recurring revenue in 2022, although the software might require substantial modification or rewriting for overseas rail networks. If it succeeds in selling hardware-based remote condition monitoring through RailComm, it can scale that business too.

The rest of Tracsis is more labour intensive and less profitable, but it is bringing technology to bear on event stewarding and traffic surveys. Consultancy sits somewhere in the middle, profitable, but people intensive and like software, it may not always be relevant in different geographies.

The company’s policy is to combine smaller acquisitions with existing ones, and it is encouraging its larger business units to work more closely together by creating group-wide services and branding. My doubts about Tracsis, therefore, focus on complexity, whether it can keep on top of this growing gaggle of quite different businesses, and scale them.

That said, even though the company has mooted larger acquisitions, judging by the size of RailComm and its one product after another approach to exporting there, it is taking a prudent approach to expansion in the US.

Scoring Tracsis

There is no denying Tracsis’ financial track record, or that despite the apparent complexity it is very well managed. I also like its guiding principle “Technology Makes It Possible, People Make It Happen”.

It would be easy to get carried away, but it is probably diversifying both geographically and in terms of markets and capabilities because it is difficult to keep the Rail division growing rapidly in the UK. Tracsis estimates the UK rail market is worth at least £100 million, but it already earns £30 million in revenue from the division.

The company’s original business was railway scheduling software, but after organic growth and perhaps 20 acquisitions (I have lost count) in almost as many years, it earns more revenue but less profit from the division that will not be named. Excluding central costs, the non-rail part of Tracsis achieved a decent adjusted profit margin of 14% in 2022, a year of recovery. The rail business earned 35%.

- Stockwatch: a small-cap with a gravity-defying outlook

- 10 shares to give you a £10,000 annual income in 2023

Perhaps Tracsis has been forced to invest the oodles of cash it earns from the railways, where competition is limited to a handful of rivals, in good but not as good businesses.

The addition of RailComm has dramatically added to the Rail division’s addressable market, but it remains to be seen what Tracsis can achieve in North America. Overseas growth has been a long-time ambition, but the company still only earns 19% of revenue outside the UK, and most of that is from an Irish acquisition in 2019.

Glass half-full, RailComm could be a game changer. Glass half-empty and it is a bit of a diversion. That is a risk, but it is probably a good one: heads we win, potentially a lot, tails we lose, probably not very much.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Excellent average cash conversion

What could stop it growing profitably? [1]

+ Resilient, strong finances

? Diversification adds complexity

? Overseas expansion

How does its strategy address the risks? [2]

+ Improvement in technology platforms

? Larger acquisitions

+ Small steps abroad

Will we all benefit? [2]

? Management still relatively fresh

+ Executive pay is not excessive

+ Communicates well with investors

Is the share price low relative to profit? [-2]

+ No. A share price of 930p values the enterprise at about £267 million, about 40 times normalised profit (22 times 2022 profit).

Despite my concerns about complexity, the main barrier to owning the shares is the enthusiasm of other investors embodied in the share price. Nevertheless, a score of 5 out of 9 indicates Tracsis could well be a good long-term investment.

It is ranked 36 out of 40 stocks in my Decision Engine.

*Please note: Last year, Tracsis published a trading update in late February, ahead of the half-year results published in April. At the time of writing, the company had not yet updated the market for the first half of its 2023 financial year, but it may have done by the time you read this. You can read the last news here.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.