Richard Beddard: why I’m upgrading this mid-cap share

19th November 2021 14:21

by Richard Beddard from interactive investor

The new chief executive is streamlining this personal care company’s focus and building a truly sustainable business. Our columnist likes what he sees.

It was an hour into PZ Cussons (LSE:PZC)’s September presentation to investors and analysts when chief executive Jonathan Myers revealed why one of its most famous brands is not one of the eight it “must-win”.

Separating the winners from the also-rans

Since he took over as chief executive early in 2020, he has been navigating the company's course through the pandemic and PZ Cussons’ recovery from years of complacency.

He started the turnaround by narrowing the company’s focus, dividing PZ Cussons’ brands into two categories: portfolio brands, and ‘must-win’ brands such as Carex hand wash and Original Source body wash. Imperial Leather, the soap, is a portfolio brand even though it is sizeable in terms of the revenue it earns.

Portfolio brands are cash cows, run efficiently to provide the resources to build the must-win brands. Must-win brands are lavished with investment, which comes in the form of PZ Cussons’ ‘Growth Wheel’, an evolving formula for innovating and marketing better products and generating higher returns.

- Four popular stocks in trouble

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

The decision to categorise Imperial Leather as a portfolio brand was hotly debated within the company; but when most people think about the much-loved soap, Myers says they think fondly about adverts from the 1980s or the soap on Granny’s bathtub. They are not thinking of buying it now. So the ageing associations of Imperial Leather must be overcome if it is to become a priority.

As well as helping the business decide how it allocates investment, the prospect of a portfolio brand being promoted to must-win status adds an element of competition within the company.

Apparently this is motivating.

The kernel of a sustainable strategy

Deciding a venerable brand like Imperial Leather is not, at least for the time being, a priority, must have been a difficult decision.

Tough choices show the company’s new strategy is decisive. The starting point for strategy though, is a diagnosis: determining the challenges the business must overcome as it seeks to grow profitably.

Under previous management, PZ Cussons had spread itself too thinly trying to emulate its bigger multinational rivals. It did not invest enough in its most promising brands, or respond quickly and decisively to discount and internet retailers who were giving consumers cheaper or more authentic alternatives.

Having decided to focus and simplify the business, the company has been working out what else it needed to do to rebuild the brands. It has consolidated suppliers and distribution centres in Africa, removed layers of management between head office and local offices, focused on its biggest geographical markets (UK, Nigeria, Indonesia and Australia), divested subsidiaries that are holding it back, and started to develop new capabilities, initially through recruitment.

Andrew Geoghegan has joined to lead the company’s marketing transformation, and Joanna Gluzman is its first chief sustainability officer.

In terms of marketing, the company is launching products online first, and following up with TV campaigns. It says Sanctuary Spa, a must-win body care range, is selling well in the UK directly through its online store. A St Tropez product launch promoted by Ashley Graham, a model and social media influencer, sold out twice in the US.

In terms of sustainability, the company has a proud history of initiatives, for example to reduce plastic packaging and trace all palm oil to sustainable sources. Now PZ Cussons plans to achieve B-Corp status by 2026. B-Corps undergo a rigorous assessment of their impact on workers, customers, suppliers, the community and the environment.

No UK listed companies are currently B-Corps, although a few have B-Corp subsidiaries (Unilever owns Ben and Jerry’s, for example).

The roadmap has yet to be drawn. There will be costs, says the PZ Cussons’ new chief financial officer Sarah Pollock, but there will also be opportunities: B-Corp status will make the products more attractive to consumers and the company more attractive to employees.

The company says B-Corp status will be self-funding. Profitability should not decline even as it balances profit with purpose.

The numbers

Determining whether the strategy is working is complicated by the fact that it is little more than a year old and the impact of the pandemic means that year was atypical.

In the year to May 2021, the surge in demand for hand wash created a boom for Carex, the UK’s leading brand, but other brands like St Tropez fake tan languished on shelves in closed stores, temporarily forgotten by people who were not going out anyway.

Original Source, the only must-win brand not to grow over the full year, was pushed aside by Carex in shop displays. Imperial Leather made way for Carex on PZ Cussons’ production lines. Since the year-end, demand for Carex has subsided somewhat, although it is still substantially higher than pre-pandemic levels, and demand for other products has improved.

The net result for 2021 was a 9% growth in adjusted profit, and despite mounting raw material cost pressures, PZ Cussons reckons it is likely to grow modestly in 2022.

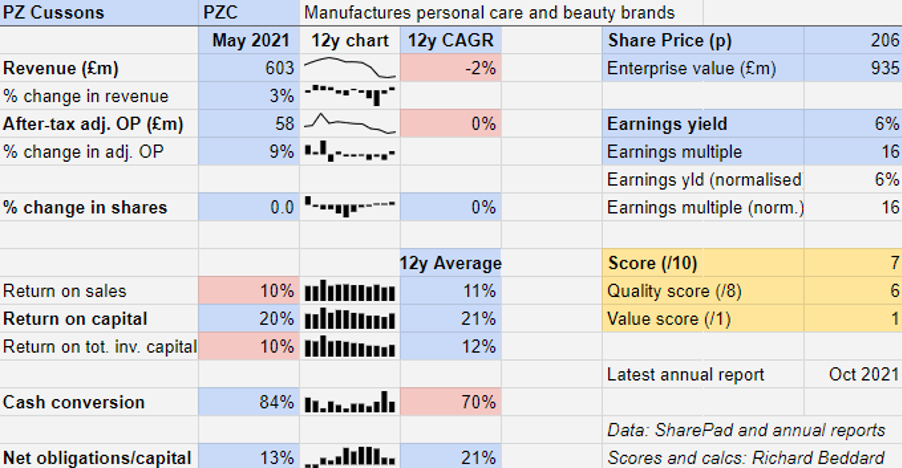

Some pink warning signs are flashing in my spreadsheet, but the numbers require interpretation.

PZ Cussons has not grown over the last 12 years, but that is probably due to mismanagement and the subsequent disposals of its food businesses, leaving a smaller core of hygiene, baby, and beauty it can grow from.

Profit margin (return on sales) and a Return on Total Invested Capital, both 10%, are not bad levels of profitability, but they can probably improve. In the past, cash conversion has averaged 70%, which is more than adequate but tainted by almost perpetual restructuring costs ignored in the profit figure. Hopefully we will see less of this in the future.

Scoring PZ Cussons

I like businesses that are getting simpler, and I like businesses that are adapting from a position of strength. PZ Cussons owns leading brands and already has a reputation for caring about people and the environment. Now it has a credible plan to burnish those attributes, it could do well.

While the company’s long-term growth expectations are modest – low-to-mid single digit annual revenue growth, it says – the effect on profit could be greater. It should be able to charge more for products as it makes them more appealing to customers, and by simplifying the business it is reducing overheads.

- Big changes at Royal Dutch Shell as simplification put to the vote

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It would also be understandable if the new management team were leery of raising expectations too high, preferring perhaps to under-promise and over-deliver.

That said, PZ Cussons’ competitors have proliferated, and it is at a very early stage in its revival. “Our problems have been years in the making, and they will be years in the fixing,” Myers says.

Does the business make good money? [2]

+ Decent return on capital

+ Cash conversion improving

? Room for improvement in profit margin

What could stop it growing profitably? [1]

+ Financial obligations substantially reduced

? Competition from other brands, discount and internet retailers

? Turnaround strategy still at a very early stage

How does its strategy address the risks? [2]

+ Simplification should reduce costs

+ Improving brands should grow revenue

+ B-Corp status will differentiate PZ Cussons

Will we all benefit? [2]

+ New management facing up to challenges

+ Company fostering leaders at all levels

+ Communicates well with investors

Is the share price low relative to profit? [1]

? Yes. A share price of 206p values the enterprise at £935 million, or about 16 times normalised profit.

My confidence in PZ Cussons is growing. A score of 8 out of 9 suggests it should be a good long-term investment. For comparison, last time I scored the company I gave it 7.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in PZ Cussons.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.