Saba saga: a blessing in disguise?

A Kepler analyst asks whether the activism the investment trust sector has seen over the past year is actually a good thing for the industry.

27th June 2025 13:56

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Ever since Saba Capital announced plans for seven of the trusts the firm had built stakes in in December 2024, commentators have largely decried their presence as negative for the investment trust industry. Opinions mostly accused the firm and its founder, New York-based Boaz Weinstein (pictured), of acting purely in self-interest, rather than being the industry saviour he claimed to be, and of being short-term focused at the expense of long-term outcomes.

I think there is a lot of truth to this: after all, Boaz has proposed for several trusts to wind up, which would lock in a gain for Saba but remove some differentiated propositions from the sector, reducing investor choice. Indeed, Saba remains involved in a number of trusts with interesting and valuable strategies, which are under threat as a result. However, the fear of becoming a target has spurred the boards of several trusts into taking action to increase their trusts’ appeal, with the goal of narrowing discounts and therefore making any activist activity less likely. If these measures have the desired results, could the whole Saba episode have been a benefit to the industry, as short-term pain for a long-term gain?

Shareholder-friendly changes

There has been a flood of news in recent weeks of many investment trusts adopting new policies, ranging from conditional tender offers to bumper enhanced dividend policies, with the express goal of increasing the appeal to a wider range of shareholders and helping to narrow the discounts.

One example is Montanaro UK Smaller Companies Ord (LSE:MTU), which has undertaken a substantial share buyback, tweaked its fee structure, and increased its dividend to c. 6%. The latter will be achieved by using an enhanced income strategy, drawing on a combination of underlying income and capital, to pay out 1.5% of NAV per quarter, an increase of 50% on the previous target. This has made MTU one of the highest-yielding trusts in the AIC UK Smaller Companies sector, an asset class not typically associated with high income. As such, we think the trust may attract a new group of investors who want to build an income portfolio from a diverse range of assets, and relish the opportunity to have a high-yielding, growth-focussed strategy in an income portfolio.

MTU’s share buyback, undertaken in February 2025, was the first time the trust had used this capability since the financial crisis in 2008. Around 20m shares were bought back, equivalent to c. 12% of the share capital. This was also roughly the same as Saba Capital’s stake in the trust, with the activist firm no longer appearing on MTU’s shareholder register, meaning this action was likely done to remove the activist’s interest. Whilst this may be viewed as a large use of capital over the short term in a sector that is frequently touted as undervalued, buying back shares at a discount will have been NAV accretive.

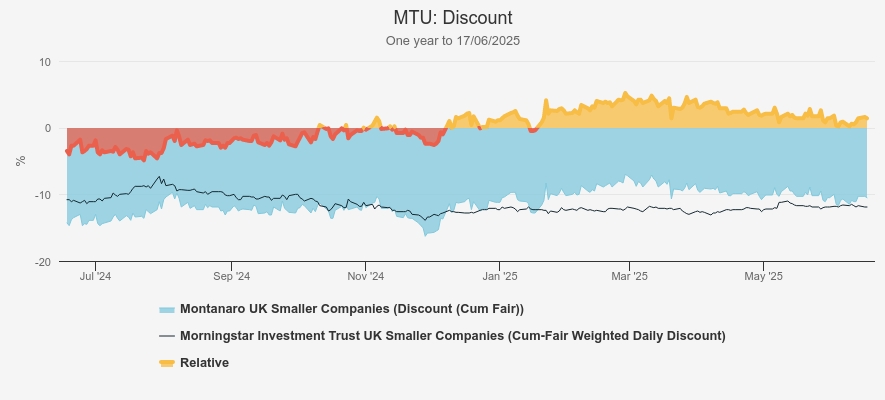

These changes seem to have had a positive impact on the discount so far. On the evening of the announcement of the policy changes (06/06/2025), the trust was trading at a discount of c. 13.6%, which has narrowed to 10.5% as of 17/06/2025. This move looks even more favourable when comparing MTU to the average discount of the peer group. Before the announcement, MTU’s discount was trading at around 2% below the sector average, but has been trading at a premium to the average since, which stands at c. 2.2% at the time of writing. So the changes have led to a boost to the share price, and the high yield could well be attracting new investors.

MTU DISCOUNT

Source: Morningstar

While the changes announced by MTU and the subsequent improvement in the rating are arguably a direct result of Saba’s approach, there are other trusts not directly affected that have introduced shareholder-friendly measures. Two Baillie Gifford trusts are key examples here. As a firm, Baillie Gifford has been one of the main targets of Saba’s attacks, with three of the initial seven requisitioned trusts managed by the firm. However, in March and April 2025, respectively, Baillie Gifford Shin Nippon Ord (LSE:BGS)and Pacific Horizon Ord (LSE:PHI) both announced the introduction of tender offers.

In the case of BGS, the trust will offer investors a 15% exit at NAV, should returns fail to beat the benchmark over the next three years. PHI will offer a slightly higher 25% tender, albeit with a performance period of five years. Whilst these aren’t immediate perks for shareholders, it does, in our view, show an acknowledgement of challenging performance, and a willingness to offer something to shareholders should this not turn around. We can’t say for sure whether Saba’s activism played a role in the board’s decisions in each case, but it has certainly created an environment in which boards are feeling the pressure to take shareholder-friendly actions.

Another trust making radical changes is JPMorgan Asia Growth & Income Ord (LSE:JAGI). In the past year, the trust hiked its target dividend to 6% of NAV per annum, boosting it by 50%, which, like MTU’s, will be funded from capital if necessary. This was done with the explicit goal of differentiating the trust from its peer group and increasing the appeal amongst a wider pool of investors. Furthermore, the board also announced a plan to introduce gearing for the first time in a number of years, with the goal of generating additional alpha over the long term. The level of gearing is initially capped at 5% to assess the impact, with the goal of increasing this over time, should it have the desired results. Whilst this hasn’t explicitly been done in response to any specific activist action, the timing is interesting and could perhaps make it less open to attack from activists.

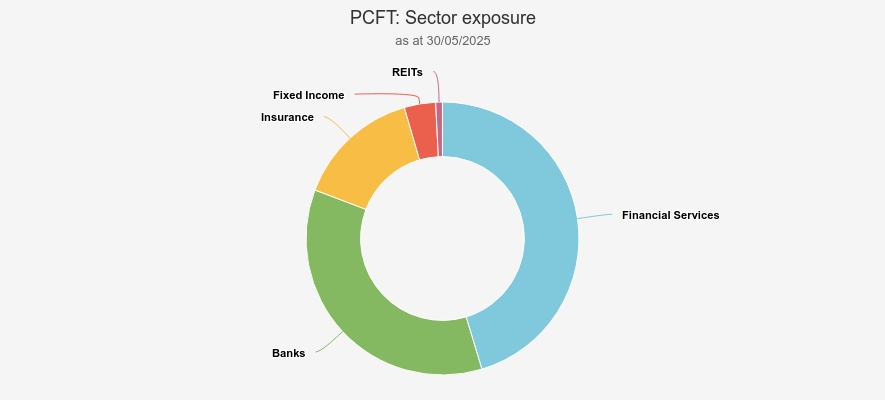

One of the more interesting strategy changes of late, in our view, is Polar Capital Global Financials Ord (LSE:PCFT). This is the only trust specialising in financials in the investment trust sector and yet traded at a discount for much of the past three years, despite the sector arguably being a beneficiary of the higher interest rate environment. PCFT’s discount has closed in the past year as the trust has approached its tender offer in June 2025, which allows shareholders to elect for all of their investment back close to NAV every five years. Whilst this policy is likely to deter most activist activity, other changes made earlier in 2025 have enhanced the offering even further, in our view. In the first half of 2025, the board adopted an enhanced dividend strategy of 4% of NAV, having previously had a progressive policy that yielded between 2% and 3%. Whilst this obviously increases the appeal to income-seeking investors, we believe the potential knock-on effects are most interesting. The managers had previously had an allocation to fixed income of up to 10% to help with revenue generation. Now this is no longer necessary, as income will be paid from capital, they can use the fixed income allocation elsewhere, including adding to areas such as emerging market banks. This adds considerable alpha potential for the trust over the long term, as not only is capital reallocated from one unlikely to offer growth to one with significant growth potential, but these are also a very low weight in the index, meaning by investing here, PCFT could generate strong alpha over the long term, which has often been a challenge for the trust.

PCFT SECTOR ALLOCATIONS

Source: Polar Capital

We think this is a prime example of the long-term benefits Saba, or the threat of similar activity by other activists, may have caused. Whilst PCFT had a respectable policy for managing its discount, the board has gone even further to enhance the trust, which could help the managers deliver NAV outperformance over the long term to the benefit of shareholders and provide a strong defence against any potential activist. Ultimately, whatever the driving force behind the litany of changes we have seen in many places in the industry – whether it be Saba’s attack or a coincidence of timing – the result is a better environment for investment trust shareholders and a more healthier, more attractive universe for them to choose from.

Conclusion

The period of activism over the past few months has been uncomfortable for many in the industry, and whilst it has caused upheaval and challenges for those targeted, it may have sparked changes in several other trusts to adopt policies that can enhance shareholder returns and investor appeal, meaning they are less likely to become the next targets.

In many cases, these adopted measures offer further differentiation to open-ended funds or ETFs, too, which could even encourage new capital into the investment trust sector. For this reason, I think Saba’s actions may arguably end up having been positive for the sector, at least when we look back on it in future.

I don’t want to diminish the negative effects—some of the targets chosen by Saba have not deserved being singled out, and in the short term, they are effectively reducing investor choice. However, perhaps in future we will see this episode as a necessary trial by fire which leaves the sector, tempered by that heat, stronger as a result.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.