Saltydog’s portfolios sail higher despite difficult six months

A fund bought in April is up 20% and Saltydog Investor’s Ocean Liner is at an all-time high. Here’s how.

6th July 2020 13:33

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A fund bought in April is up 20% and Saltydog Investor’s Ocean Liner is at an all-time high. Here’s how.

It's hard to believe that we're already halfway through the year, and what a year it's been.

The first quarter was one of the worst on record. At the end of February/beginning of March, the value of equities all around the world plummeted.

It took the S&P 500 only 22 trading days to fall 30% from its record high which it reached on 19 February. According to data from the Bank of America Securities, that's the fastest drop of this magnitude in history.

In the UK, it was a similar story. On 12 February, the FTSE 100 was still trading above 7,500. On 23 March, it closed below 5,000 for the first time since 2011. It had gone down by a third.

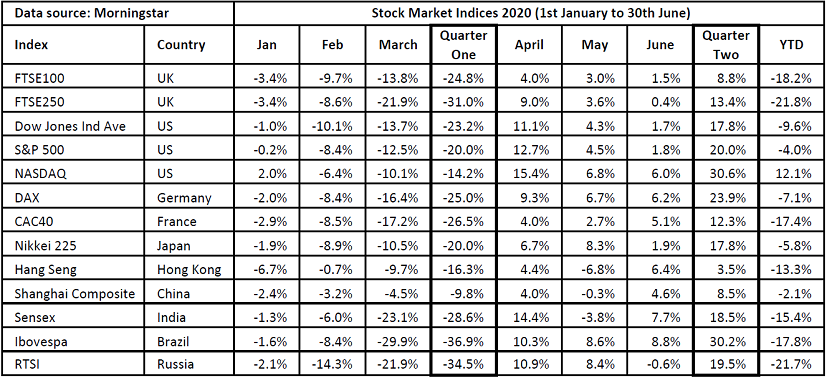

Between the beginning of January and the end of March, all indices in the table below made losses. The Shanghai composite suffered the least, but still went down by 9.8%. The worst, the Brazilian Ibovespa, fell by almost 37%.

Markets then set off on a remarkable recovery.

- FTSE 100's big winners and losers in 2020 so far

- Ian Cowie: will first-half losers be the winners of tomorrow?

- Analysis: the possibility of a melt-up in financial markets is real

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

At the end of April, the FTSE 100 closed just above 5,900, and peaked above 6,500 during trading on 8 June. It had gained 30% from the low in March. Although it hasn’t managed to get any higher, it has just recorded its best quarter since 2010 and, as you can see from the table below, many other indices have done significantly better.

Past performance is not a guide to future performance.

Although the recovery has been impressive, and much faster than many had predicted, most indices are still lower than they were at the beginning of the year. The UK indices seem to have suffered more than most. The FTSE 100 is 18% lower than it was on the 1st January, and the FTSE 250 is down almost 22%.

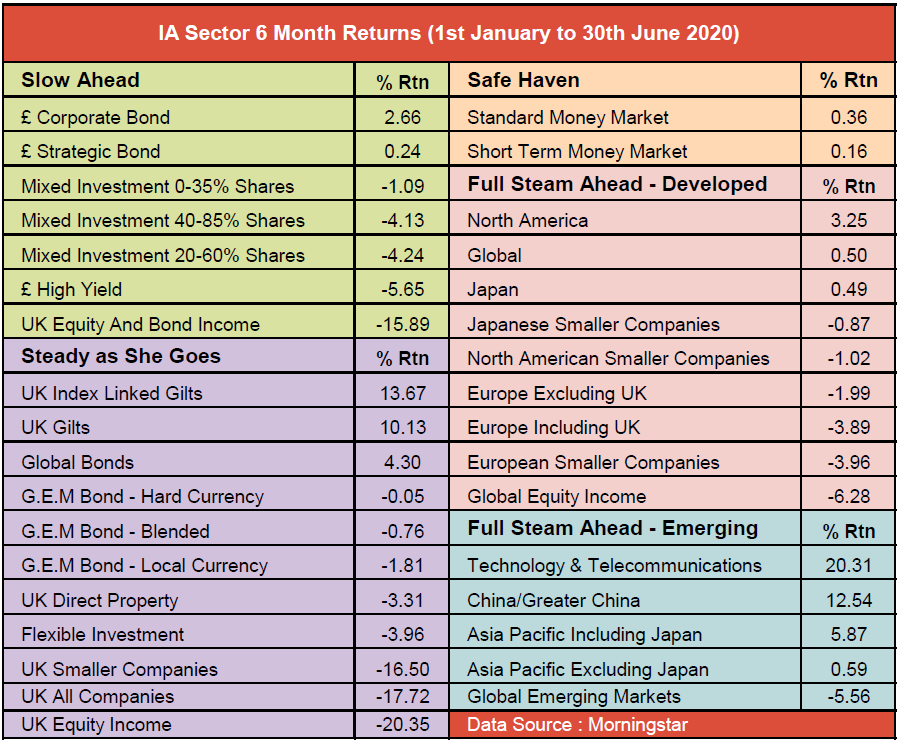

The Investment Association sector average returns for the last six months also make interesting reading. Again, the UK equity sectors have struggled. The UK Smaller Companies sector has dropped 16.5%, the UK All Companies sector is down nearly 18%, and the UK Equity Income sector has fallen by more than 20%.

Past performance is not a guide to future performance.

The UK Gilts and Index Linked Gilts have performed well, as is often the case when the global economy is under stress, and £ Corporate Bonds and £ Strategic Bonds are both up over the year.

All of the equity-based sectors made losses during the first quarter, but have started to recover, and some are now showing gains for the first half of the year.

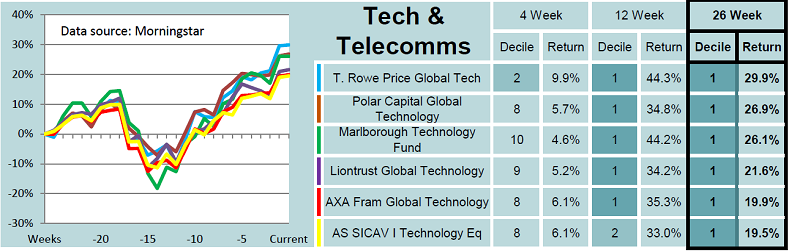

The leading sector, ‘Technology and Telecommunications’, is up over 20% since the beginning of the year.

The T. Rowe Price Global Technology fund was showing a 26-week return of nearly 30% when we did our analysis last week, and it’s gone up more since then.

Past performance is not a guide to future performance.

Our portfolios invested in the Polar Capital Global Technology fund on 23 April 2020, and it’s currently showing a gain of over 20%.

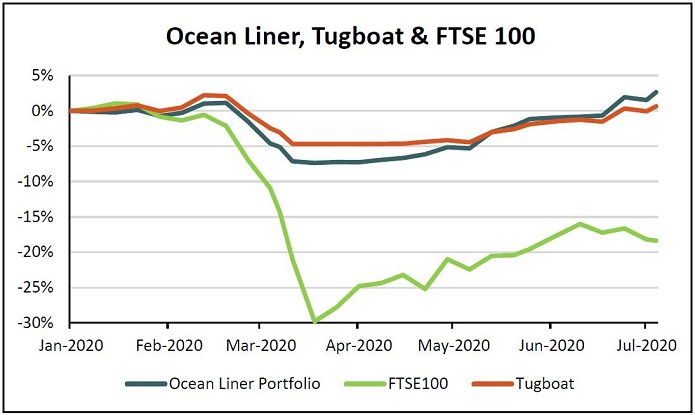

By navigating between the different sectors, and holding significant amounts of cash during the worst of the downturn, our Tugboat portfolio has already gone ahead of where it was at the beginning of the year, while our Ocean Liner is at an all-time high.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.